DO NOT MAIL Maryland Tax Forms and Instructions

What is the DO NOT MAIL Maryland Tax Forms And Instructions

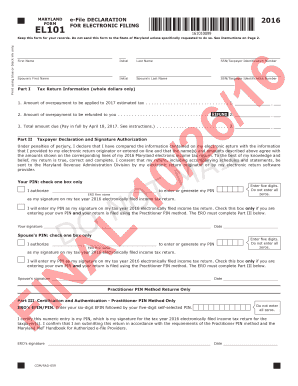

The DO NOT MAIL Maryland Tax Forms And Instructions are specific documents issued by the Maryland State Comptroller's Office. These forms are designed for taxpayers who need to provide information electronically rather than through traditional mail. The instructions guide users on how to properly complete these forms to ensure compliance with state tax regulations.

How to use the DO NOT MAIL Maryland Tax Forms And Instructions

Using the DO NOT MAIL Maryland Tax Forms And Instructions involves several steps. First, taxpayers should download the forms from the official Maryland State Comptroller's website or access them through authorized electronic platforms. After obtaining the forms, users must carefully read the accompanying instructions to understand the required information and any specific formatting needed. Completing the forms electronically allows for easier submission and tracking.

Steps to complete the DO NOT MAIL Maryland Tax Forms And Instructions

To complete the DO NOT MAIL Maryland Tax Forms And Instructions, follow these steps:

- Download the appropriate form from the Maryland State Comptroller's website.

- Read the instructions thoroughly to understand what information is required.

- Fill out the form electronically, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before finalizing it.

- Submit the completed form electronically as directed in the instructions.

Legal use of the DO NOT MAIL Maryland Tax Forms And Instructions

The legal use of the DO NOT MAIL Maryland Tax Forms And Instructions is governed by state tax laws. These forms must be completed and submitted in accordance with the guidelines provided to ensure they are legally binding. Electronic submissions are recognized under Maryland law, provided that the forms meet all specified requirements, including proper signatures and certifications.

Filing Deadlines / Important Dates

Filing deadlines for the DO NOT MAIL Maryland Tax Forms And Instructions vary depending on the type of tax being filed. Generally, individual income tax returns are due by April 15 each year. It is essential for taxpayers to be aware of specific deadlines to avoid penalties. Checking the Maryland State Comptroller's website for the most current dates is advisable.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the DO NOT MAIL Maryland Tax Forms electronically through designated online platforms. This method is encouraged for its efficiency and speed. Alternatively, some forms may still be submitted via mail or in-person at designated state offices, though electronic submission is often preferred to expedite processing times.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in the DO NOT MAIL Maryland Tax Forms And Instructions can result in various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to adhere to the instructions and submit their forms on time to avoid these consequences.

Quick guide on how to complete do not mail maryland tax forms and instructions

Easily Prepare DO NOT MAIL Maryland Tax Forms And Instructions on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle DO NOT MAIL Maryland Tax Forms And Instructions on any device using the airSlate SignNow apps for Android or iOS and improve any document-related process today.

How to Edit and Electronically Sign DO NOT MAIL Maryland Tax Forms And Instructions Effortlessly

- Find DO NOT MAIL Maryland Tax Forms And Instructions and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign DO NOT MAIL Maryland Tax Forms And Instructions to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the do not mail maryland tax forms and instructions

How to create an e-signature for a PDF online

How to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an e-signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What are the key features of DO NOT MAIL Maryland Tax Forms And Instructions?

The DO NOT MAIL Maryland Tax Forms And Instructions offer users a seamless way to handle their tax documents digitally. With robust e-signature capabilities, users can complete and store their forms securely online, ensuring compliance with state regulations.

-

How does airSlate SignNow ensure the security of my DO NOT MAIL Maryland Tax Forms And Instructions?

AirSlate SignNow employs advanced encryption and security protocols to protect your DO NOT MAIL Maryland Tax Forms And Instructions. Your sensitive information is safeguarded throughout the signing process, providing peace of mind for users handling important documents.

-

Are there any integration options available for DO NOT MAIL Maryland Tax Forms And Instructions?

Yes, airSlate SignNow offers various integration options that allow you to connect your DO NOT MAIL Maryland Tax Forms And Instructions with popular applications. This flexibility enhances productivity by allowing you to streamline your workflows and manage your tax documents efficiently.

-

Is there a cost associated with using DO NOT MAIL Maryland Tax Forms And Instructions?

AirSlate SignNow provides a cost-effective solution for managing your DO NOT MAIL Maryland Tax Forms And Instructions. Various pricing plans are available, ensuring that you can choose an option that fits your budget without sacrificing necessary features.

-

Can I track the status of my DO NOT MAIL Maryland Tax Forms And Instructions?

Absolutely! AirSlate SignNow allows you to track the status of your DO NOT MAIL Maryland Tax Forms And Instructions in real time. You can easily see when documents are viewed, signed, and completed, helping you stay organized during tax season.

-

How user-friendly is the process of completing DO NOT MAIL Maryland Tax Forms And Instructions?

The airSlate SignNow platform is designed with user experience in mind, making the completion of your DO NOT MAIL Maryland Tax Forms And Instructions straightforward. Intuitive navigation and clear instructions ensure that both novice and experienced users can easily manage their tax documents.

-

What benefits do I gain by using airSlate SignNow for DO NOT MAIL Maryland Tax Forms And Instructions?

Using airSlate SignNow for DO NOT MAIL Maryland Tax Forms And Instructions offers numerous benefits, including time savings through efficient digital workflows and increased accuracy by reducing manual errors. Additionally, it improves accessibility, allowing you to manage your tax documents from anywhere.

Get more for DO NOT MAIL Maryland Tax Forms And Instructions

- Massachusetts dissolution form

- Massachusetts llc 497309837 form

- Living trust for husband and wife with no children massachusetts form

- Massachusetts trust form

- Living trust for individual who is single divorced or widow or widower with children massachusetts form

- Living trust for husband and wife with one child massachusetts form

- Living trust for husband and wife with minor and or adult children massachusetts form

- Ma trust form

Find out other DO NOT MAIL Maryland Tax Forms And Instructions

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online