IL 2210 Computation of Penalties for Individuals Form

What is the IL 2210 Computation Of Penalties For Individuals

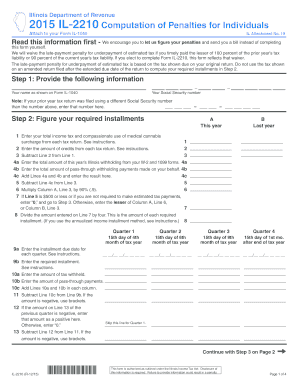

The IL 2210 Computation Of Penalties For Individuals is a form used by taxpayers in Illinois to calculate penalties for underpayment of state income tax. This form is essential for individuals who do not meet the required payment thresholds throughout the tax year. It helps determine if a penalty applies and, if so, the amount that must be paid. Understanding this form is crucial for maintaining compliance with state tax regulations and avoiding unnecessary penalties.

How to use the IL 2210 Computation Of Penalties For Individuals

Using the IL 2210 Computation Of Penalties For Individuals involves several steps. First, gather your tax information, including total income and tax withheld. Next, calculate your total tax liability for the year. If you find that your payments are less than the required amount, you will need to fill out the form. Follow the instructions carefully, ensuring that all calculations are accurate to avoid further penalties. Finally, submit the completed form with your tax return or as directed by the Illinois Department of Revenue.

Steps to complete the IL 2210 Computation Of Penalties For Individuals

Completing the IL 2210 Computation Of Penalties For Individuals requires a methodical approach:

- Gather all necessary documents, such as your income statements and previous tax returns.

- Determine your total tax liability for the year.

- Calculate your total payments made during the year, including withholding and estimated payments.

- Compare your total payments to your tax liability to identify any shortfall.

- Fill out the IL 2210 form, detailing your calculations and any penalties incurred.

- Review the form for accuracy before submission.

Legal use of the IL 2210 Computation Of Penalties For Individuals

The IL 2210 Computation Of Penalties For Individuals is legally binding when filled out correctly and submitted to the Illinois Department of Revenue. It serves as an official document that outlines any penalties for underpayment of taxes. Compliance with the instructions and accuracy in reporting are essential to ensure that the form is accepted and that any penalties are calculated correctly. This form must be retained for your records, as it may be needed for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the IL 2210 Computation Of Penalties For Individuals align with the general tax filing deadlines in Illinois. Typically, individual income tax returns are due on April fifteenth of each year. If you are required to submit the IL 2210 form, it should be filed along with your tax return by this date. It is essential to be aware of any extensions or changes to deadlines, especially in cases of natural disasters or other significant events that may affect filing requirements.

Penalties for Non-Compliance

Failing to comply with the requirements of the IL 2210 Computation Of Penalties For Individuals can result in significant penalties. If you underpay your taxes and do not file this form, you may incur additional interest and penalties on the amount owed. The penalties can accumulate quickly, leading to a larger financial burden. It is advisable to address any potential underpayment as soon as possible to mitigate these risks and ensure compliance with state tax laws.

Quick guide on how to complete 2015 il 2210 computation of penalties for individuals

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can locate the appropriate form and securely save it online. airSlate SignNow supplies all the tools necessary to create, modify, and digitally sign your documents quickly and seamlessly. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The easiest way to adjust and digitally sign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for such tasks.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and digitally sign [SKS] and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 2210 Computation Of Penalties For Individuals

Create this form in 5 minutes!

People also ask

-

What is the IL 2210 Computation Of Penalties For Individuals?

The IL 2210 Computation Of Penalties For Individuals refers to the method used to calculate penalties for underpayment of estimated tax by individual taxpayers in Illinois. Understanding this computation can help you avoid unnecessary penalties when filing your tax returns.

-

How can airSlate SignNow help me with IL 2210 Computation Of Penalties For Individuals?

airSlate SignNow offers a streamlined process for electronically signing and sending tax forms, including the documentation related to the IL 2210 Computation Of Penalties For Individuals. Our solution ensures that your documents are securely signed and delivered, reducing the risk of errors in your tax submissions.

-

What features does airSlate SignNow provide for managing tax documents?

With airSlate SignNow, you can easily manage your tax documents through features like templates, customizable workflows, and real-time tracking. This means you can efficiently handle forms related to the IL 2210 Computation Of Penalties For Individuals and other tax-related documentation without hassle.

-

Is there a cost associated with using airSlate SignNow for tax processes?

Yes, airSlate SignNow offers various pricing plans to suit the needs of individuals and businesses. With our cost-effective solution, you can manage your essential document workflows, including those that pertain to the IL 2210 Computation Of Penalties For Individuals, without breaking the bank.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! airSlate SignNow supports integrations with various tax and accounting software, making it easy to incorporate the IL 2210 Computation Of Penalties For Individuals into your existing systems. This integration helps streamline your tax processes and enhance overall efficiency.

-

How secure is airSlate SignNow for handling sensitive tax information?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and complies with industry standards to protect your sensitive information, including anything related to the IL 2210 Computation Of Penalties For Individuals, ensuring that your data remains confidential.

-

Can airSlate SignNow assist in avoiding penalties related to tax documentation?

Yes, by using airSlate SignNow to ensure timely and accurate submission of your tax forms, you can signNowly reduce the risk of incurring penalties related to the IL 2210 Computation Of Penalties For Individuals. Our platform helps you manage deadlines and compliance effortlessly.

Get more for IL 2210 Computation Of Penalties For Individuals

- 511 form capital tax collection bureau

- Incometaxfill 2012 form

- Aaadm inspection forms

- 409 statement form

- Authorization for annuity withdrawal guggenheim life form

- Southwest baggage claim form

- Orange and rockland application for new residential construction form

- Activity permit application toronto pearson international airport form

Find out other IL 2210 Computation Of Penalties For Individuals

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement