SUBTRACTIONS from Form

What is the SUBTRACTIONS FROM

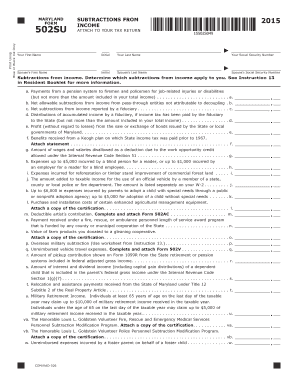

The SUBTRACTIONS FROM is a specific form used primarily for reporting certain deductions that taxpayers can claim on their income tax returns. This form allows individuals and businesses to detail various subtractions from their gross income, which can ultimately reduce their taxable income. Understanding this form is crucial for ensuring accurate tax reporting and maximizing potential refunds or minimizing tax liabilities.

How to use the SUBTRACTIONS FROM

Using the SUBTRACTIONS FROM involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and records of deductible expenses. Next, fill out the form by entering your personal information and detailing each subtraction you wish to claim. It is essential to provide clear and accurate figures to avoid discrepancies during processing. Finally, review the completed form for accuracy before submission.

Steps to complete the SUBTRACTIONS FROM

Completing the SUBTRACTIONS FROM can be straightforward if you follow these steps:

- Collect necessary documents, such as W-2s, 1099s, and receipts for deductible expenses.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- List each subtraction you are claiming, ensuring that you provide the correct amounts and descriptions.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to certify that the information provided is true and correct.

Legal use of the SUBTRACTIONS FROM

The SUBTRACTIONS FROM must be used in compliance with IRS regulations to ensure its legality. Taxpayers are required to provide accurate information and only claim deductions they are eligible for. Misreporting or fraudulent claims can lead to penalties, including fines and interest on unpaid taxes. It is advisable to consult the IRS guidelines or a tax professional if there is any uncertainty regarding the appropriate use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the SUBTRACTIONS FROM typically align with the annual tax return deadlines. Generally, individual taxpayers must submit their forms by April fifteenth of each year. However, if you are unable to meet this deadline, you may file for an extension, which grants additional time to submit your tax return. It is important to be aware of these dates to avoid late fees and penalties.

Required Documents

To accurately complete the SUBTRACTIONS FROM, certain documents are required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses, such as medical bills or charitable contributions

- Records of any other relevant financial information that supports your claimed subtractions

Examples of using the SUBTRACTIONS FROM

Common examples of subtractions that can be reported on the SUBTRACTIONS FROM include:

- Mortgage interest deductions

- State and local taxes paid

- Charitable contributions made to qualified organizations

- Medical expenses exceeding a certain percentage of adjusted gross income

Quick guide on how to complete subtractions from

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for this by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SUBTRACTIONS FROM

Create this form in 5 minutes!

How to create an eSignature for the subtractions from

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What are SUBTRACTIONS FROM standard pricing in airSlate SignNow?

airSlate SignNow offers competitive pricing options designed to suit various business needs. The SUBTRACTIONS FROM subscription plans ensure you only pay for the features you truly need. Each plan provides access to essential eSigning tools, allowing users to choose a suitable package without unnecessary expenses.

-

How can SUBTRACTIONS FROM features enhance my document workflow?

The SUBTRACTIONS FROM features in airSlate SignNow can greatly streamline your document workflow. By allowing seamless eSigning, document tracking, and automated reminders, your team can focus on more important tasks while improving efficiency. This not only saves time but also reduces the potential for errors in the signing process.

-

Are there any hidden costs associated with SUBTRACTIONS FROM?

No, airSlate SignNow prides itself on transparency, especially regarding SUBTRACTIONS FROM. When you choose a plan, you'll find no surprises with hidden fees. All features, including eSigning and document management, are clearly outlined, ensuring you understand what you’re paying for.

-

What benefits can I expect from using SUBTRACTIONS FROM?

Using airSlate SignNow's SUBTRACTIONS FROM offers numerous advantages, including faster document turnaround and reduced paper usage. With eSigning capabilities, you eliminate the delays typically associated with traditional signing processes. This leads to improved customer satisfaction and more efficient business operations.

-

How does airSlate SignNow support integrations with other tools for SUBTRACTIONS FROM?

airSlate SignNow provides robust integrations tailored to enhance SUBTRACTIONS FROM capabilities. You can easily connect with popular applications such as Google Drive, Salesforce, and more. This seamless integration allows for a cohesive workflow, ensuring all your tools work harmoniously together.

-

Can I customize templates for SUBTRACTIONS FROM?

Yes, you can customize your documents and templates in airSlate SignNow with SUBTRACTIONS FROM. This feature allows you to create reusable templates tailored to specific needs, ensuring consistency in your branding and messaging. Customization helps streamline the document preparation process and enhances brand identity.

-

Is training available for new users of SUBTRACTIONS FROM?

Absolutely! airSlate SignNow offers training resources specifically for users exploring SUBTRACTIONS FROM. From tutorial videos to detailed guides, you'll find ample support to help you get started swiftly. Our customer support team is also available for any questions you may have along the way.

Get more for SUBTRACTIONS FROM

Find out other SUBTRACTIONS FROM

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document