It 1040 it 1040 Tax Ohio Form

What is the IT 1040 IT 1040 Tax Ohio

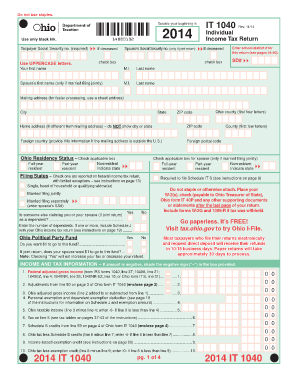

The IT 1040 Tax Ohio form is the state's individual income tax return used by residents to report their income and calculate their tax liability. This form is essential for individuals who earn income within Ohio, including wages, salaries, and other sources of income. Completing the IT 1040 accurately ensures compliance with state tax laws and helps determine any refund or amount owed to the state.

How to use the IT 1040 IT 1040 Tax Ohio

Using the IT 1040 Tax Ohio form involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions. After completing the form, review it carefully for accuracy before submitting it. This form can be filed electronically or by mail, depending on your preference.

Steps to complete the IT 1040 IT 1040 Tax Ohio

Completing the IT 1040 Tax Ohio requires careful attention to detail. Here are the steps to follow:

- Gather all necessary income documents, such as W-2s and 1099s.

- Provide your personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the form.

- Calculate your deductions and credits according to Ohio tax regulations.

- Determine your tax liability based on the income and deductions reported.

- Sign and date the form before submission.

Legal use of the IT 1040 IT 1040 Tax Ohio

The IT 1040 Tax Ohio form is legally binding when completed and submitted according to Ohio tax laws. To ensure its legal validity, taxpayers must provide accurate information and sign the form. E-signatures are accepted under specific conditions, and using a reliable electronic signature solution can enhance the security and compliance of the submission process.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the IT 1040 Tax Ohio form. Typically, the deadline for filing is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any potential extensions available for filing, which may require additional forms to be submitted.

Required Documents

To complete the IT 1040 Tax Ohio form accurately, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Documentation for any deductions or credits claimed.

- Previous year's tax return for reference.

Quick guide on how to complete 2014 it 1040 2014 it 1040 tax ohio

Effortlessly Prepare IT 1040 IT 1040 Tax Ohio on Any Device

Digital document management has gained prominence among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage IT 1040 IT 1040 Tax Ohio on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to Edit and eSign IT 1040 IT 1040 Tax Ohio with Ease

- Find IT 1040 IT 1040 Tax Ohio and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, taking mere seconds and holding the same legal validity as a traditional wet ink signature.

- Review the details carefully and click the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign IT 1040 IT 1040 Tax Ohio to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the IT 1040 IT 1040 Tax Ohio form?

The IT 1040 IT 1040 Tax Ohio form is the individual income tax return required for residents of Ohio to report their earnings and calculate their tax obligations. It is important to complete this form accurately to ensure compliance with state laws and avoid penalties.

-

How can airSlate SignNow assist with filing the IT 1040 IT 1040 Tax Ohio?

airSlate SignNow simplifies the process of completing and eSigning your IT 1040 IT 1040 Tax Ohio by allowing you to manage and send documents electronically. This not only saves time but also enhances accuracy and security throughout the filing process.

-

What features does airSlate SignNow offer for IT 1040 IT 1040 Tax Ohio document management?

With airSlate SignNow, you can create templates for your IT 1040 IT 1040 Tax Ohio forms, set reminders for deadlines, and track the status of your documents. These features help ensure that you stay organized and meet all necessary tax deadlines efficiently.

-

Is airSlate SignNow a cost-effective solution for handling IT 1040 IT 1040 Tax Ohio forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing IT 1040 IT 1040 Tax Ohio forms. By reducing paper usage, postage costs, and the need for physical storage, it ultimately saves businesses money while streamlining document management.

-

Can I integrate airSlate SignNow with my accounting software for IT 1040 IT 1040 Tax Ohio?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage your IT 1040 IT 1040 Tax Ohio and keep your records organized. This ensures a smooth workflow and helps reduce manual entry errors.

-

What benefits does eSigning my IT 1040 IT 1040 Tax Ohio provide?

eSigning your IT 1040 IT 1040 Tax Ohio using airSlate SignNow boosts security, speeds up the signing process, and makes document sharing more convenient. It also provides a legally binding signature, which is crucial for tax submissions and compliance.

-

How does airSlate SignNow protect my sensitive IT 1040 IT 1040 Tax Ohio information?

airSlate SignNow prioritizes your data security by employing advanced encryption and authentication measures. This ensures that your personal and financial information related to the IT 1040 IT 1040 Tax Ohio remains confidential and secure throughout the document handling process.

Get more for IT 1040 IT 1040 Tax Ohio

- Nebraska personal form

- Nebraska copy 497318463 form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497318464 form

- Bill of sale of automobile and odometer statement new hampshire form

- Bill of sale for automobile or vehicle including odometer statement and promissory note new hampshire form

- Promissory note in connection with sale of vehicle or automobile new hampshire form

- Bill of sale for watercraft or boat new hampshire form

- Bill of sale of automobile and odometer statement for as is sale new hampshire form

Find out other IT 1040 IT 1040 Tax Ohio

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure