Subtractions from Income Maryland Tax Forms and Instructions

What are Maryland subtractions from income?

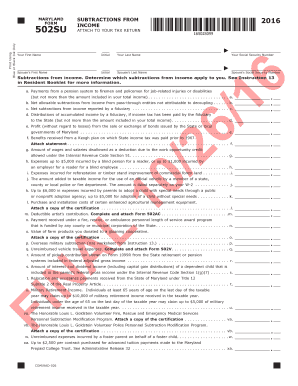

The Maryland subtractions from income refer to specific deductions that taxpayers can claim to reduce their taxable income when filing their state tax returns. These subtractions can include various types of income, such as retirement benefits, certain types of interest income, and other qualifying deductions. Understanding these subtractions is crucial for accurately calculating your tax liability and ensuring compliance with state tax regulations.

Steps to complete the Maryland subtractions from income instructions

Completing the Maryland subtractions from income instructions involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099s, and any other relevant income statements.

- Review the specific subtractions available for your situation, such as retirement income or specific deductions.

- Fill out the appropriate Maryland tax forms, ensuring that you accurately report all income and claim any eligible subtractions.

- Double-check your calculations to avoid errors that could lead to penalties or delays in processing.

- Submit your completed forms by the designated filing deadline, either electronically or by mail.

Key elements of the Maryland subtractions from income instructions

When reviewing the Maryland subtractions from income instructions, it is important to focus on several key elements:

- Eligibility Criteria: Understand who qualifies for specific subtractions based on income type and amount.

- Documentation Requirements: Keep track of necessary documents that support your claims for subtractions.

- Filing Methods: Familiarize yourself with how to submit your forms, whether online, by mail, or in person.

- Deadlines: Be aware of important dates for filing your tax return and claiming subtractions.

State-specific rules for Maryland subtractions from income

Maryland has specific rules governing the subtractions from income that may differ from federal tax regulations. These rules can include limits on the amount of certain deductions or specific eligibility requirements based on residency status or income level. It is essential to consult the Maryland tax code or a tax professional to ensure compliance with state-specific regulations.

Examples of using the Maryland subtractions from income instructions

Examples of how to utilize the Maryland subtractions from income instructions include:

- Claiming a subtraction for pension income received from a qualified retirement plan.

- Subtracting certain types of interest income that are exempt from Maryland state tax.

- Using deductions for contributions made to a Maryland 529 college savings plan.

Filing deadlines for Maryland subtractions from income

Filing deadlines for claiming Maryland subtractions from income typically align with the state income tax return deadlines. Generally, individual taxpayers must file their Maryland tax returns by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Maryland Comptroller's website for any updates or changes to these deadlines.

Quick guide on how to complete subtractions from income maryland tax forms and instructions

Complete Subtractions From Income Maryland Tax Forms And Instructions effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it digitally. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Subtractions From Income Maryland Tax Forms And Instructions on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Subtractions From Income Maryland Tax Forms And Instructions seamlessly

- Obtain Subtractions From Income Maryland Tax Forms And Instructions and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Subtractions From Income Maryland Tax Forms And Instructions and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the subtractions from income maryland tax forms and instructions

How to generate an electronic signature for a PDF document online

How to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

How to make an e-signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What are the Maryland subtractions from income instructions?

The Maryland subtractions from income instructions provide guidelines on how to reduce your taxable income by identifying specific deductions available to taxpayers. Understanding these instructions is crucial for ensuring compliance and maximizing your tax savings. You can find detailed information on the official Maryland tax website or consult a tax professional.

-

How can airSlate SignNow help with Maryland subtractions from income instructions?

airSlate SignNow allows businesses to easily send and eSign documents that may include tax forms related to Maryland subtractions from income instructions. By streamlining the signing process, you can ensure that your documents are processed efficiently and securely. This can save you time and help maintain accurate records for tax reporting.

-

Are there any costs associated with using airSlate SignNow for tax documents?

AirSlate SignNow offers a cost-effective solution for managing your documents, including those that pertain to Maryland subtractions from income instructions. Pricing varies depending on the features you choose, but overall, it provides great value for businesses looking to optimize their processes. Look into their subscription plans to find the best fit for your needs.

-

What features does airSlate SignNow provide for managing tax documents?

AirSlate SignNow offers various features including customizable templates, real-time tracking, and secure eSigning that can be particularly useful for managing tax documents related to Maryland subtractions from income instructions. These features enhance document management efficiency and ensure compliance with legal requirements. Additionally, the intuitive interface makes it user-friendly.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow easily integrates with various third-party applications to enhance your tax management process, including software used for tracking Maryland subtractions from income instructions. This integration capability allows for seamless data flow between platforms, reducing the need for manual entry and improving accuracy. Explore the available integrations to find the right fit for your business.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing comes with numerous benefits, including enhanced efficiency in document preparation and eSigning, particularly for Maryland subtractions from income instructions. It helps reduce turnaround times and administrative burdens, allowing you to focus on more important business tasks. Additionally, the platform’s security features ensure the protection of sensitive information.

-

How user-friendly is the airSlate SignNow platform?

The airSlate SignNow platform is designed with user experience in mind, making it easy for anyone to navigate, whether you're dealing with Maryland subtractions from income instructions or other documents. The intuitive interface allows users to quickly create, send, and manage documents without needing extensive training. Features like drag-and-drop functionality further enhance usability.

Get more for Subtractions From Income Maryland Tax Forms And Instructions

- Trim carpenter contract for contractor north dakota form

- Fencing contract for contractor north dakota form

- Hvac contract for contractor north dakota form

- Landscape contract for contractor north dakota form

- Commercial contract for contractor north dakota form

- Excavator contract for contractor north dakota form

- Renovation contract for contractor north dakota form

- Concrete mason contract for contractor north dakota form

Find out other Subtractions From Income Maryland Tax Forms And Instructions

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple