FORM 104CR 092816

What is the FORM 104CR 092816

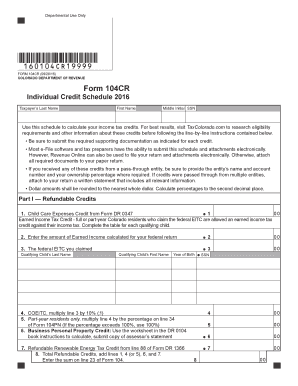

The FORM 104CR 092816 is a specific tax form utilized in the United States for claiming a credit for property taxes paid. This form is primarily designed for individuals who wish to receive a refund for property taxes that they have already paid during the tax year. It is essential for taxpayers to understand the purpose of this form to ensure they accurately report their property tax payments and receive any eligible credits.

How to use the FORM 104CR 092816

Using the FORM 104CR 092816 involves several steps to ensure that all necessary information is correctly filled out. Taxpayers should begin by gathering all relevant documentation related to their property taxes, including receipts or statements that indicate the amount paid. Once all information is collected, taxpayers can complete the form by entering their personal information, property details, and the total amount of property taxes paid. It is crucial to double-check all entries for accuracy before submission.

Steps to complete the FORM 104CR 092816

Completing the FORM 104CR 092816 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents related to property tax payments.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the property for which you are claiming the credit, including the property address and the amount of property taxes paid.

- Calculate the total credit amount you are eligible for based on the information provided.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the FORM 104CR 092816

The FORM 104CR 092816 is legally binding when filled out correctly and submitted according to IRS guidelines. It is important for taxpayers to ensure that all information is truthful and accurate, as providing false information can lead to penalties or legal repercussions. The form must be submitted by the designated deadline to qualify for any credits, and maintaining a copy of the completed form for personal records is advisable.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the FORM 104CR 092816 to avoid any penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 of the following year. If taxpayers require additional time, they may file for an extension, but it is important to check specific state requirements as they may vary.

Required Documents

To complete the FORM 104CR 092816, several documents are necessary. Taxpayers should have:

- Receipts or statements showing property tax payments.

- Proof of ownership of the property.

- Any previous tax returns that may provide context for the current claim.

Having these documents ready will facilitate the completion of the form and help ensure that the claim is processed smoothly.

Quick guide on how to complete form 104cr 092816

Complete FORM 104CR 092816 effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle FORM 104CR 092816 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and eSign FORM 104CR 092816 effortlessly

- Obtain FORM 104CR 092816 and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign FORM 104CR 092816 to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 104cr 092816

The way to create an e-signature for your PDF document in the online mode

The way to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an e-signature for a PDF file on Android devices

People also ask

-

What is FORM 104CR 092816 and how can airSlate SignNow assist with it?

FORM 104CR 092816 is a tax credit form used in certain states to claim credits for property taxes. airSlate SignNow provides an easy-to-use platform for filling out, signing, and sending FORM 104CR 092816 securely, ensuring that your submissions are efficient and compliant.

-

Can I integrate airSlate SignNow with other software while managing FORM 104CR 092816?

Yes, airSlate SignNow offers seamless integrations with various software platforms, allowing you to manage FORM 104CR 092816 with your existing tools. This flexibility enhances your workflow, streamlining the preparation and filing process for your tax credits.

-

How much does it cost to use airSlate SignNow for FORM 104CR 092816?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using airSlate SignNow for FORM 104CR 092816, you gain access to a cost-effective solution for document signing and management without compromising on functionality.

-

What features does airSlate SignNow include for handling FORM 104CR 092816?

airSlate SignNow includes a range of features perfect for FORM 104CR 092816, such as customizable templates, real-time tracking, and secure storage. These features ensure that you can complete your tax credit forms efficiently while maintaining compliance and security.

-

Is it safe to send FORM 104CR 092816 through airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security and compliance, employing advanced encryption standards to protect your data. When sending FORM 104CR 092816 through airSlate SignNow, you can rest assured that your information remains confidential and secure.

-

How does airSlate SignNow improve the workflow for filing FORM 104CR 092816?

Using airSlate SignNow improves workflow efficiency by simplifying the preparation and submission process of FORM 104CR 092816. With features like automated reminders and electronic signatures, you can expedite approvals, saving time and reducing the risk of errors.

-

Can I access airSlate SignNow from any device when managing FORM 104CR 092816?

Yes, airSlate SignNow is accessible from any device with an internet connection, allowing you to manage FORM 104CR 092816 on-the-go. Whether you're using a mobile phone, tablet, or computer, you can conveniently handle your document needs anywhere, anytime.

Get more for FORM 104CR 092816

- Essential legal life documents for new parents louisiana form

- Louisiana statutory form

- Small business accounting package louisiana form

- Revocation of power of attorney for care of child or provisional custody by mandate louisiana form

- Louisiana procedures 497309326 form

- Newly divorced individuals package louisiana form

- Contractors forms package louisiana

- Louisiana vehicle form

Find out other FORM 104CR 092816

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement