Nebraska Tax Calculation Schedule for Individual Income Tax Form

What is the Nebraska Tax Calculation Schedule For Individual Income Tax

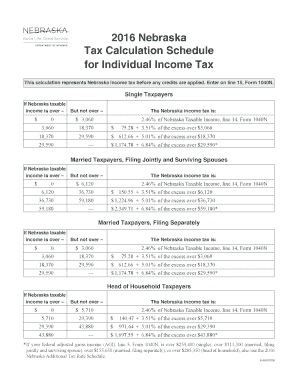

The Nebraska Tax Calculation Schedule for Individual Income Tax is a vital form used by residents to determine their state income tax liability. This schedule outlines the steps for calculating taxable income, applicable deductions, and credits. It is essential for ensuring compliance with Nebraska tax laws and for accurately reporting income to the state. Understanding this form helps taxpayers navigate their financial responsibilities effectively.

How to use the Nebraska Tax Calculation Schedule For Individual Income Tax

To use the Nebraska Tax Calculation Schedule, begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Fill out the form by entering your total income, applicable deductions, and credits as specified. Follow the provided instructions carefully to ensure accurate calculations. The completed schedule will help you determine your total tax due or refund amount, which is crucial for your overall tax filing process.

Steps to complete the Nebraska Tax Calculation Schedule For Individual Income Tax

Completing the Nebraska Tax Calculation Schedule involves several key steps:

- Gather all necessary income documents, including W-2 and 1099 forms.

- Calculate your total income and enter it in the designated section of the schedule.

- Identify and apply any deductions you qualify for, such as standard or itemized deductions.

- Calculate any applicable tax credits that may reduce your tax liability.

- Follow the instructions to compute your total tax liability or refund.

- Review your calculations for accuracy before submitting the form.

Legal use of the Nebraska Tax Calculation Schedule For Individual Income Tax

The Nebraska Tax Calculation Schedule is legally binding when completed accurately and submitted according to state regulations. It is important to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or legal issues. Utilizing electronic tools for completion can enhance security and compliance, provided they meet the necessary legal standards for eSignatures and document submission.

Key elements of the Nebraska Tax Calculation Schedule For Individual Income Tax

Key elements of the Nebraska Tax Calculation Schedule include:

- Total Income: The sum of all income sources, including wages, dividends, and interest.

- Deductions: Allowable deductions that reduce taxable income, such as personal exemptions and standard deductions.

- Tax Credits: Specific credits that directly reduce the amount of tax owed.

- Tax Rates: The applicable tax rates based on income brackets as defined by Nebraska state law.

- Final Tax Liability: The calculated amount owed to the state after applying deductions and credits.

Filing Deadlines / Important Dates

Filing deadlines for the Nebraska Tax Calculation Schedule align with the general state income tax deadlines. Typically, individual income tax returns are due by April fifteenth each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these dates to avoid late fees and penalties.

Quick guide on how to complete 2016 nebraska tax calculation schedule for individual income tax

Complete Nebraska Tax Calculation Schedule For Individual Income Tax seamlessly on any device

Digital document management has surged in popularity among companies and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without interruptions. Manage Nebraska Tax Calculation Schedule For Individual Income Tax on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related processes today.

How to modify and electronically sign Nebraska Tax Calculation Schedule For Individual Income Tax with ease

- Find Nebraska Tax Calculation Schedule For Individual Income Tax and then click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes requiring new copies to be printed. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Nebraska Tax Calculation Schedule For Individual Income Tax and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Nebraska Tax Calculation Schedule For Individual Income Tax?

The Nebraska Tax Calculation Schedule For Individual Income Tax is a comprehensive guide that outlines the steps and formulas for determining individual tax obligations in Nebraska. This schedule ensures taxpayers can accurately calculate their income taxes based on the state's tax laws. Understanding this schedule is crucial for compliance and optimizing tax savings.

-

How does airSlate SignNow facilitate the Nebraska Tax Calculation Schedule For Individual Income Tax planning?

airSlate SignNow offers an easy-to-use platform that allows businesses and individuals to eSign and manage tax-related documents efficiently. By streamlining the document workflow, users can focus on using the Nebraska Tax Calculation Schedule For Individual Income Tax without the stress of paperwork. This enhances efficiency and ensures accurate record-keeping for tax purposes.

-

Is there a cost associated with using airSlate SignNow for managing the Nebraska Tax Calculation Schedule For Individual Income Tax?

Using airSlate SignNow comes with a cost-effective pricing model that caters to various business sizes. Each plan includes features that streamline document management, which is essential when dealing with the Nebraska Tax Calculation Schedule For Individual Income Tax. Users can select a plan that aligns with their needs and budget, ensuring access to the necessary tools.

-

What features does airSlate SignNow provide that help in the Nebraska Tax Calculation Schedule For Individual Income Tax process?

airSlate SignNow includes features like customizable templates, automated workflows, and secure storage, all beneficial when working with the Nebraska Tax Calculation Schedule For Individual Income Tax. These tools enable users to create, send, and manage tax documents seamlessly. Moreover, the platform ensures compliance and enhances efficiency during tax season.

-

Can airSlate SignNow integrate with other software for Nebraska Tax Calculation?

Yes, airSlate SignNow seamlessly integrates with various accounting and productivity software, making it easier to manage the Nebraska Tax Calculation Schedule For Individual Income Tax. This integration helps streamline workflows and ensures that all documents are accurately prepared and signed. Users can connect their existing tools for an enhanced experience.

-

How secure is airSlate SignNow when handling documents related to Nebraska Tax Calculation Schedule For Individual Income Tax?

airSlate SignNow prioritizes security with industry-standard encryption and compliance measures that protect sensitive information related to the Nebraska Tax Calculation Schedule For Individual Income Tax. Users can confidently store, send, and eSign documents, knowing their data is secure. This commitment to security is essential for maintaining trust in tax-related transactions.

-

What are the benefits of using airSlate SignNow for Nebraska Tax Calculation?

The main benefits of using airSlate SignNow for the Nebraska Tax Calculation Schedule For Individual Income Tax include increased efficiency, reduced turnaround times, and enhanced accuracy in document handling. The platform simplifies the eSigning process, allowing for quicker approvals and improved record-keeping. By leveraging these benefits, users can ensure timely filing and compliance.

Get more for Nebraska Tax Calculation Schedule For Individual Income Tax

- Name affidavit of buyer nebraska form

- Name affidavit of seller nebraska form

- Non foreign affidavit under irc 1445 nebraska form

- Owners or sellers affidavit of no liens nebraska form

- Affidavit of occupancy and financial status nebraska form

- Complex will with credit shelter marital trust for large estates nebraska form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497318242 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497318243 form

Find out other Nebraska Tax Calculation Schedule For Individual Income Tax

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe