M1w Form

What is the M1W?

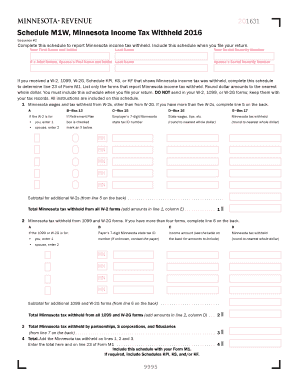

The M1W form is a Minnesota tax document used primarily for income tax purposes. It serves as a withholding tax form that allows employers to report the amount of state income tax withheld from employees’ wages. This form is essential for both employers and employees to ensure proper tax compliance and reporting. Understanding the M1W is crucial for accurate tax filings and maintaining compliance with Minnesota state tax regulations.

How to Use the M1W

Using the M1W form involves several key steps. First, employers must accurately fill out the form with the necessary information, including the employee's name, Social Security number, and the amount withheld. Once completed, the form should be submitted to the Minnesota Department of Revenue. Employees should keep a copy for their records and ensure that the information matches their payroll records to avoid discrepancies during tax season.

Steps to Complete the M1W

Completing the M1W form requires careful attention to detail. Follow these steps:

- Gather necessary information, including employee details and withholding amounts.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail to the Minnesota Department of Revenue.

- Retain a copy for your records for future reference.

Legal Use of the M1W

The M1W form is legally binding when completed correctly and submitted in accordance with Minnesota tax laws. Employers must ensure that the information reported is accurate to avoid penalties. The form must be filed by the specified deadlines to maintain compliance with state regulations. Failure to adhere to these legal requirements can result in fines or other penalties.

Key Elements of the M1W

Several key elements are essential when dealing with the M1W form:

- Employee Information: Accurate details about the employee, including name and Social Security number.

- Withholding Amount: The total amount of state income tax withheld from the employee's wages.

- Employer Information: Details about the employer, including name and tax identification number.

- Submission Method: The form can be submitted electronically or via mail, depending on the employer's preference.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the M1W form. Typically, employers must submit the form by the end of the tax year to ensure compliance. Additionally, quarterly filings may be required depending on the withholding amounts. Keeping track of these deadlines helps avoid penalties and ensures timely reporting to the Minnesota Department of Revenue.

Quick guide on how to complete m1w

Prepare M1w effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed papers, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow furnishes you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage M1w on any platform using airSlate SignNow Android or iOS applications and simplify any document-driven task today.

How to modify and eSign M1w with ease

- Find M1w and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow supplies specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign M1w and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is m1w and how does it relate to airSlate SignNow?

m1w is a key feature of airSlate SignNow that enhances document management efficiency. It allows users to seamlessly send and eSign documents, ensuring a streamlined workflow for businesses of all sizes. By integrating m1w into your processes, you can save time and reduce errors, making it an essential tool for any organization.

-

How does pricing work for m1w on airSlate SignNow?

The pricing for m1w within airSlate SignNow is designed to be cost-effective for businesses looking to optimize their document workflows. There are various pricing tiers depending on the features you require, allowing flexibility for small startups to large enterprises. This ensures you only pay for the tools you need without any unnecessary expenses.

-

What features does m1w offer?

m1w offers a comprehensive set of features that include document sharing, eSigning capabilities, and real-time collaboration tools. These features allow for quick transactions and streamlined communication between teams and clients. By leveraging m1w, businesses can signNowly enhance their operational efficiency.

-

What are the benefits of using m1w in my business?

By using m1w, businesses can enjoy increased productivity, reduced paper usage, and faster turnaround times on document processing. Additionally, m1w provides users with a secure platform for electronic signatures, ensuring compliance while protecting sensitive information. Ultimately, it helps businesses save time and resources while improving customer satisfaction.

-

Can m1w be integrated with other software tools?

Yes, m1w can easily integrate with numerous software tools and applications to enhance your business processes. This integration facilitates seamless data transfer and helps maintain consistency across platforms. Whether you’re using CRMs, payment systems, or project management tools, m1w allows for a versatile and comprehensive workflow.

-

Is m1w secure for handling sensitive documents?

Absolutely, m1w prioritizes the security of your documents with advanced encryption and compliance with industry standards. Your data is securely transmitted and stored, giving you peace of mind when handling sensitive information. airSlate SignNow ensures that all transactions through m1w are protected against unauthorized access.

-

How can I get started with m1w in airSlate SignNow?

Getting started with m1w in airSlate SignNow is simple and user-friendly. You can sign up for a free trial on our website to explore its features and functionalities. Once you’re familiar with the platform, you can choose the pricing plan that suits your business best to fully utilize m1w.

Get more for M1w

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497317532 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497317533 form

- North dakota tenant 497317534 form

- North dakota law form

- North dakota notice 497317536 form

- Letter from tenant to landlord about insufficient notice of rent increase north dakota form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease north dakota form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase north dakota form

Find out other M1w

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship