It 1040 it 1040 Ohio Department of Taxation State of Tax Brackets Form

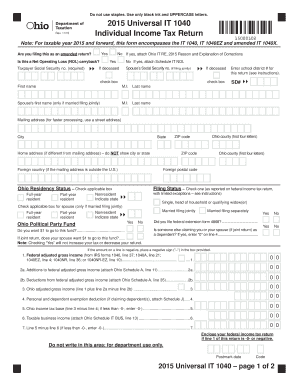

Understanding the IT 1040 Form for Ohio State Income Tax

The IT 1040 form is the primary document used for filing individual income tax in Ohio. This form is essential for residents and non-residents who earn income in the state. It captures various income types, deductions, and credits that may apply to your tax situation. Understanding this form is crucial for accurate filing and compliance with Ohio tax laws.

Steps to Complete the IT 1040 Form

Completing the IT 1040 form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain deductions.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Calculate your tax liability using the Ohio income tax brackets, which vary based on your income level.

- Review your completed form for accuracy before submission.

Required Documents for Filing the IT 1040

When preparing to file the IT 1040 form, it is important to have the following documents ready:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income, such as rental income or dividends

- Receipts for deductible expenses, including medical expenses and charitable contributions

- Any prior year tax returns, which can provide useful information for the current filing

Filing Deadlines for the IT 1040 Form

Filing deadlines for the IT 1040 form are typically aligned with federal tax deadlines. Generally, the deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines to avoid penalties.

Legal Use of the IT 1040 Form

The IT 1040 form must be used in accordance with Ohio state tax laws. It is legally binding once submitted and can be subject to audits by the Ohio Department of Taxation. Ensuring that all information is accurate and complete is essential to avoid legal issues and potential penalties.

Ohio Income Tax Brackets

Ohio has a progressive income tax system, meaning that tax rates increase with higher income levels. The tax brackets are updated periodically, so it is important to refer to the most current rates when completing the IT 1040 form. Understanding these brackets helps taxpayers estimate their tax liability accurately.

Quick guide on how to complete 2013 it 1040 2013 it 1040 ohio department of taxation state of tax brackets

Effortlessly Prepare IT 1040 IT 1040 Ohio Department Of Taxation State Of Tax brackets on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage IT 1040 IT 1040 Ohio Department Of Taxation State Of Tax brackets on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign IT 1040 IT 1040 Ohio Department Of Taxation State Of Tax brackets with ease

- Locate IT 1040 IT 1040 Ohio Department Of Taxation State Of Tax brackets and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet-ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements within a few clicks from your preferred device. Modify and eSign IT 1040 IT 1040 Ohio Department Of Taxation State Of Tax brackets and ensure seamless communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the impact of Ohio state income tax on businesses using airSlate SignNow?

Ohio state income tax can affect your business's overall financial health. By utilizing airSlate SignNow, businesses streamline document workflows, which can help reduce administrative costs associated with tax compliance, including Ohio state income tax forms.

-

How does airSlate SignNow assist with Ohio state income tax documentation?

airSlate SignNow simplifies the preparation and signing of critical documents that may be needed for Ohio state income tax compliance. With our electronic signature capabilities, you can ensure that all necessary forms are properly completed and submitted in a timely manner.

-

What features of airSlate SignNow can help manage Ohio state income tax forms?

airSlate SignNow offers features like customizable templates and automated reminders to help you manage Ohio state income tax forms more effectively. These tools ensure that you never miss a deadline and that your forms are always up to date.

-

What are the pricing options for airSlate SignNow in relation to Ohio state income tax needs?

airSlate SignNow offers competitive pricing plans designed to accommodate various business sizes, making it easier to manage Ohio state income tax needs. Businesses can choose a plan that fits their budget while still having access to essential features for tax documentation.

-

Can I integrate airSlate SignNow with accounting software that tracks Ohio state income tax?

Yes, airSlate SignNow can be easily integrated with popular accounting software platforms. This integration allows you to seamlessly manage your Ohio state income tax documents alongside your financial data, enhancing your overall workflow.

-

Is airSlate SignNow secure for handling Ohio state income tax documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, including those related to Ohio state income tax. Our platform employs advanced encryption and compliance measures to ensure that all sensitive data is protected.

-

How can airSlate SignNow help small businesses with Ohio state income tax?

For small businesses, airSlate SignNow offers a cost-effective solution to simplify the process of handling Ohio state income tax documentation. This platform helps save time and resources, allowing small business owners to focus more on their operations rather than paperwork.

Get more for IT 1040 IT 1040 Ohio Department Of Taxation State Of Tax brackets

- Construction contract cost plus or fixed fee new hampshire form

- Painting contract for contractor new hampshire form

- Trim carpenter contract for contractor new hampshire form

- Fencing contract for contractor new hampshire form

- Hvac contract for contractor new hampshire form

- Landscape contract for contractor new hampshire form

- Commercial contract for contractor new hampshire form

- Excavator contract for contractor new hampshire form

Find out other IT 1040 IT 1040 Ohio Department Of Taxation State Of Tax brackets

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online