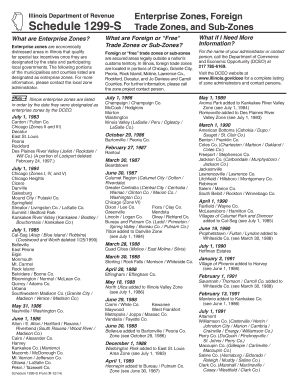

Schedule 1299 S Enterprise Zones, Foreign Trade Zones, and Sub Zones Schedule 1299 S Form

What is the Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S

The Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S is a tax form used by businesses in the United States to claim tax credits and benefits associated with operating in designated enterprise zones and foreign trade zones. This form helps businesses take advantage of various incentives aimed at promoting economic development in specific areas. By utilizing this schedule, businesses can potentially reduce their tax liabilities and enhance their financial standing.

How to use the Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S

To effectively use the Schedule 1299 S, businesses must first determine their eligibility for the associated tax credits. This involves reviewing the specific criteria set forth by the IRS and state authorities. Once eligibility is confirmed, businesses can fill out the form by providing necessary details about their operations within the designated zones. It is essential to ensure that all information is accurate and complete to facilitate the approval process.

Steps to complete the Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S

Completing the Schedule 1299 S involves several key steps:

- Gather relevant financial documents and records related to your business operations in the enterprise or foreign trade zones.

- Review the eligibility criteria to confirm that your business qualifies for the tax credits.

- Fill out the form with accurate information, including business details, tax identification numbers, and specific zone information.

- Calculate the applicable tax credits based on the guidelines provided by the IRS.

- Double-check the completed form for accuracy before submission.

Key elements of the Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S

Several key elements are integral to the Schedule 1299 S. These include:

- Tax Identification Number: Essential for identifying the business submitting the form.

- Zone Designation: Specific details about the enterprise or foreign trade zone where the business operates.

- Credit Calculation: Clear instructions on how to calculate the tax credits based on the business's activities.

- Signature Section: A designated area for authorized personnel to sign and date the form, confirming its accuracy.

Legal use of the Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S

The legal use of the Schedule 1299 S is governed by IRS regulations and state laws. Businesses must ensure compliance with all legal requirements when filling out and submitting the form. This includes maintaining accurate records, adhering to deadlines, and understanding the implications of the tax credits claimed. Failure to comply with these regulations can result in penalties or the denial of claimed benefits.

Form Submission Methods (Online / Mail / In-Person)

The Schedule 1299 S can be submitted through various methods, depending on the preferences of the business and the requirements of the IRS. Businesses may choose to:

- Submit the form electronically through approved e-filing systems.

- Mail a paper copy of the completed form to the appropriate IRS address.

- In some cases, deliver the form in person to local IRS offices.

Quick guide on how to complete 2014 schedule 1299 s enterprise zones foreign trade zones and sub zones schedule 1299 s

Complete [SKS] effortlessly on any device

Online document management has gained immense traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any obstacles. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign [SKS] seamlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S?

Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S is a tax incentive program designed to encourage economic development in specific regions. This program allows qualifying businesses to receive signNow tax benefits. By leveraging this schedule, businesses can enhance their growth potential in targeted areas.

-

How does airSlate SignNow facilitate the management of Schedule 1299 S?

airSlate SignNow simplifies the process of handling documents related to Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S. With its eSigning capabilities, businesses can quickly prepare, send, and sign agreements electronically, all while ensuring compliance with tax regulations. This efficiency helps businesses manage their applications and submissions more effectively.

-

What are the pricing options for using airSlate SignNow with Schedule 1299 S?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, making it a cost-effective solution for managing Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S applications. Plans are structured to provide flexibility, allowing businesses of all sizes to find an option that suits their budget. Users can choose from monthly or annual billing to maximize their value.

-

Can airSlate SignNow integrate with other software for Schedule 1299 S processes?

Yes, airSlate SignNow seamlessly integrates with numerous CRM and document management tools to enhance the handling of Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S. This integration allows for streamlined workflows, improving efficiency and ensuring all related documents are easily accessible. Users can connect their existing tools for a more cohesive experience.

-

What features does airSlate SignNow offer for businesses using Schedule 1299 S?

AirSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage specifically beneficial for Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S. These features help businesses manage their documentation needs efficiently and ensure quick compliance with tax requirements. The user-friendly interface makes it easy for anyone to get started.

-

What benefits can businesses expect from using airSlate SignNow for Schedule 1299 S?

Businesses can expect enhanced productivity and reduced turnaround times when using airSlate SignNow for Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S. The ability to eSign documents quickly eliminates the need for physical paperwork, streamlining the overall process. This translates to more time focused on core business activities and increased operational efficiency.

-

How secure is airSlate SignNow when managing Schedule 1299 S documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents related to Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S. The platform employs advanced encryption and compliance measures to protect user data. This ensures that all documents are safe and secure, giving businesses peace of mind while managing their tax-related paperwork.

Get more for Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S

- Sample request formpdffillercom

- Allinurl online nebraska form

- 1996 kia sportage repair manual pdf form

- 26th annual meyers nave form

- Citizens revised 4 point form magnum inspections inc

- Marta mobility form

- Qualified contract application arizona department of housing form

- Special event application irces com form

Find out other Schedule 1299 S Enterprise Zones, Foreign Trade Zones, And Sub Zones Schedule 1299 S

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile