Form 42A740 S21 4972 K Kentucky Tax on Lump Sum Distributions

What is the Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions

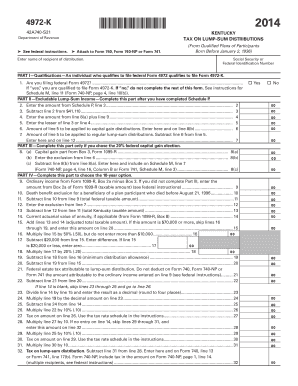

The Form 42A740 S21 4972 K is a tax form used in Kentucky specifically for reporting and calculating tax on lump sum distributions. Lump sum distributions typically refer to the total payout of retirement benefits or other similar financial distributions received in a single payment rather than in installments. This form is essential for individuals who have received such distributions, as it helps ensure compliance with state tax regulations and facilitates the accurate reporting of taxable income.

How to use the Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions

To effectively use the Form 42A740 S21 4972 K, individuals must first gather all relevant financial documentation related to their lump sum distributions. This includes details about the amount received, the source of the distribution, and any applicable deductions. Once the necessary information is collected, the form can be filled out, ensuring that all sections are completed accurately. After completing the form, it should be submitted according to the specified filing methods, which may include online submission, mailing, or in-person delivery to the appropriate tax authority.

Steps to complete the Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions

Completing the Form 42A740 S21 4972 K involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide details regarding the lump sum distribution, including the total amount received and the date of distribution.

- Calculate the taxable portion of the distribution based on the guidelines provided in the form instructions.

- Include any applicable deductions or credits that may apply to your situation.

- Review the completed form for accuracy before submission.

Key elements of the Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions

The Form 42A740 S21 4972 K contains several key elements that are crucial for accurate tax reporting. These include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Distribution Details: Taxpayers must report the total amount and the source of the lump sum distribution.

- Tax Calculation: This section is where taxpayers calculate the taxable amount based on specific tax rates and guidelines.

- Deductions and Credits: Taxpayers can list any deductions or credits that may reduce their overall tax liability.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form 42A740 S21 4972 K. Generally, the form must be filed by the tax deadline for the year in which the lump sum distribution was received. This deadline typically aligns with the federal tax filing deadline, which is usually April 15. However, taxpayers should verify specific dates each year, as they may vary due to weekends or holidays.

Penalties for Non-Compliance

Failure to file the Form 42A740 S21 4972 K or inaccuracies in reporting can result in penalties imposed by the Kentucky Department of Revenue. These penalties may include fines or interest on unpaid taxes. It is crucial for taxpayers to ensure that the form is completed accurately and submitted on time to avoid potential financial repercussions.

Quick guide on how to complete form 42a740 s21 4972 k kentucky tax on lump sum distributions

Effortlessly Prepare [SKS] on Any Device

Web-based document management has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to access the correct format and securely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information with specialized tools that airSlate SignNow offers.

- Create your signature using the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] to ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 42a740 s21 4972 k kentucky tax on lump sum distributions

The way to make an e-signature for your PDF document in the online mode

The way to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions?

Form 42A740 S21 4972 K is a tax form specific to Kentucky that taxpayers must complete when reporting lump sum distributions. This form helps individuals properly calculate their tax obligations related to such distributions. Understanding this form is essential for compliance and tax planning.

-

How can airSlate SignNow help with Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions?

airSlate SignNow simplifies the process of filling out and submitting Form 42A740 S21 4972 K. Our eSigning solution allows users to easily sign and send this important tax document electronically, making tax season stress-free and efficient. With our platform, you can complete your tax submissions from anywhere.

-

What are the pricing options for airSlate SignNow when handling Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions?

airSlate SignNow offers competitive pricing plans to suit various business needs, including those requiring assistance with Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions. Our plans provide access to features that facilitate document management and eSigning. You can choose a plan that fits your frequency of use and budget.

-

Are there any specific features in airSlate SignNow that cater to Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions?

Yes, airSlate SignNow includes features such as document templates and automated workflows specifically tailored for Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions. These features streamline the process and ensure you never miss any details while filling out your tax form. Additionally, our solution enhances accuracy and saves time.

-

Can airSlate SignNow integrate with accounting software for Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing users to manage Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions efficiently. This integration helps maintain accurate records and simplifies the data entry process for tax submissions. You can sync data between your tools for maximum efficiency.

-

What are the benefits of using airSlate SignNow for tax documents like Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions?

Using airSlate SignNow for Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions offers many benefits, including enhanced security and compliance. Our platform ensures that your tax documents are protected during transmission and storage. Additionally, eSigning accelerates the process, allowing for quicker submissions.

-

Is airSlate SignNow user-friendly for completing Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions?

Yes, airSlate SignNow is designed with user experience in mind, making it very user-friendly. Completing Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions can be done easily, even for those who may not be tech-savvy. Our intuitive interface guides you through the necessary steps, ensuring a smooth experience.

Get more for Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions

- Southern university baton rouge proof of immunization compliance form

- The common pain application pain management center paincenter stanford form

- Slac stanford fullform

- Securities transfer form pdf giving to stanford stanford university giving stanford

- Lab rotation evaluation forms department of biology stanford biology stanford

- Form fitness for duty pdf

- Rigging inspection form

- Authorization for disclosure of health information stony brook medicalcenter stonybrook

Find out other Form 42A740 S21 4972 K Kentucky Tax On Lump Sum Distributions

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free