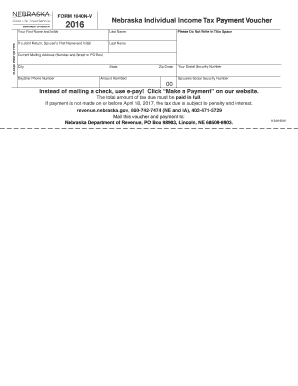

Form 1040N V, Nebraska Individual Income Tax Payment

What is the Form 1040N V, Nebraska Individual Income Tax Payment

The Form 1040N V is a specific document used for making individual income tax payments in Nebraska. This form is essential for residents who owe taxes to the state and prefer to submit their payments electronically. It serves as a payment voucher, ensuring that the state accurately processes the payment associated with the taxpayer's individual income tax return. Understanding this form is crucial for compliance and timely payment to avoid penalties.

How to obtain the Form 1040N V, Nebraska Individual Income Tax Payment

To obtain the Form 1040N V, taxpayers can visit the Nebraska Department of Revenue's official website. The form is typically available for download in PDF format, allowing individuals to print it for their records. Additionally, some tax preparation software may include the form as part of their services, making it easier for users to access and complete the necessary information.

Steps to complete the Form 1040N V, Nebraska Individual Income Tax Payment

Completing the Form 1040N V involves several straightforward steps:

- Download the form from the Nebraska Department of Revenue's website or access it through tax software.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount of tax you are paying, ensuring it matches your tax return.

- Sign and date the form to validate your payment.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the Form 1040N V, Nebraska Individual Income Tax Payment

The Form 1040N V is legally binding when filled out correctly and submitted according to state regulations. It is essential to ensure that all information is accurate to avoid any legal complications. The form must be signed to validate the payment, and electronic submissions must comply with eSignature laws to ensure their legality. Utilizing a reliable electronic signature solution can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040N V typically align with the state income tax deadlines. Taxpayers should be aware of the following important dates:

- April 15: Standard deadline for individual income tax payments.

- October 15: Extended deadline for those who filed for an extension.

It is crucial to submit the form and payment by these dates to avoid penalties and interest on late payments.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040N V can be submitted through various methods:

- Online: Taxpayers can submit their payments electronically through the Nebraska Department of Revenue's online portal.

- Mail: The form can be printed and sent to the appropriate address listed on the form.

- In-Person: Taxpayers may also choose to deliver their form and payment directly to their local Department of Revenue office.

Quick guide on how to complete form 1040n v 2016 nebraska individual income tax payment

Prepare Form 1040N V, Nebraska Individual Income Tax Payment effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Form 1040N V, Nebraska Individual Income Tax Payment on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Form 1040N V, Nebraska Individual Income Tax Payment with ease

- Find Form 1040N V, Nebraska Individual Income Tax Payment and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight signNow sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1040N V, Nebraska Individual Income Tax Payment and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 1040N V, Nebraska Individual Income Tax Payment?

Form 1040N V is a payment voucher used by residents of Nebraska to make their individual income tax payments. This form simplifies the payment process by providing a structured way to report and remit tax owed to the Nebraska Department of Revenue.

-

How can I complete Form 1040N V using airSlate SignNow?

With airSlate SignNow, completing Form 1040N V for Nebraska Individual Income Tax Payment is straightforward. Our user-friendly interface allows you to fill out the form electronically, ensuring that all necessary information is accurately captured before submission.

-

Is there a cost associated with using airSlate SignNow for Form 1040N V?

Yes, airSlate SignNow offers various pricing plans, allowing businesses to choose the one that fits their needs. Using our platform to handle Form 1040N V, Nebraska Individual Income Tax Payment can be cost-effective compared to traditional paper processing.

-

What features does airSlate SignNow provide for handling Form 1040N V?

AirSlate SignNow saves time with features like eSigning, cloud storage, and easy document sharing. These features enhance the process of preparing and submitting Form 1040N V, Nebraska Individual Income Tax Payment by ensuring documents are securely signed and stored digitally.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow supports integrations with various accounting and tax management software. This ensures that your Form 1040N V, Nebraska Individual Income Tax Payment documentation is seamlessly incorporated into your overall financial workflow.

-

What are the benefits of eSigning Form 1040N V with airSlate SignNow?

eSigning Form 1040N V through airSlate SignNow accelerates the approval process and reduces paper waste. Customers benefit from a secure and legally binding signature that makes filing their Nebraska Individual Income Tax Payment hassle-free.

-

How secure is my information when using airSlate SignNow for Form 1040N V?

AirSlate SignNow prioritizes the security of your documents. When you handle Form 1040N V, Nebraska Individual Income Tax Payment, your information is protected with encryption and advanced security measures, ensuring that your data remains confidential.

Get more for Form 1040N V, Nebraska Individual Income Tax Payment

- Tenants maintenance repair request form nebraska

- Guaranty attachment to lease for guarantor or cosigner nebraska form

- Amendment to lease or rental agreement nebraska form

- Warning notice due to complaint from neighbors nebraska form

- Lease subordination agreement nebraska form

- Apartment rules and regulations nebraska form

- Agreed cancellation of lease nebraska form

- Amendment of residential lease nebraska form

Find out other Form 1040N V, Nebraska Individual Income Tax Payment

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement