Colorado Alternative Minimum Tax Form

What is the Colorado Alternative Minimum Tax Form

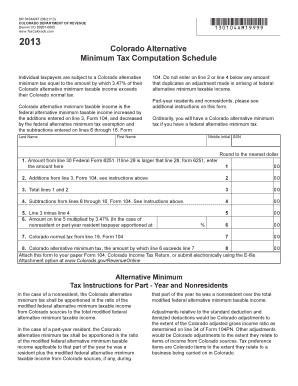

The Colorado Alternative Minimum Tax Form is a tax document used to calculate the alternative minimum tax (AMT) owed by individuals and businesses in Colorado. This form ensures that taxpayers pay a minimum amount of tax, even if deductions and credits reduce their regular tax liability significantly. The AMT is designed to prevent high-income earners from using loopholes to avoid paying taxes. Understanding this form is essential for accurate tax reporting and compliance with state tax laws.

How to use the Colorado Alternative Minimum Tax Form

Using the Colorado Alternative Minimum Tax Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, deductions, and credits. Next, fill out the form by entering your income, allowable deductions, and any adjustments required for AMT calculations. It is important to follow the instructions provided with the form carefully, as errors can lead to delays in processing or additional tax liabilities. Once completed, review the form for accuracy before submitting it.

Steps to complete the Colorado Alternative Minimum Tax Form

Completing the Colorado Alternative Minimum Tax Form requires careful attention to detail. Start by entering your personal information at the top of the form. Then, proceed to calculate your total income, including wages, dividends, and other sources. After that, list any deductions you are eligible for, such as medical expenses or mortgage interest. Adjust your taxable income based on the AMT rules, which may require adding back certain deductions. Finally, calculate the AMT owed and ensure that you sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado Alternative Minimum Tax Form typically align with the federal income tax deadlines. For most taxpayers, this means the form is due by April 15 each year. If you need additional time, you may file for an extension, but it is crucial to pay any estimated tax owed by the original deadline to avoid penalties. Always check for any updates or changes to deadlines that may occur due to state regulations or specific circumstances.

Legal use of the Colorado Alternative Minimum Tax Form

The Colorado Alternative Minimum Tax Form is legally binding when filled out correctly and submitted according to state tax laws. It is essential to ensure that all information provided is accurate and complete, as discrepancies can lead to audits or penalties. The form must be signed by the taxpayer or an authorized representative to validate its submission. Understanding the legal requirements surrounding this form helps ensure compliance and protects taxpayers from potential legal issues.

Key elements of the Colorado Alternative Minimum Tax Form

Key elements of the Colorado Alternative Minimum Tax Form include the taxpayer's identification information, total income, allowable deductions, and calculations for the AMT. The form also requires details on any tax credits claimed and adjustments made to taxable income. Understanding these components is vital for accurately determining the amount of AMT owed and ensuring that all necessary information is reported to the state.

Quick guide on how to complete alternative minimum tax form

Effortlessly Prepare alternative minimum tax form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed files, as you can access the correct format and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without hold-ups. Manage alternative minimum tax form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Modify and Electronically Sign alternative minimum tax form with Ease

- Obtain alternative minimum tax form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form searches, or errors that require generating new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign alternative minimum tax form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to alternative minimum tax form

Create this form in 5 minutes!

How to create an eSignature for the alternative minimum tax form

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

How to create an e-signature for a PDF document on Android

People also ask alternative minimum tax form

-

What is the alternative minimum tax form, and why do I need it?

The alternative minimum tax form is a tax document used to determine your alternative minimum tax liability. It ensures that individuals and corporations pay a minimum amount of tax, even if they have various deductions and exemptions. Understanding this form is crucial for compliance and to avoid unexpected tax bills.

-

How does airSlate SignNow assist with the alternative minimum tax form?

AirSlate SignNow simplifies the process of managing the alternative minimum tax form by enabling efficient document creation, signing, and sharing. Our platform allows you to quickly gather necessary signatures and organize all relevant tax documents in one secure location, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including features for managing the alternative minimum tax form. Our pricing is competitive, and we provide a cost-effective solution for businesses looking to streamline document management and eSignature workflows.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage the alternative minimum tax form alongside your other financial documents. This integration helps maintain a streamlined workflow, ensuring that your tax forms are always up-to-date and accessible.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow offers a variety of features for effective tax document management, including customizable templates for the alternative minimum tax form, secure cloud storage, and real-time tracking of document status. These features ensure that you have complete control over your tax documents at all times.

-

How does airSlate SignNow ensure the security of my tax information?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and secure servers to protect your sensitive information when managing the alternative minimum tax form and other documents. You can trust that your data remains confidential and secure while using our platform.

-

What benefits can I expect from using airSlate SignNow for my alternative minimum tax form?

By using airSlate SignNow for your alternative minimum tax form, you'll experience increased efficiency in document handling, reduced turnaround times for signatures, and enhanced compliance tracking. Our user-friendly interface makes it easy to manage tax documents, allowing you to focus on your core business activities.

Get more for alternative minimum tax form

- Request to modify child support arizona judicial department supreme state az form

- For department use only date received region date reviewer received review completion date applicant approved partial denied form

- What is game and fish inspection of a watercraft arizona form

- Bill of sale arizona game and fish department azgfd form

- Disclosure ownership form

- Adhsbhs form mh 104

- Mileage reimbursement form pdf ahcccs

- Completing the arizona fetal death certificate arizona department azdhs form

Find out other alternative minimum tax form

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later