Fillable Form 3921

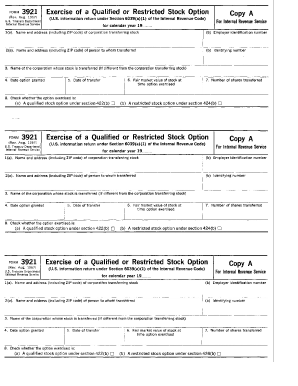

What is the fillable form 3921

The fillable form 3921 is a tax document used in the United States to report the transfer of stock acquired through an employee stock option plan. This form is essential for both employers and employees as it outlines the details of stock options exercised during the tax year. It provides crucial information needed for tax reporting and compliance, ensuring that both parties meet their obligations under the Internal Revenue Service (IRS) guidelines.

How to use the fillable form 3921

Using the fillable form 3921 involves several straightforward steps. First, ensure you have the correct version of the form, as it may be updated periodically. Next, gather all necessary information, including the employee's name, address, and Social Security number, along with details about the stock options, such as the exercise date and the fair market value at the time of exercise. Once you have all the required information, complete the form accurately, ensuring all fields are filled out correctly to avoid delays or issues with the IRS.

Steps to complete the fillable form 3921

Completing the fillable form 3921 requires attention to detail. Follow these steps:

- Obtain the latest version of the fillable form 3921 from a reliable source.

- Fill in the employee's details, including their name and Social Security number.

- Provide information about the stock options exercised, including the date of exercise and the number of shares.

- Indicate the fair market value of the stock on the exercise date.

- Review the completed form for accuracy before submission.

Legal use of the fillable form 3921

The fillable form 3921 is legally binding when completed and submitted according to IRS regulations. It is essential for employers to provide this form to employees who have exercised stock options, as it ensures compliance with tax reporting requirements. The form must be filed with the IRS and provided to employees by the deadline specified by the IRS to avoid penalties. Proper use of this form helps maintain transparency and accountability in employee compensation practices.

IRS Guidelines

The IRS provides specific guidelines regarding the fillable form 3921, including filing deadlines and requirements for accuracy. Employers must issue the form to employees by January 31 of the year following the exercise of stock options. Additionally, the IRS requires that the form be filed electronically if there are more than two forms to submit. Following these guidelines is crucial to ensure compliance and avoid potential penalties for late or incorrect filings.

Form Submission Methods

The fillable form 3921 can be submitted in various ways. Employers may choose to file the form electronically through the IRS e-file system, which is often the preferred method for efficiency and accuracy. Alternatively, the form can be mailed directly to the IRS or provided to employees in person. It's important to choose a submission method that aligns with IRS requirements and ensures timely processing of the form.

Quick guide on how to complete fillable form 3921

Accomplish Fillable Form 3921 effortlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Fillable Form 3921 across any platform using the airSlate SignNow Android or iOS apps and simplify any document-related process today.

The most effective method to modify and eSign Fillable Form 3921 with ease

- Locate Fillable Form 3921 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal authority as a traditional wet signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Fillable Form 3921 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the fillable form 3921 used for?

The fillable form 3921 is utilized for reporting the transfer of stock acquired through an employee stock purchase plan. This form helps both employers and employees keep accurate records for tax purposes, and using airSlate SignNow can simplify the signing and completion process.

-

How can I fill out the fillable form 3921 using airSlate SignNow?

To fill out the fillable form 3921 using airSlate SignNow, simply upload the form, add your fields, and customize it according to your needs. Our easy-to-use platform will guide you through the steps required, making the form filling process straightforward and efficient.

-

Is there a cost associated with using airSlate SignNow for the fillable form 3921?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs. You can choose a plan that fits your budget while accessing features that make the completion of the fillable form 3921 and other documents easy and affordable.

-

Can I integrate other applications with airSlate SignNow for the fillable form 3921?

Absolutely! airSlate SignNow offers integrations with numerous applications, allowing you to streamline your workflows. Whether you're using CRM systems or project management tools, integrating airSlate SignNow can enhance your ability to manage and send the fillable form 3921 efficiently.

-

What features does airSlate SignNow offer for the fillable form 3921?

airSlate SignNow provides a variety of features for the fillable form 3921, including customizable templates, automated workflows, and secure eSignature capabilities. These features ensure that your forms are completed accurately and efficiently while maintaining compliance with regulations.

-

Is my data secure when using airSlate SignNow for the fillable form 3921?

Yes, airSlate SignNow prioritizes the security of your data. Our platform employs industry-standard encryption and adheres to compliance regulations to protect sensitive information, making it safe to keep and manage your fillable form 3921 and other important documents.

-

Can multiple users collaborate on the fillable form 3921 in airSlate SignNow?

Yes, multiple users can collaborate on the fillable form 3921 within airSlate SignNow. Our platform allows you to invite team members to view, edit, and sign the form, facilitating effective collaboration and ensuring everyone is on the same page during the process.

Get more for Fillable Form 3921

- Assignment of contract for deed by seller minnesota form

- Notice of assignment of contract for deed minnesota form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement minnesota form

- Buyers home inspection checklist minnesota form

- Sellers information for appraiser provided to buyer minnesota

- Handbook real estate 497311869 form

- Mn subcontractors form

- Option to purchase addendum to residential lease lease or rent to own minnesota form

Find out other Fillable Form 3921

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online