New Mexico Personal Income Pit 1 Form

What is the New Mexico Personal Income PIT 1 Form

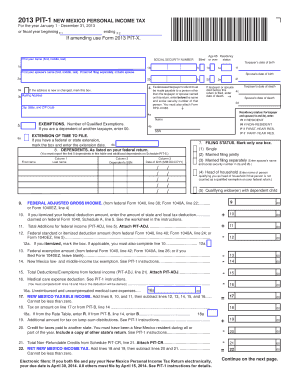

The New Mexico Personal Income PIT 1 Form is a tax document used by residents of New Mexico to report their personal income to the state. This form is essential for individuals who need to calculate their state income tax liability based on their earnings. The PIT 1 Form includes various sections where taxpayers can detail their income sources, deductions, and credits, ensuring compliance with state tax regulations.

How to use the New Mexico Personal Income PIT 1 Form

Using the New Mexico Personal Income PIT 1 Form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, accurately fill out the form by providing your personal information, including your Social Security number, and detailing your income sources. Be sure to apply any eligible deductions and credits to reduce your taxable income. Finally, review the completed form for accuracy before submitting it to the New Mexico Taxation and Revenue Department.

Steps to complete the New Mexico Personal Income PIT 1 Form

Completing the New Mexico Personal Income PIT 1 Form requires careful attention to detail. Follow these steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources in the designated section.

- Apply any deductions you qualify for, such as standard deductions or itemized deductions.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form, certifying that the information provided is accurate.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the New Mexico Personal Income PIT 1 Form. Typically, the form must be submitted by April 15 of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions available and the specific dates for those extensions to avoid penalties.

Form Submission Methods

The New Mexico Personal Income PIT 1 Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online using the New Mexico Taxation and Revenue Department's electronic filing system. Alternatively, the form can be mailed to the appropriate address provided by the department. In-person submissions are also accepted at designated tax offices throughout the state, allowing for direct assistance if needed.

Key elements of the New Mexico Personal Income PIT 1 Form

Several key elements are essential to understand when working with the New Mexico Personal Income PIT 1 Form. These include:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Total income from various sources.

- Deductions and Credits: Eligible deductions that can lower taxable income.

- Tax Calculation: The method used to determine the total tax owed.

- Signature: Required to validate the form.

Quick guide on how to complete 2014 new mexico personal income pit 1 form

Complete New Mexico Personal Income Pit 1 Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to access the necessary template and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage New Mexico Personal Income Pit 1 Form on any device using airSlate SignNow apps for Android or iOS and streamline any document-centric procedure today.

How to modify and eSign New Mexico Personal Income Pit 1 Form with ease

- Locate New Mexico Personal Income Pit 1 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Edit and eSign New Mexico Personal Income Pit 1 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the New Mexico Personal Income Pit 1 Form?

The New Mexico Personal Income Pit 1 Form is a document used by individuals and entities to report the state income tax owed to New Mexico. It is an essential form for taxpayers to ensure compliance with state tax regulations, providing necessary financial information to the Department of Taxation and Revenue.

-

How can airSlate SignNow help with my New Mexico Personal Income Pit 1 Form?

AirSlate SignNow provides an efficient platform to electronically sign and send your New Mexico Personal Income Pit 1 Form, making the submission process quicker and more reliable. Our easy-to-use interface streamlines the paperwork, allowing you to focus on what matters most.

-

Is there a cost associated with using airSlate SignNow for the New Mexico Personal Income Pit 1 Form?

Yes, there is a competitive pricing model for using airSlate SignNow. Our cost-effective solution offers various plans tailored to meet different needs, ensuring you have access to the tools necessary for managing your New Mexico Personal Income Pit 1 Form without breaking the bank.

-

Can I track the status of my New Mexico Personal Income Pit 1 Form with airSlate SignNow?

Absolutely! AirSlate SignNow includes features that allow you to track the status of your New Mexico Personal Income Pit 1 Form in real-time. You receive notifications at every stage, ensuring you are updated on the progress of your submission.

-

What features does airSlate SignNow offer for managing the New Mexico Personal Income Pit 1 Form?

AirSlate SignNow offers numerous features for managing the New Mexico Personal Income Pit 1 Form, including secure electronic signatures, document templates, and customizable workflows. These tools help improve efficiency and accuracy in handling your tax documents.

-

Is it easy to integrate airSlate SignNow with other software for the New Mexico Personal Income Pit 1 Form?

Yes, airSlate SignNow seamlessly integrates with various software applications. This means you can easily incorporate our solution with your existing systems for a smoother process in managing your New Mexico Personal Income Pit 1 Form.

-

How secure is my information when using airSlate SignNow for the New Mexico Personal Income Pit 1 Form?

Security is a top priority at airSlate SignNow. When you use our platform to handle your New Mexico Personal Income Pit 1 Form, your information is safeguarded with advanced encryption and secure data storage practices, ensuring your personal data remains protected.

Get more for New Mexico Personal Income Pit 1 Form

- Newly widowed individuals package nebraska form

- Employment interview package nebraska form

- Employment employee personnel file package nebraska form

- Assignment of mortgage package nebraska form

- Assignment of lease package nebraska form

- Lease purchase agreements package nebraska form

- Satisfaction cancellation or release of mortgage package nebraska form

- Premarital agreements package nebraska form

Find out other New Mexico Personal Income Pit 1 Form

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now