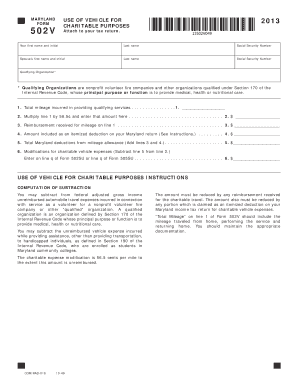

MARYLAND USE of VEHICLE for FORM CHARITABLE PURPOSES 502V

What is the Maryland Use of Vehicle for Form Charitable Purposes 502V

The Maryland Use of Vehicle for Form Charitable Purposes 502V is a specific form used to document the donation of a vehicle for charitable purposes. This form is essential for both the donor and the receiving charity, as it provides a record of the transaction and can have implications for tax deductions. When a vehicle is donated, the donor may be eligible for a tax deduction based on the fair market value of the vehicle or the proceeds from its sale, depending on the charity's use of the vehicle.

Steps to Complete the Maryland Use of Vehicle for Form Charitable Purposes 502V

Completing the Maryland Use of Vehicle for Form Charitable Purposes 502V involves several key steps:

- Gather necessary information about the vehicle, including make, model, year, and VIN.

- Determine the fair market value of the vehicle, which may require research or an appraisal.

- Fill out the form with accurate details, including the donor's information and the charity's information.

- Sign and date the form to validate the donation.

- Provide a copy of the completed form to the charity and retain a copy for personal records.

Legal Use of the Maryland Use of Vehicle for Form Charitable Purposes 502V

The legal use of the Maryland Use of Vehicle for Form Charitable Purposes 502V is governed by both state and federal regulations. To ensure the form is legally binding, it must be completed accurately and signed by the donor. The form serves as proof of the vehicle donation, which is crucial for tax purposes. It is important to follow the guidelines set forth by the IRS regarding vehicle donations to avoid any potential issues with tax deductions.

Eligibility Criteria for the Maryland Use of Vehicle for Form Charitable Purposes 502V

To be eligible to use the Maryland Use of Vehicle for Form Charitable Purposes 502V, the donor must meet specific criteria:

- The vehicle must be in good working condition and free of major defects.

- The donor must own the vehicle outright, with no liens or outstanding loans.

- The donation must be made to a qualified charitable organization recognized by the IRS.

Form Submission Methods for the Maryland Use of Vehicle for Form Charitable Purposes 502V

The Maryland Use of Vehicle for Form Charitable Purposes 502V can be submitted through various methods:

- Online submission via the charity's website, if available.

- Mailing the completed form to the charity's designated address.

- In-person delivery to the charity's office, ensuring a receipt is obtained.

IRS Guidelines for the Maryland Use of Vehicle for Form Charitable Purposes 502V

The IRS provides specific guidelines regarding vehicle donations, which are essential to understand when using the Maryland Use of Vehicle for Form Charitable Purposes 502V. Donors should be aware of the following:

- Tax deductions are generally based on the fair market value of the vehicle or the sale price if the charity sells it.

- Form 1098-C may need to be filed by the charity, which reports the vehicle donation to the IRS.

- Donors should keep all documentation related to the donation for tax filing purposes.

Quick guide on how to complete maryland use of vehicle for form charitable purposes 502v

Prepare MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and eSign MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V with minimal effort

- Obtain MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V and click Get Form to begin.

- Use the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland use of vehicle for form charitable purposes 502v

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an e-signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V?

The MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V is a form used in Maryland to document the use of a vehicle when making charitable contributions. It helps verify the purpose and usage of a vehicle intended for charitable donations, ensuring compliance with state regulations.

-

How can airSlate SignNow assist with MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V?

airSlate SignNow streamlines the process of completing and signing the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V. Our platform allows users to digitally fill out the form, share it with relevant parties, and obtain electronic signatures quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the form?

airSlate SignNow offers various pricing plans to fit different needs, making it a cost-effective solution for managing the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V. You can choose a plan based on your usage frequency, making it accessible for occasional or frequent users.

-

What features does airSlate SignNow offer for managing the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V?

Key features of airSlate SignNow include easy document creation, secure eSignature capabilities, document tracking, and template creation. These features simplify the management of the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V, making the process seamless.

-

Can I collaborate with others on the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V using airSlate SignNow?

Yes, airSlate SignNow allows for real-time collaboration. Multiple users can access and edit the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V, making it easy for teams to work together and ensure that all required information is accurately captured.

-

Does airSlate SignNow integrate with other software for managing the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V?

airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and CRM systems. These integrations enhance your workflow for the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V by allowing you to easily access and manage documents from various platforms.

-

What are the benefits of using airSlate SignNow for charitable vehicle forms?

Using airSlate SignNow for the MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V provides numerous benefits, including reduced paperwork, faster processing times, and enhanced security for sensitive information. This cost-effective solution simplifies the entire process of document management for charitable purposes.

Get more for MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V

- Demolition contract for contractor north dakota form

- Framing contract for contractor north dakota form

- Security contract for contractor north dakota form

- Insulation contract for contractor north dakota form

- Paving contract for contractor north dakota form

- Site work contract for contractor north dakota form

- Siding contract for contractor north dakota form

- Nd contract form

Find out other MARYLAND USE OF VEHICLE FOR FORM CHARITABLE PURPOSES 502V

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document