New York State Department of Taxation and Finance Yonkers Nonresident Earnings Tax Return for the Full Year January 1, , through Form

Understanding the New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return

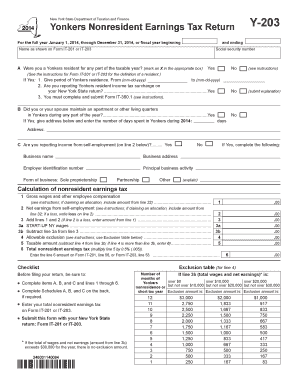

The New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return is a crucial document for individuals who earn income in Yonkers but reside outside the city. This form is specifically designed for the full year from January 1 through December 31, or for a fiscal year that begins and ends as indicated on the form IT-201 or IT-203. It is essential for ensuring compliance with local tax obligations for nonresidents, allowing them to accurately report their earnings and pay the appropriate taxes.

Steps to Complete the Yonkers Nonresident Earnings Tax Return

Completing the Yonkers Nonresident Earnings Tax Return involves several key steps:

- Gather necessary documents, including W-2 forms and any other income statements.

- Determine your residency status and ensure you meet the nonresident criteria.

- Fill out the form accurately, ensuring all income sources are reported.

- Calculate the Yonkers tax owed based on the provided tax rates.

- Review the completed form for accuracy before submission.

Required Documents for Filing

To file the Yonkers Nonresident Earnings Tax Return, you will need to collect several important documents:

- W-2 forms from all employers for the tax year.

- Any 1099 forms for additional income sources.

- Records of any deductions or credits you plan to claim.

- Identification information, including Social Security numbers for yourself and any dependents.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines associated with the Yonkers Nonresident Earnings Tax Return. Typically, the deadline for submission aligns with the federal tax return deadline, which is April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Always check for specific local announcements regarding any changes to deadlines.

Legal Use of the Yonkers Nonresident Earnings Tax Return

The Yonkers Nonresident Earnings Tax Return is legally binding once completed and submitted. It is important to ensure that the information provided is truthful and accurate, as submitting false information can lead to penalties. The form must be signed and dated by the taxpayer, confirming that all details are correct to the best of their knowledge.

Digital vs. Paper Version of the Tax Return

Both digital and paper versions of the Yonkers Nonresident Earnings Tax Return are available. The digital version allows for easier submission and may include features such as auto-calculation of taxes owed. The paper version requires manual calculations and mailing to the appropriate tax office. Choosing the digital option can streamline the process and reduce the risk of errors.

Quick guide on how to complete new york state department of taxation and finance yonkers nonresident earnings tax return for the full year january 1 2014

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] across any platform using the airSlate SignNow Android or iOS applications and streamline your document-based tasks today.

Edit and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the available tools to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return?

The New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return is a tax form required for individuals who earned income in Yonkers but reside outside of the city. This return is crucial for accurately reporting income for the full year from January 1 to December 31 or for a specified fiscal year. It ensures compliance with local tax laws and facilitates proper tax assessment.

-

Who needs to file the Yonkers Nonresident Earnings Tax Return?

Any nonresident individual who earned income within Yonkers during the tax year is required to file the New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return. This includes anyone whose earnings are subject to the Yonkers income tax. It's important to review the specific income thresholds and requirements outlined by the state.

-

What are the main features of airSlate SignNow's document signing solution for tax returns?

airSlate SignNow offers features such as easy eSigning, document templates, and automated workflows, making it perfect for managing the New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return. Users can create, edit, and send tax documents securely, ensuring they are signed and returned promptly. These features streamline the filing process for tax returns and enhance overall efficiency.

-

How does airSlate SignNow help with compliance for tax filings?

Using airSlate SignNow to manage your New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return keeps your documents organized and compliant. The platform offers built-in security features that ensure sensitive information is protected. Additionally, you can track the status of your documents to ensure timely submission.

-

Is there a cost associated with using airSlate SignNow for tax documents?

While airSlate SignNow offers various pricing plans, it provides a cost-effective solution for sending and eSigning your New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return. Users can choose plans that fit their business needs, and there are options for both individual users and larger teams, ensuring that you can find a solution that meets your budget.

-

Can airSlate SignNow integrate with other tax software?

Yes, airSlate SignNow can integrate with various tax software platforms to enhance your experience with the New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return. This integration allows you to import data seamlessly and helps automate the workflow, saving you valuable time and reducing the risk of errors.

-

What benefits does eSigning provide for tax documents?

eSigning with airSlate SignNow offers numerous benefits for your New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return. It speeds up the signing process, reduces paper use, and provides legal documentation of consent. This efficiency is especially beneficial during tax season when timely submissions are crucial.

Get more for New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return For The Full Year January 1, , Through

Find out other New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return For The Full Year January 1, , Through

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later