Form 1040 Schedule A&B Itemized Deductions and Interest & Dividend Income Irs

What is the Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs

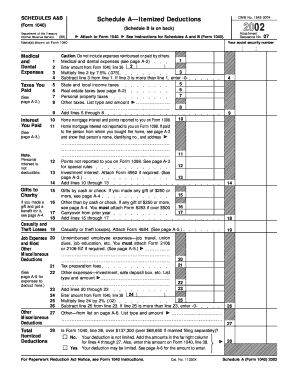

The Form 1040 Schedule A and B are integral parts of the U.S. federal income tax return process. Schedule A is used to report itemized deductions, which can reduce taxable income significantly. This includes deductions for medical expenses, state and local taxes, mortgage interest, and charitable contributions. Schedule B, on the other hand, is utilized to report interest and dividend income. Taxpayers must complete these schedules if they choose to itemize deductions instead of taking the standard deduction or if they have specific types of income from interest or dividends. Understanding these forms is essential for accurate tax reporting and maximizing potential refunds.

Steps to complete the Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs

Completing the Form 1040 Schedule A and B involves several key steps. First, gather all necessary documentation, including receipts for deductible expenses and statements of interest and dividends received. For Schedule A, categorize your deductions into sections such as medical expenses, taxes paid, and mortgage interest. Calculate the total for each category and sum them to find your total itemized deductions. For Schedule B, list all sources of interest and dividend income, ensuring you include amounts from all accounts and investments. Finally, transfer the totals from both schedules to the appropriate sections of your Form 1040, ensuring accuracy to avoid potential issues with the IRS.

Legal use of the Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs

The legal use of the Form 1040 Schedule A and B is governed by IRS regulations. These forms must be completed accurately and submitted as part of your federal tax return. Failure to report income or improperly claiming deductions can lead to penalties or audits by the IRS. Additionally, e-signatures on these forms are legally binding, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. Using a secure platform for digital signing can enhance the legal standing of your submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 Schedule A and B. Taxpayers should refer to the IRS instructions for these forms, which outline eligibility criteria, allowable deductions, and reporting requirements. It's important to stay updated on any changes to tax laws that may affect deductions or reporting methods. The IRS also emphasizes the importance of accuracy in reporting to avoid discrepancies that could lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040, including Schedule A and B, are critical for compliance. Typically, individual tax returns are due on April fifteenth each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these important dates helps ensure timely and accurate filing.

Required Documents

To complete the Form 1040 Schedule A and B, certain documents are essential. For Schedule A, gather receipts for medical expenses, records of property taxes, mortgage interest statements, and proof of charitable donations. For Schedule B, collect bank statements and investment account summaries that detail interest and dividend income. Having these documents organized will facilitate a smoother filing process and help ensure that all applicable deductions and income are accurately reported.

Examples of using the Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs

Examples of using the Form 1040 Schedule A and B can illustrate how different taxpayers benefit from itemizing deductions and reporting interest and dividend income. For instance, a homeowner with significant mortgage interest and property taxes may find that itemizing on Schedule A yields a lower taxable income compared to the standard deduction. Similarly, an investor receiving dividends from stocks must report this income on Schedule B to comply with IRS regulations. These examples highlight the importance of understanding how to utilize these forms effectively to maximize tax benefits.

Quick guide on how to complete 2002 form 1040 schedule aampb itemized deductions and interest amp dividend income irs

Effortlessly Prepare Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs on any platform with the airSlate SignNow mobile applications for Android or iOS and enhance any document-oriented workflow today.

The Easiest Method to Modify and eSign Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs Effortlessly

- Obtain Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs and then click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or downloading it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Form 1040 Schedule A& B Itemized Deductions?

Form 1040 Schedule A& B Itemized Deductions allows taxpayers to detail qualifying expenses to lower their taxable income. This can include deductions for things like medical expenses, state taxes, and mortgage interest. It's essential for ensuring you maximize your deductions based on IRS guidelines.

-

How can airSlate SignNow help with eSigning Form 1040 Schedule A& B?

airSlate SignNow provides a user-friendly platform for electronic signatures, allowing you to sign Form 1040 Schedule A& B Itemized Deductions and other documents seamlessly. You can securely eSign your forms from anywhere, streamlining the tax filing process and ensuring compliance with IRS requirements.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow includes features such as document templates, customizable signing workflows, and automated reminders. These helpful tools can aid users in gathering and organizing their Form 1040 Schedule A& B Itemized Deductions and other tax-related documents efficiently.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. These plans provide access to essential features for managing Form 1040 Schedule A& B Itemized Deductions and other documents at a competitive price, making it an affordable solution for eSigning needs.

-

What are the benefits of digitizing Form 1040 Schedule A& B with airSlate SignNow?

Digitizing your Form 1040 Schedule A& B Itemized Deductions process with airSlate SignNow saves time and enhances efficiency. It minimizes paper usage, allows for easy tracking of signatures, and promotes better organization of your documents, simplifying tax filing tasks.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and document management systems, enhancing your workflows. This means you can manage your Form 1040 Schedule A& B Itemized Deductions and Interest & Dividend Income IRS documents alongside your existing tools for improved efficiency.

-

How secure is the airSlate SignNow platform for handling tax documents?

airSlate SignNow prioritizes security and compliance, ensuring that your Form 1040 Schedule A& B Itemized Deductions documents are protected. With industry-standard encryption and secure cloud storage, you can confidently manage sensitive information while complying with IRS regulations.

Get more for Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497319227 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497319228 form

- Letter tenant in 497319229 form

- Nj letter tenant form

- Landlord tenant use form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497319232 form

- New jersey tenant notice form

- New jersey landlord form

Find out other Form 1040 Schedule A&B Itemized Deductions And Interest & Dividend Income Irs

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract