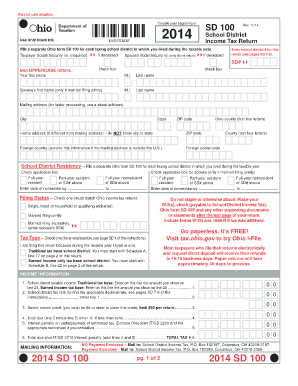

SD 100 School District Income Tax Return Tax Ohio Form

What is the SD 100 School District Income Tax Return Tax Ohio

The SD 100 School District Income Tax Return is a tax form used by residents of Ohio to report income earned and calculate school district income tax obligations. This form is essential for individuals living in school districts that impose an income tax, ensuring compliance with local tax laws. The SD 100 form captures various income sources, deductions, and credits that may apply to the taxpayer's situation.

Steps to complete the SD 100 School District Income Tax Return Tax Ohio

Completing the SD 100 form involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099 forms, and any other income statements.

- Fill out personal information, such as your name, address, and social security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Calculate any applicable deductions and credits to reduce your taxable income.

- Determine the total school district income tax owed based on the calculated income.

- Review the completed form for accuracy before submission.

How to obtain the SD 100 School District Income Tax Return Tax Ohio

The SD 100 form can be obtained through various channels:

- Visit the official Ohio Department of Taxation website to download the form.

- Request a physical copy from your local school district office.

- Access tax preparation software that includes the SD 100 form as part of their offerings.

Legal use of the SD 100 School District Income Tax Return Tax Ohio

The SD 100 form is legally binding when completed accurately and submitted on time. It must adhere to Ohio tax laws and regulations. Failure to file this form can result in penalties, including fines and interest on unpaid taxes. It is crucial to ensure that all information provided is truthful and complete to avoid legal repercussions.

Filing Deadlines / Important Dates

Timely submission of the SD 100 form is essential to avoid penalties. The typical filing deadline for the SD 100 is the same as the federal income tax return deadline, usually April fifteenth. However, it is advisable to check with the local school district for any specific deadlines or extensions that may apply.

Form Submission Methods (Online / Mail / In-Person)

The SD 100 form can be submitted through various methods:

- Electronically through authorized tax preparation software that supports e-filing for Ohio tax forms.

- By mail, sending the completed form to the appropriate school district tax office.

- In-person at designated tax offices or local government offices, where available.

Quick guide on how to complete 2014 sd 100 school district income tax return tax ohio

Complete SD 100 School District Income Tax Return Tax Ohio effortlessly on any device

Web-based document administration has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage SD 100 School District Income Tax Return Tax Ohio on any device with airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

The easiest method to edit and eSign SD 100 School District Income Tax Return Tax Ohio seamlessly

- Find SD 100 School District Income Tax Return Tax Ohio and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Craft your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, the frustration of searching for forms, or mistakes that require printing new document copies. airSlate SignNow meets your requirements for document management in just a few clicks from any device you prefer. Modify and eSign SD 100 School District Income Tax Return Tax Ohio to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the SD 100 School District Income Tax Return Tax Ohio?

The SD 100 School District Income Tax Return Tax Ohio is a form used by residents to report income for school district tax purposes in Ohio. This tax helps fund local education systems and is essential for compliance with state regulations. Understanding this form is crucial for any Ohio resident subject to school district income tax.

-

How can airSlate SignNow help me with the SD 100 School District Income Tax Return Tax Ohio?

airSlate SignNow provides an efficient way to prepare, sign, and submit your SD 100 School District Income Tax Return Tax Ohio electronically. With our user-friendly platform, you can easily fill out the necessary forms and ensure they are properly signed and submitted. This streamlines the entire process and reduces the risk of errors.

-

Is airSlate SignNow affordable for filing the SD 100 School District Income Tax Return Tax Ohio?

Yes, airSlate SignNow offers cost-effective solutions for eSigning and document management, making it an affordable choice for filing the SD 100 School District Income Tax Return Tax Ohio. Our pricing plans are designed to fit various budgets, ensuring that businesses and individuals can efficiently manage their tax documents without overspending.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers robust features for managing tax documents such as customizable templates, secure storage, eSignature functionality, and integration with popular accounting software. These features enhance your ability to manage the SD 100 School District Income Tax Return Tax Ohio effectively. You can ensure compliance and streamline your filing process effortlessly.

-

Can I integrate airSlate SignNow with my existing accounting software for the SD 100 filing?

Absolutely! airSlate SignNow supports integration with various accounting software solutions. This allows you to seamlessly manage your financial documents and file your SD 100 School District Income Tax Return Tax Ohio without any disruptions in your workflow. Such integration simplifies data transfer and reduces manual entry errors.

-

What are the benefits of using airSlate SignNow for eSigning my tax returns?

Using airSlate SignNow for eSigning your tax returns offers numerous benefits including increased security, faster turnaround times, and convenience. You can easily sign your SD 100 School District Income Tax Return Tax Ohio from anywhere, avoiding the delays associated with traditional paper methods. This ensures your documents are processed promptly.

-

Is there customer support available for help with my SD 100 filings?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions or issues related to your SD 100 School District Income Tax Return Tax Ohio filings. Our support team is knowledgeable and ready to help you navigate the document management process. You can signNow them through various channels, including chat and email.

Get more for SD 100 School District Income Tax Return Tax Ohio

- Nh rights form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497318503 form

- New hampshire seller form

- Notice of default for past due payments in connection with contract for deed new hampshire form

- Final notice of default for past due payments in connection with contract for deed new hampshire form

- Assignment of contract for deed by seller new hampshire form

- Notice of assignment of contract for deed new hampshire form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement new hampshire form

Find out other SD 100 School District Income Tax Return Tax Ohio

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple