CT 1041 Booklet, Connecticut Income Tax Return for CT Gov Form

What is the CT 1041 Booklet, Connecticut Income Tax Return For CT gov

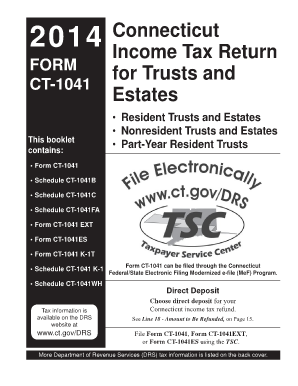

The CT 1041 Booklet is an official document used for filing the Connecticut Income Tax Return for estates and trusts. This booklet provides comprehensive guidelines and forms necessary for reporting income, deductions, and credits specific to estates and trusts operating within Connecticut. It is essential for fiduciaries to accurately complete this form to ensure compliance with state tax laws.

How to use the CT 1041 Booklet, Connecticut Income Tax Return For CT gov

Using the CT 1041 Booklet involves several steps. First, review the instructions provided within the booklet to understand the requirements for completing the form. Gather all necessary financial documents related to the estate or trust, including income statements and receipts for deductions. Complete the forms as instructed, ensuring that all information is accurate and complete. Finally, submit the completed booklet by the designated filing deadline to avoid penalties.

Steps to complete the CT 1041 Booklet, Connecticut Income Tax Return For CT gov

To complete the CT 1041 Booklet, follow these steps:

- Read the instructions thoroughly to understand the filing requirements.

- Collect all relevant financial information, including income and expenses.

- Fill out the required forms in the booklet, ensuring accuracy in all entries.

- Review the completed forms for any errors or omissions.

- Submit the forms either electronically or via mail, following the guidelines provided.

Legal use of the CT 1041 Booklet, Connecticut Income Tax Return For CT gov

The CT 1041 Booklet is legally recognized for filing income tax returns for estates and trusts in Connecticut. To ensure its legal validity, it is crucial to adhere to all state regulations regarding signatures and documentation. Electronic signatures are accepted if they meet the necessary legal standards, making it easier for fiduciaries to file their returns securely and efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the CT 1041 Booklet are crucial for compliance. Generally, the due date for filing the Connecticut Income Tax Return for estates and trusts aligns with the federal tax return deadlines. It is important to check for any specific state extensions or changes to deadlines that may apply. Filing on time helps avoid penalties and interest on any taxes owed.

Required Documents

When preparing to complete the CT 1041 Booklet, certain documents are essential. These typically include:

- Income statements for the estate or trust.

- Receipts for any deductible expenses.

- Prior year tax returns, if applicable.

- Documentation supporting any credits claimed.

Having these documents organized will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The CT 1041 Booklet can be submitted through various methods. Taxpayers can choose to file electronically using approved e-filing software, which is often the most efficient method. Alternatively, the completed forms can be mailed to the appropriate state tax office. In-person submissions may also be possible at designated state tax offices, depending on current regulations and availability.

Quick guide on how to complete ct 1041 booklet 2014 connecticut income tax return for ctgov

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a superb environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 1041 booklet 2014 connecticut income tax return for ctgov

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the CT 1041 Booklet, Connecticut Income Tax Return For CT gov?

The CT 1041 Booklet is a crucial guide for filing your Connecticut Income Tax Return for trusts and estates. It includes necessary forms and instructions that help you comply with state tax regulations effectively. Using this booklet ensures you meet legal requirements while maximizing deductions and credits available to your trust or estate.

-

How can I obtain the CT 1041 Booklet, Connecticut Income Tax Return For CT gov?

You can download the CT 1041 Booklet, Connecticut Income Tax Return For CT gov directly from the official Connecticut government website or through tax preparation software that supports Connecticut tax forms. Ensure you have the latest version to avoid any mistakes in your filing process.

-

What are the benefits of using the CT 1041 Booklet for my income tax return?

Using the CT 1041 Booklet, Connecticut Income Tax Return For CT gov streamlines the process of reporting income and deductions for trusts and estates. It provides clear instructions and helps reduce the chances of making errors, which can lead to penalties. Furthermore, it allows you to take advantage of various tax credits available in Connecticut.

-

Is there a cost associated with the CT 1041 Booklet for Connecticut Income Tax Returns?

The CT 1041 Booklet, Connecticut Income Tax Return For CT gov, is available for free download from the state website. However, if you seek assistance or use tax filing services, there may be associated fees. It’s best to evaluate all options to determine what fits your budget.

-

What features are included in the CT 1041 Booklet for filing returns?

The CT 1041 Booklet provides detailed instructions on completing the Connecticut Income Tax Return, including sections on income reporting, allowable deductions, and other credits. Additionally, it contains helpful charts and tables to aid in the calculation of tax liabilities. This comprehensive approach makes the filing process more manageable.

-

Can I eFile my CT 1041 Booklet, Connecticut Income Tax Return For CT gov?

Yes, you can eFile your CT 1041 Booklet, Connecticut Income Tax Return For CT gov through approved tax preparation software. eFiling is a convenient option that speeds up the processing time and may lead to quicker refunds. Ensure your software is updated to include the latest forms and instructions.

-

What should I do if I make a mistake on my CT 1041 Booklet submission?

If you discover a mistake on your CT 1041 Booklet submission, you can amend your return using Form CT-1040X. This form allows you to correct any errors in your originally filed return regarding the Connecticut Income Tax Return for trusts and estates. Prompt correction can help avoid potential penalties and interest charges.

Get more for CT 1041 Booklet, Connecticut Income Tax Return For CT gov

- Idaho search log form

- Motion for temporary orders idaho form

- Contractor request for payment for use with a construction manager public works administration state of idaho form

- Il bid form

- Bid form state of illinois state il

- Dcfs forms

- In home service psa 12 state of illinois state il form

- Application form amp instructions more from yimg com

Find out other CT 1041 Booklet, Connecticut Income Tax Return For CT gov

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter