Printable Oklahoma Form OW 8 P SUP I Oklahoma Annualized

Understanding the Printable Oklahoma Form OW 8 P SUP I

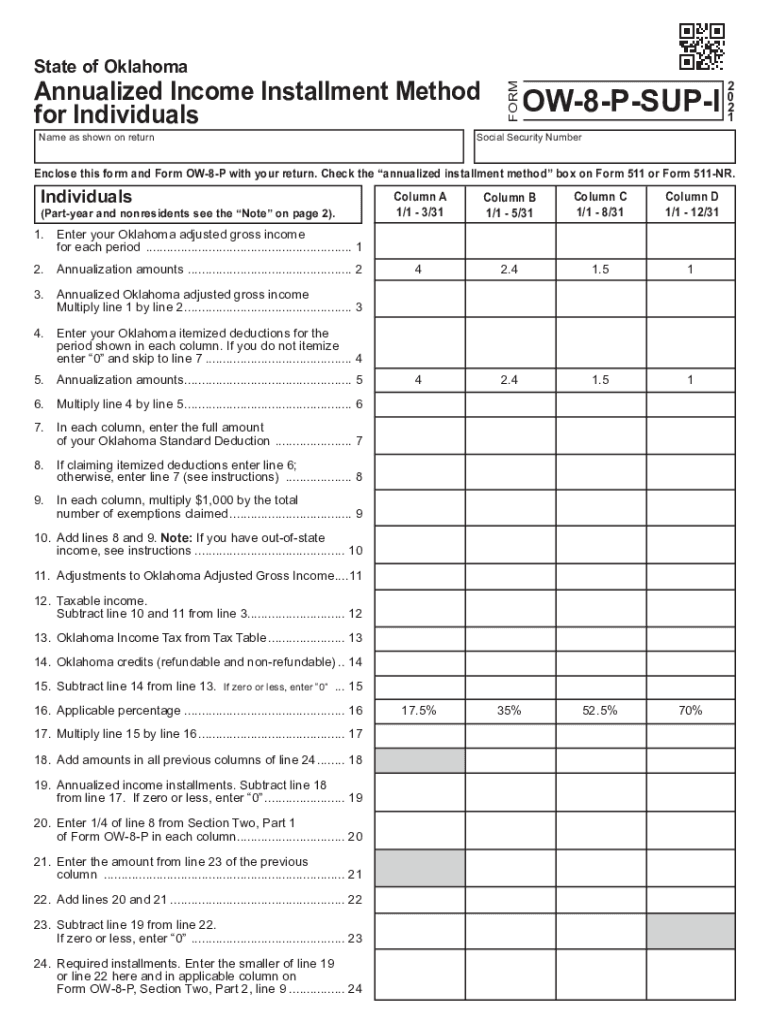

The Printable Oklahoma Form OW 8 P SUP I is an essential document used for annualized income calculations for certain taxpayers in Oklahoma. This form helps individuals report their income accurately and ensures compliance with state tax regulations. It is particularly relevant for those whose income fluctuates throughout the year, allowing for a more precise tax assessment based on actual earnings rather than estimates.

Steps to Complete the Printable Oklahoma Form OW 8 P SUP I

Completing the Printable Oklahoma Form OW 8 P SUP I involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out personal identification information at the top of the form, ensuring accuracy.

- Calculate your annualized income based on your earnings for the reporting period.

- Complete the sections related to deductions and credits applicable to your situation.

- Review all entries for accuracy before signing and dating the form.

Legal Use of the Printable Oklahoma Form OW 8 P SUP I

The Printable Oklahoma Form OW 8 P SUP I is legally recognized for tax reporting purposes in Oklahoma. To ensure its acceptance by the state tax authorities, it must be filled out correctly and submitted by the specified deadlines. Compliance with state regulations is crucial, as failure to use the form properly could lead to penalties or issues with tax assessments.

Filing Deadlines for the Printable Oklahoma Form OW 8 P SUP I

Timely submission of the Printable Oklahoma Form OW 8 P SUP I is essential. Typically, the form must be filed by April fifteenth of the following year after the income year ends. Taxpayers should be aware of any changes in deadlines that may occur due to state regulations or unforeseen circumstances, such as natural disasters or public health emergencies.

Who Issues the Printable Oklahoma Form OW 8 P SUP I

The Printable Oklahoma Form OW 8 P SUP I is issued by the Oklahoma Tax Commission. This state agency is responsible for managing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the Oklahoma Tax Commission's website or through authorized tax preparation services.

Examples of Using the Printable Oklahoma Form OW 8 P SUP I

Various taxpayer scenarios may require the use of the Printable Oklahoma Form OW 8 P SUP I. For instance:

- A self-employed individual with fluctuating income may use this form to report their earnings accurately.

- A seasonal worker who earns a significant portion of their income during specific months can benefit from this form to reflect their actual earnings.

- Individuals with multiple income sources may find this form useful for consolidating their income reporting.

Quick guide on how to complete printable oklahoma form ow 8 p sup i oklahoma annualized

Prepare Printable Oklahoma Form OW 8 P SUP I Oklahoma Annualized effortlessly on any device

Digital document management has gained greater popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Printable Oklahoma Form OW 8 P SUP I Oklahoma Annualized on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign Printable Oklahoma Form OW 8 P SUP I Oklahoma Annualized with ease

- Obtain Printable Oklahoma Form OW 8 P SUP I Oklahoma Annualized and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and press the Done button to save your changes.

- Choose how you want to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors necessitating new document prints. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Printable Oklahoma Form OW 8 P SUP I Oklahoma Annualized to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable oklahoma form ow 8 p sup i oklahoma annualized

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

How to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

How to create an e-signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to ow 8 p?

AirSlate SignNow is an electronic signature platform that allows users to send and eSign documents seamlessly. It supports businesses in streamlining their workflow, making it efficient and cost-effective—essentially embodying the principles of ow 8 p.

-

How much does airSlate SignNow cost and how does it relate to ow 8 p?

AirSlate SignNow offers flexible pricing plans designed to meet various business needs. These cost-effective options align with the ow 8 p philosophy, ensuring that companies can manage their document signing processes without breaking their budget.

-

What are the key features of airSlate SignNow?

AirSlate SignNow boasts features like customizable templates, real-time tracking, and cloud storage. These functionalities enhance user experience and efficiency, complementing the ow 8 p framework to promote effective document management.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow integrates smoothly with various popular tools and platforms, enhancing your document workflows. This interoperability supports the ow 8 p concept by allowing users to optimize their processes across multiple applications.

-

What benefits does airSlate SignNow offer for businesses?

With airSlate SignNow, businesses can expect increased productivity, reduced turnaround times, and improved customer satisfaction through streamlined document signing. These advantages are intrinsic to the efficiencies conveyed by ow 8 p.

-

Is airSlate SignNow compliant with industry regulations?

Absolutely, airSlate SignNow is compliant with major eSignature laws and regulations, ensuring that your documents are secure and legally binding. This adherence to compliance is a critical part of the ow 8 p approach, safeguarding your company's interests.

-

How can businesses ensure a smooth transition to airSlate SignNow?

To ensure a smooth transition, businesses should take advantage of airSlate SignNow's comprehensive onboarding resources and customer support. This commitment to assist users aligns with the ow 8 p approach, facilitating an effortless adoption of the platform.

Get more for Printable Oklahoma Form OW 8 P SUP I Oklahoma Annualized

Find out other Printable Oklahoma Form OW 8 P SUP I Oklahoma Annualized

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online