Form 1099 DIV Rev January Dividends and Distributions

What is the Form 1099 DIV Rev January Dividends And Distributions

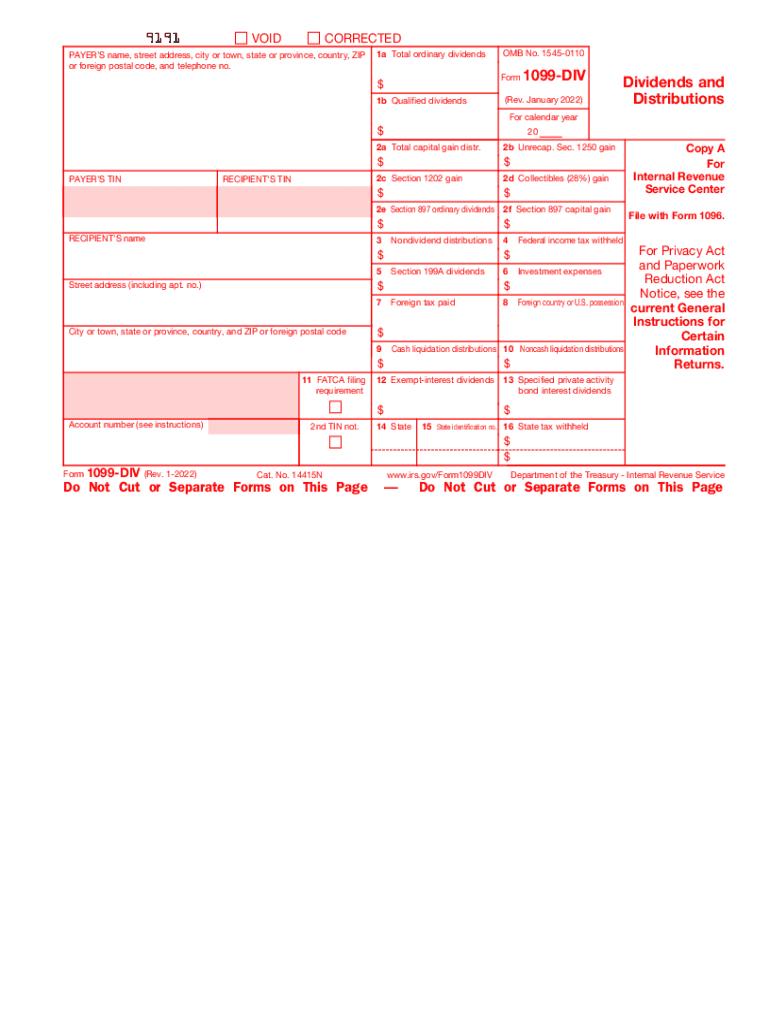

The Form 1099 DIV is a tax document used to report dividends and distributions received by taxpayers during the tax year. This form is essential for individuals who have investments in stocks, mutual funds, or other financial instruments that generate dividend income. The IRS requires this form to ensure that all dividend income is reported accurately for tax purposes. It includes various types of distributions, such as ordinary dividends, qualified dividends, and capital gain distributions, which are crucial for determining the correct tax liability.

Steps to complete the Form 1099 DIV Rev January Dividends And Distributions

Completing the Form 1099 DIV involves several key steps to ensure accuracy and compliance with IRS regulations:

- Gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN).

- Identify the total amount of dividends paid during the year, categorizing them into ordinary dividends, qualified dividends, and capital gain distributions.

- Fill out the appropriate boxes on the form, ensuring that each type of distribution is reported in its designated section.

- Double-check all entries for accuracy, as errors can lead to penalties or delays in processing.

- Provide copies of the completed form to the recipient and submit it to the IRS by the designated deadline.

How to obtain the Form 1099 DIV Rev January Dividends And Distributions

The Form 1099 DIV can be obtained through various channels. Taxpayers can download the form directly from the IRS website, where the most recent version is available in PDF format. Additionally, many financial institutions and tax preparation software programs provide access to the form, allowing users to generate it automatically based on their investment records. It is important to ensure that the correct version of the form is used to comply with current tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 DIV are crucial for compliance. Generally, the form must be sent to recipients by January thirty-first of the year following the tax year in which the dividends were paid. Additionally, the form must be filed with the IRS by the end of February if submitted on paper, or by the end of March if filed electronically. Missing these deadlines can result in penalties, so it is essential to stay informed about these important dates.

Legal use of the Form 1099 DIV Rev January Dividends And Distributions

The legal use of the Form 1099 DIV is governed by IRS regulations that require accurate reporting of dividend income. This form serves as a formal declaration of earnings from investments and must be filed by any entity that pays dividends to individuals or other entities. Failure to file the form or to report accurate information can lead to legal consequences, including fines and penalties. It is vital for filers to understand their obligations under tax law to avoid non-compliance issues.

Who Issues the Form

The Form 1099 DIV is typically issued by financial institutions, corporations, and mutual funds that distribute dividends to shareholders. These entities are responsible for compiling the necessary information regarding dividends paid during the tax year and ensuring that the form is accurately completed and distributed to recipients. Shareholders should expect to receive this form from the entity that holds their investment, allowing them to report their income correctly on their tax returns.

Quick guide on how to complete form 1099 div rev january 2022 dividends and distributions

Effortlessly Prepare Form 1099 DIV Rev January Dividends And Distributions on Any Device

Digital document management has become increasingly favored by enterprises and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow offers all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1099 DIV Rev January Dividends And Distributions on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The Easiest Way to Edit and Electronically Sign Form 1099 DIV Rev January Dividends And Distributions

- Locate Form 1099 DIV Rev January Dividends And Distributions and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, and errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Modify and electronically sign Form 1099 DIV Rev January Dividends And Distributions and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 1099 div 2022 pdf and why do I need it?

A 1099 div 2022 pdf is a tax form used to report dividends and distributions from investments. If you receive dividends from stocks or mutual funds, you'll need this form to accurately report your income during tax season. Using airSlate SignNow can simplify the process of managing and eSigning your 1099 div 2022 pdf for efficient filing.

-

How can I easily create a 1099 div 2022 pdf using airSlate SignNow?

Creating a 1099 div 2022 pdf with airSlate SignNow is simple and quick. You can upload your existing documents, fill in the necessary information, and then eSign them in just a few clicks. This user-friendly platform ensures that your forms are ready for tax filing without unnecessary hassle.

-

Is airSlate SignNow secure for handling my 1099 div 2022 pdf?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your documents, including your 1099 div 2022 pdf. With features like encryption and secure cloud storage, you can trust us to keep your sensitive tax information safe and secure.

-

What are the pricing plans for using airSlate SignNow for 1099 div 2022 pdf management?

airSlate SignNow offers a variety of pricing plans to fit your business needs, starting from a free trial to premium subscriptions. This cost-effective solution allows users to manage 1099 div 2022 pdf documents without breaking the bank. Sign up today to explore our features and find the perfect plan for you.

-

Can I integrate airSlate SignNow with other tools for processing my 1099 div 2022 pdf?

Yes, airSlate SignNow integrates seamlessly with numerous applications and platforms. You can easily link your accounting software or document management systems to enhance your efficiency when handling 1099 div 2022 pdf forms. This integration helps streamline your workflow and simplifies collaboration.

-

What features does airSlate SignNow offer for managing 1099 div 2022 pdf forms?

airSlate SignNow includes powerful features specifically for managing your 1099 div 2022 pdf forms. These include customizable templates, eSignatures, document tracking, and automated reminders. Our robust set of features simplifies processes and ensures timely tax form submissions.

-

How does eSigning my 1099 div 2022 pdf benefit me?

eSigning your 1099 div 2022 pdf saves time and eliminates the need for printing and scanning documents. This not only accelerates the process but also enhances accuracy by reducing human error. With airSlate SignNow, you can complete your tax documents from anywhere, at any time.

Get more for Form 1099 DIV Rev January Dividends And Distributions

- Exercising option purchase 497319318 form

- Nj custody child support form

- Complaint divorce with form

- Nj divorce 497319321 form

- Assignment of lease and rent from borrower to lender new jersey form

- New jersey divorce 497319323 form

- Assignment of lease from lessor with notice of assignment new jersey form

- New jersey notice template form

Find out other Form 1099 DIV Rev January Dividends And Distributions

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter