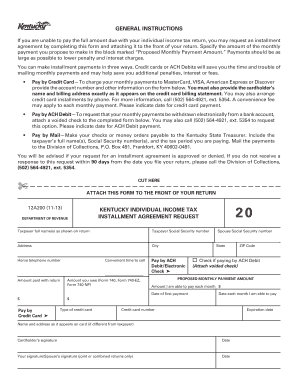

Form 12A200 Kentucky Individual Income Tax Installment

What is the Form 12A200 Kentucky Individual Income Tax Installment

The Form 12A200 Kentucky Individual Income Tax Installment is a state-specific document used by individuals in Kentucky to report and pay their income tax liabilities in installments. This form is particularly useful for taxpayers who may not be able to pay their total tax owed in one lump sum. By using this form, individuals can manage their tax payments more effectively, ensuring compliance with state tax regulations while alleviating financial pressure.

How to use the Form 12A200 Kentucky Individual Income Tax Installment

To use the Form 12A200, individuals must first determine their total income tax liability for the year. Once this amount is established, taxpayers can calculate the installment payments based on their financial situation. The form provides a structured way to outline these payments, including due dates and amounts. It is essential to follow the instructions carefully to ensure that all necessary information is included and that payments are submitted on time.

Steps to complete the Form 12A200 Kentucky Individual Income Tax Installment

Completing the Form 12A200 involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total income tax liability for the year.

- Determine the amount you can pay in each installment.

- Fill out the form with accurate information, including your personal details and payment amounts.

- Review the completed form for accuracy before submission.

Legal use of the Form 12A200 Kentucky Individual Income Tax Installment

The Form 12A200 is legally binding when completed and submitted according to Kentucky state tax laws. This means that all information provided must be truthful and accurate. Failure to comply with the legal requirements associated with this form can result in penalties or interest on unpaid taxes. It is crucial to keep a copy of the submitted form for your records, as it serves as proof of your compliance with state tax obligations.

Filing Deadlines / Important Dates

Timely filing of the Form 12A200 is essential to avoid penalties. The deadlines for submitting this form typically align with the state income tax filing deadlines. Taxpayers should be aware of the specific due dates for each installment payment, as well as the final deadline for the annual tax return. Keeping track of these dates ensures that individuals remain compliant with Kentucky tax laws and avoid unnecessary fees.

Required Documents

When completing the Form 12A200, certain documents are necessary to ensure accurate reporting. These may include:

- W-2 forms or 1099 forms for income verification.

- Previous year’s tax returns for reference.

- Any relevant documentation related to deductions or credits.

Having these documents on hand facilitates a smoother completion process and helps ensure that all required information is accurately reported.

Quick guide on how to complete form 12a200 kentucky individual income tax installment

Complete Form 12A200 Kentucky Individual Income Tax Installment effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Form 12A200 Kentucky Individual Income Tax Installment on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Form 12A200 Kentucky Individual Income Tax Installment without hassle

- Locate Form 12A200 Kentucky Individual Income Tax Installment and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Alter and eSign Form 12A200 Kentucky Individual Income Tax Installment and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 12a200 kentucky individual income tax installment

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

How to make an e-signature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an e-signature for a PDF file on Android

People also ask

-

What is the Form 12A200 Kentucky Individual Income Tax Installment?

The Form 12A200 Kentucky Individual Income Tax Installment is a tax form used by residents of Kentucky to report and pay their individual income tax obligations in installments. This form is crucial for those who cannot pay their taxes in full but wish to stay compliant with state tax regulations. Utilizing the Form 12A200 can help taxpayers manage their financial obligations more effectively.

-

How can airSlate SignNow assist with the Form 12A200 Kentucky Individual Income Tax Installment?

airSlate SignNow simplifies the process of completing and eSigning the Form 12A200 Kentucky Individual Income Tax Installment. Our platform allows users to fill out the form digitally, ensuring accuracy and saving time. With our eSignature feature, you can securely sign your tax installment documents from anywhere.

-

What are the pricing plans for using airSlate SignNow for the Form 12A200 Kentucky Individual Income Tax Installment?

airSlate SignNow offers flexible pricing plans that cater to various needs, whether you are an individual or a business. Each plan includes the necessary tools to manage your Form 12A200 Kentucky Individual Income Tax Installment efficiently. Check our website for the latest pricing details and choose the plan that best fits your requirements.

-

What features of airSlate SignNow help optimize the process of filing the Form 12A200 Kentucky Individual Income Tax Installment?

airSlate SignNow provides several features that optimize the filing of the Form 12A200 Kentucky Individual Income Tax Installment, including templates, eSigning, and document tracking. Our easy-to-use interface ensures that you can complete the tax form quickly and accurately. Additionally, real-time notifications keep you updated on the status of your documents.

-

Are there any integrations available with airSlate SignNow for the Form 12A200 Kentucky Individual Income Tax Installment?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software tools that can enhance the management of your Form 12A200 Kentucky Individual Income Tax Installment. These integrations help streamline workflows by enabling users to import and export data easily. This connectivity ensures that your tax process is as efficient as possible.

-

What are the benefits of using airSlate SignNow for the Form 12A200 Kentucky Individual Income Tax Installment?

Using airSlate SignNow for the Form 12A200 Kentucky Individual Income Tax Installment provides numerous benefits, such as saving time, reducing paperwork, and increasing accuracy in your filings. The platform's user-friendly design makes it easy to complete forms and obtain necessary signatures quickly. Additionally, our secure cloud storage ensures that your sensitive information is well-protected.

-

Is airSlate SignNow secure for filing the Form 12A200 Kentucky Individual Income Tax Installment?

Absolutely, airSlate SignNow prioritizes security when it comes to handling documents like the Form 12A200 Kentucky Individual Income Tax Installment. Our platform utilizes advanced encryption and compliance measures to protect your data. You can trust us to safeguard your personal and financial information while you focus on completing your tax obligations.

Get more for Form 12A200 Kentucky Individual Income Tax Installment

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497316987 form

- North carolina notice form

- North carolina violating form

- Nc notice property form

- Business credit application north carolina form

- Individual credit application north carolina form

- Interrogatories to plaintiff for motor vehicle occurrence north carolina form

- Interrogatories to defendant for motor vehicle accident north carolina form

Find out other Form 12A200 Kentucky Individual Income Tax Installment

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later