AR1000NR Arkansas Individual Income Tax Return Dfa Arkansas Form

What is the AR1000NR Arkansas Individual Income Tax Return

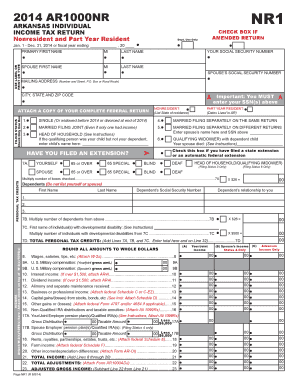

The AR1000NR is the Arkansas Individual Income Tax Return form specifically designed for non-residents. This form is essential for individuals who earn income in Arkansas but do not reside in the state. It allows them to report their income and calculate their tax obligations accurately. The form includes sections for reporting various types of income, deductions, and credits applicable to non-residents, ensuring compliance with Arkansas tax laws.

Steps to complete the AR1000NR Arkansas Individual Income Tax Return

Completing the AR1000NR involves several key steps to ensure accurate filing:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Provide your name, address, and Social Security number at the top of the form.

- Report income: Enter all sources of income earned in Arkansas, including wages, interest, and dividends.

- Calculate deductions: Identify and apply any deductions you qualify for, which may reduce your taxable income.

- Determine tax liability: Use the tax tables provided to calculate the amount of tax owed based on your reported income.

- Sign and date the form: Ensure you sign the form to validate your submission.

Legal use of the AR1000NR Arkansas Individual Income Tax Return

The AR1000NR form is legally recognized for filing Arkansas state income tax for non-residents. To ensure its validity, the form must be completed accurately and submitted by the designated deadlines. The use of electronic signatures is permissible, provided that the signing process complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This legal framework supports the use of digital tools for tax filing, making the process more efficient.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the AR1000NR is crucial for compliance. Typically, the deadline for submitting the Arkansas Individual Income Tax Return for non-residents aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check for any updates or changes to deadlines each tax year.

Required Documents

To complete the AR1000NR, several documents are necessary:

- W-2 forms: These report wages and tax withheld from your employer.

- 1099 forms: These are used for reporting various types of income, such as freelance work or interest income.

- Proof of deductions: Documentation for any deductions you plan to claim, such as receipts or statements.

- Identification: A valid Social Security number or Individual Taxpayer Identification Number (ITIN).

Form Submission Methods (Online / Mail / In-Person)

The AR1000NR can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers choose to file electronically using approved tax software, which often simplifies the process and speeds up refunds.

- Mail: The completed form can be printed and mailed to the Arkansas Department of Finance and Administration at the designated address.

- In-Person: Taxpayers may also submit their forms in person at local offices, where assistance may be available.

Quick guide on how to complete 2014 ar1000nr arkansas individual income tax return dfa arkansas

Complete AR1000NR Arkansas Individual Income Tax Return Dfa Arkansas effortlessly on any device

Online document handling has gained traction with companies and individuals alike. It presents an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary format and securely store it digitally. airSlate SignNow equips you with all the tools required to create, amend, and eSign your papers quickly without delays. Manage AR1000NR Arkansas Individual Income Tax Return Dfa Arkansas on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign AR1000NR Arkansas Individual Income Tax Return Dfa Arkansas with ease

- Obtain AR1000NR Arkansas Individual Income Tax Return Dfa Arkansas and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign AR1000NR Arkansas Individual Income Tax Return Dfa Arkansas and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2014 ar1000nr arkansas individual income tax return dfa arkansas

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with Arkansas income tax documentation?

airSlate SignNow is a user-friendly platform that enables you to send and eSign crucial documents, including those related to Arkansas income tax. By streamlining the document management process, it helps ensure that you can complete your tax documentation quickly and efficiently. Whether you need to sign forms or manage approvals, our solution simplifies tax procedures for Arkansas residents.

-

How much does airSlate SignNow cost for managing Arkansas income tax forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it a cost-effective choice for managing Arkansas income tax forms. You can choose a plan that fits your budget and requirements, ensuring you only pay for what you need. With pricing options designed for small to large businesses, you can find an affordable solution for your Arkansas tax documentation.

-

What features does airSlate SignNow provide for Arkansas income tax processes?

AirSlate SignNow includes a suite of features that enhance the eSigning and document management experience, tailored for Arkansas income tax processes. Key features include customizable templates, audit trails, and secure cloud storage, all designed to facilitate hassle-free tax filing. These tools can greatly reduce the time spent on paperwork, allowing you to focus on more strategic tasks.

-

Can airSlate SignNow integrate with accounting software to assist with Arkansas income tax?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage Arkansas income tax preparations. This integration allows you to directly import and eSign tax documents without switching platforms, enhancing productivity and accuracy. By streamlining document workflows, you can ensure compliance and efficiency during tax season.

-

Is airSlate SignNow secure for handling sensitive Arkansas income tax information?

Absolutely, airSlate SignNow prioritizes the security of your sensitive information, including Arkansas income tax details. Our platform utilizes advanced encryption technologies to safeguard all documents and communications. With robust security measures in place, you can trust that your tax information remains protected while using our services.

-

How does airSlate SignNow improve the efficiency of filing Arkansas income tax?

airSlate SignNow enhances the efficiency of filing Arkansas income tax by streamlining document workflows and reducing the time spent on manual processes. Users can quickly prepare, sign, and send tax documents from anywhere, making the whole process faster and hassle-free. This efficiency allows you to meet deadlines without unnecessary stress.

-

What benefits can I expect from using airSlate SignNow for my Arkansas income tax needs?

Using airSlate SignNow for your Arkansas income tax needs provides several benefits, including increased productivity, reduced paperwork, and enhanced collaboration. The easy-to-use interface allows for quick eSigning and document sharing, which speeds up the entire process. With our software, you can ensure that tax documents are accurate, signed, and submitted on time.

Get more for AR1000NR Arkansas Individual Income Tax Return Dfa Arkansas

- Revocation of living will montana form

- Montana healthcare power of attorney montana form

- Revised uniform anatomical gift act donation montana

- Employment hiring process package montana form

- Revocation of anatomical gift act donation montana form

- Employment or job termination package montana form

- Newly widowed individuals package montana form

- Employment interview package montana form

Find out other AR1000NR Arkansas Individual Income Tax Return Dfa Arkansas

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document