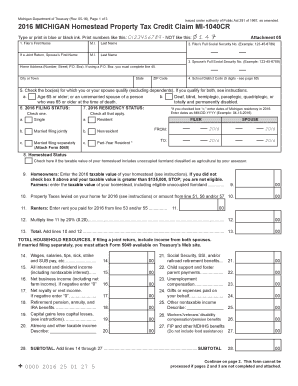

Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR Form

What is the Michigan Homestead Property Tax Credit Claim MI 1040CR?

The Michigan Homestead Property Tax Credit Claim MI 1040CR is a form that allows eligible homeowners in Michigan to claim a credit against their property taxes. This credit is designed to assist those who meet specific income and residency requirements, helping to alleviate the financial burden of property taxes. The form is essential for residents who own or rent their homes and wish to receive tax relief based on their property tax payments.

Eligibility Criteria for the Michigan Homestead Property Tax Credit Claim MI 1040CR

To qualify for the Michigan Homestead Property Tax Credit Claim MI 1040CR, applicants must meet certain criteria, including:

- Being a Michigan resident and occupying the property as their principal residence.

- Meeting income limits set by the state, which may vary from year to year.

- Having a property tax liability that exceeds a specified percentage of their income.

It is important for applicants to review the eligibility requirements carefully to ensure they qualify for the credit before submitting the form.

Steps to Complete the Michigan Homestead Property Tax Credit Claim MI 1040CR

Completing the Michigan Homestead Property Tax Credit Claim MI 1040CR involves several key steps:

- Gather necessary documentation, including proof of income and property tax statements.

- Fill out the MI 1040CR form accurately, ensuring all required fields are completed.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form to the appropriate state department, either online or by mail.

Following these steps carefully will help ensure that the claim is processed smoothly.

Required Documents for the Michigan Homestead Property Tax Credit Claim MI 1040CR

When filing the Michigan Homestead Property Tax Credit Claim MI 1040CR, applicants must provide specific documents to support their claim. These typically include:

- Proof of income, such as W-2 forms or tax returns.

- Property tax statements or receipts to verify the amount paid.

- Identification documents, if necessary, to confirm residency.

Having these documents ready can expedite the filing process and increase the likelihood of a successful claim.

Form Submission Methods for the Michigan Homestead Property Tax Credit Claim MI 1040CR

Applicants have several options for submitting the Michigan Homestead Property Tax Credit Claim MI 1040CR:

- Online submission through the Michigan Department of Treasury's website.

- Mailing the completed form to the appropriate address provided on the form.

- In-person submission at local tax offices, if preferred.

Choosing the right submission method can depend on personal preference and the urgency of the claim.

Legal Use of the Michigan Homestead Property Tax Credit Claim MI 1040CR

Understanding the legal framework surrounding the Michigan Homestead Property Tax Credit Claim MI 1040CR is crucial for applicants. The form must be completed and submitted in compliance with state laws and regulations. Failure to adhere to these guidelines can result in penalties or denial of the claim. It is advisable for applicants to familiarize themselves with the legal requirements to ensure their submission is valid and recognized by the state.

Quick guide on how to complete 2016 michigan homestead property tax credit claim mi 1040cr 2016 michigan homestead property tax credit claim mi 1040cr

Effortlessly Prepare [SKS] on Any Gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and bears the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require new document prints. airSlate SignNow addresses your document management needs in just a few clicks from your selected device. Edit and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR

Create this form in 5 minutes!

How to create an eSignature for the 2016 michigan homestead property tax credit claim mi 1040cr 2016 michigan homestead property tax credit claim mi 1040cr

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

The way to generate an e-signature for a PDF on Android devices

People also ask

-

What is the Michigan Homestead Property Tax Credit Claim MI 1040CR?

The Michigan Homestead Property Tax Credit Claim MI 1040CR is a tax credit designed to help Michigan homeowners reduce the amount of property taxes they pay. By filing this claim, eligible residents can receive financial assistance on property taxes based on their income and the value of their home.

-

Who is eligible to file the Michigan Homestead Property Tax Credit Claim MI 1040CR?

Eligibility for the Michigan Homestead Property Tax Credit Claim MI 1040CR typically includes homeowners who occupy their property as a primary residence and meet certain income requirements. Other factors, such as age, disabilities, and family status, can also affect eligibility.

-

How can I file the Michigan Homestead Property Tax Credit Claim MI 1040CR?

You can file the Michigan Homestead Property Tax Credit Claim MI 1040CR by completing the form and submitting it to your local tax authority. You may also consider using airSlate SignNow for a convenient eSignature process, ensuring your documents are sent and signed quickly and efficiently.

-

What documents do I need to provide for the Michigan Homestead Property Tax Credit Claim MI 1040CR?

When filing the Michigan Homestead Property Tax Credit Claim MI 1040CR, you'll need to provide proof of home occupancy, income documentation, and any other information required by the state. Organizing these documents beforehand can streamline your application process.

-

How much can I receive from the Michigan Homestead Property Tax Credit Claim MI 1040CR?

The amount you can receive from the Michigan Homestead Property Tax Credit Claim MI 1040CR varies based on your household income, the taxable value of your home, and the amount of property taxes paid. Generally, the credit can signNowly reduce your property tax burden if you qualify.

-

Are there any deadlines for the Michigan Homestead Property Tax Credit Claim MI 1040CR?

Yes, there are specific deadlines for submitting the Michigan Homestead Property Tax Credit Claim MI 1040CR, usually aligned with tax filing deadlines. Be sure to check the Michigan Department of Treasury's website for the latest dates to ensure your claim is submitted on time.

-

Can I amend my Michigan Homestead Property Tax Credit Claim MI 1040CR after submitting?

Yes, if you've made an error or have new information, you can amend your Michigan Homestead Property Tax Credit Claim MI 1040CR. Follow the proper procedures outlined by the Michigan Department of Treasury to ensure your amended claim is processed correctly.

Get more for Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR

- Certification non fmla medical form

- Personal reference form sparrow health system sparrow

- Asbestos questionnaire part i sparrow health system sparrow form

- Authorization for release of information form barnes jewish hospital barnesjewish

- Elliot hospital records resources form

- 918641 w2yh newsletter page 1 workflowone specialty form

- Outpatient consent form

- Polst form new jersey hospital association

Find out other Michigan Homestead Property Tax Credit Claim MI 1040CR Michigan Homestead Property Tax Credit Claim MI 1040CR

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online