Il1040es Form

What is the IL1040ES?

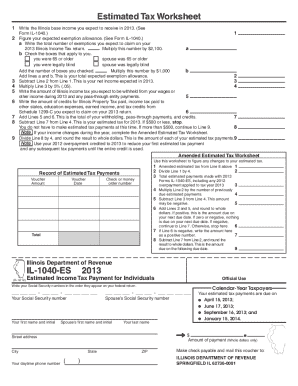

The IL1040ES is a tax form used by individuals in Illinois to make estimated income tax payments. This form is essential for taxpayers who expect to owe a certain amount of tax for the year and prefer to pay it in installments rather than a lump sum at the end of the tax year. It is particularly relevant for self-employed individuals, freelancers, and those with significant income not subject to withholding. Understanding the IL1040ES is crucial for maintaining compliance with state tax laws and avoiding penalties.

How to use the IL1040ES

Using the IL1040ES involves several steps to ensure accurate completion and timely submission. Taxpayers should first determine their estimated tax liability for the year, which can be based on previous year's income or current income projections. Once the estimated amount is calculated, taxpayers can fill out the IL1040ES form, providing necessary personal information and the estimated payment amounts. Payments can be made electronically or by mail, depending on the taxpayer's preference. It is essential to keep records of all payments for future reference and tax filing.

Steps to complete the IL1040ES

Completing the IL1040ES requires careful attention to detail. Follow these steps for accurate completion:

- Gather financial documents, including previous tax returns and income statements.

- Calculate your estimated tax liability based on your expected income.

- Fill out the IL1040ES form, entering your personal information and estimated payment amounts.

- Choose your payment method: electronic payment through the Illinois Department of Revenue website or mailing a check with the completed form.

- Submit the form and payment by the due date to avoid penalties.

Legal use of the IL1040ES

The IL1040ES is legally recognized as a valid form for making estimated tax payments in Illinois. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the Illinois Department of Revenue. This includes timely submission of the form and accurate reporting of estimated income. Utilizing a reliable electronic signature solution can enhance the legal validity of the form when filed online, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Timely filing of the IL1040ES is critical to avoid penalties. The deadlines for submitting estimated payments typically fall on the following dates:

- April 15: First payment due for the current tax year.

- June 15: Second payment due.

- September 15: Third payment due.

- January 15 of the following year: Fourth payment due.

Taxpayers should mark these dates on their calendars to ensure compliance and avoid unnecessary penalties.

Who Issues the Form

The IL1040ES form is issued by the Illinois Department of Revenue. This state agency is responsible for tax collection and administration in Illinois. Taxpayers can access the form directly from the department's website or through authorized tax preparation software. It is important to use the most current version of the form to ensure compliance with state tax regulations.

Quick guide on how to complete il1040es

Complete Il1040es effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without any holdups. Manage Il1040es on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Il1040es with ease

- Find Il1040es and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Il1040es and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il1040es

The way to generate an e-signature for your PDF online

The way to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an e-signature for a PDF document on Android

People also ask

-

What is il1040es and how can airSlate SignNow help?

The il1040es refers to the estimated tax payment form used by individuals in the U.S. AirSlate SignNow simplifies the process of signing and submitting your il1040es by providing a user-friendly eSignature solution, ensuring that you can complete your tax documentation quickly and securely.

-

Does airSlate SignNow support eSigning for il1040es?

Yes, airSlate SignNow fully supports eSigning for il1040es forms. Our platform allows you to electronically sign and send this important tax document with a simple click, making it easier to manage your tax obligations without the hassle of manual paperwork.

-

What are the pricing plans for using airSlate SignNow for il1040es?

AirSlate SignNow offers flexible pricing plans to accommodate varying user needs. Whether you're an individual or a business, you can choose an affordable plan that lets you manage your il1040es eSignatures without breaking the bank.

-

Can I customize my il1040es eSign documents with airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize your il1040es eSign documents to ensure they meet your specific requirements. Our platform allows you to add fields, text, and even company branding to enhance your documents.

-

Is there mobile support for signing il1040es with airSlate SignNow?

Yes, airSlate SignNow offers mobile support for signing il1040es on the go. Our mobile app lets you access, review, and eSign your documents anytime and anywhere, making it convenient to manage your tax forms with ease.

-

What security measures does airSlate SignNow take for il1040es documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure cloud storage to protect your il1040es documents, ensuring that your sensitive tax information remains confidential and safe from unauthorized access.

-

Can I track my il1040es documents in airSlate SignNow?

Yes, airSlate SignNow includes tracking features for your il1040es documents. You'll receive notifications about the status of your eSignatures and can easily monitor when your documents are signed, sent, or viewed by recipients.

Get more for Il1040es

- Hunting forms package montana

- Identity theft recovery package montana form

- Aging parent package montana form

- Sale of a business package montana form

- Legal documents for the guardian of a minor package montana form

- How to become a montana resident form

- Commercial property sales package montana form

- General partnership package montana form

Find out other Il1040es

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors