Topic No 753 Form W 4Employee's Withholding Certificate2021 New W 4 FormNo Allowances, Plus Computational BridgeHow to Fill Out

Understanding the ME Form W-4 Employee's Withholding Certificate

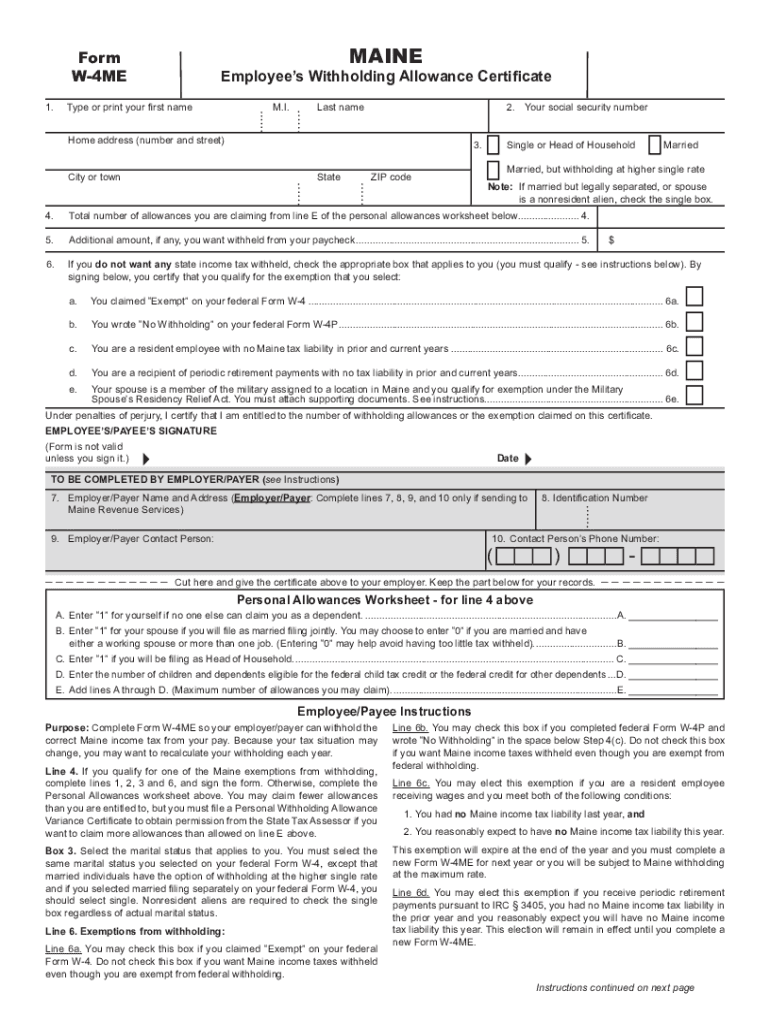

The ME Form W-4, also known as the Employee's Withholding Certificate, is a crucial document for employees in the United States. It is used to determine the amount of federal income tax that should be withheld from an employee's paycheck. By accurately completing this form, employees can ensure that their withholding aligns with their tax situation, helping to avoid underpayment or overpayment of taxes throughout the year.

Steps to Complete the ME Form W-4

Filling out the ME Form W-4 involves several key steps:

- Personal Information: Enter your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: If applicable, use the worksheet provided to calculate additional withholding.

- Claim Dependents: If you have dependents, indicate the number and any applicable tax credits.

- Additional Amounts: Specify any additional amount you want withheld from each paycheck.

- Signature: Sign and date the form to validate it.

Legal Use of the ME Form W-4

The ME Form W-4 is legally recognized for determining tax withholding in the United States. It complies with IRS regulations, ensuring that the information provided is used appropriately by employers for tax purposes. Employees should keep a copy of their completed form for their records, as it may be necessary for future reference or audits.

Key Elements of the ME Form W-4

Several key elements are essential when filling out the ME Form W-4:

- Filing Status: Choose from options such as single, married, or head of household.

- Dependents: Accurately report any dependents to maximize potential tax credits.

- Additional Withholding: Consider specifying an extra amount to ensure adequate tax coverage.

IRS Guidelines for the ME Form W-4

The IRS provides specific guidelines for completing the ME Form W-4. These guidelines include instructions on how to calculate withholding amounts based on income, filing status, and the number of dependents. It is essential to refer to the latest IRS publications to ensure compliance with current tax laws and regulations.

Filing Deadlines for the ME Form W-4

Employees should submit their ME Form W-4 to their employer as soon as they start a new job or experience a change in their tax situation. While there is no specific deadline for submitting the form, it is crucial to do so promptly to ensure that the correct amount of tax is withheld from the first paycheck. Additionally, employees may update their W-4 at any time during the year if their financial situation changes.

Quick guide on how to complete topic no 753 form w 4employees withholding certificate2021 new w 4 formno allowances plus computational bridgehow to fill out a

Fill out Topic No 753 Form W 4Employee's Withholding Certificate2021 New W 4 FormNo Allowances, Plus Computational BridgeHow To Fill Out effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage Topic No 753 Form W 4Employee's Withholding Certificate2021 New W 4 FormNo Allowances, Plus Computational BridgeHow To Fill Out on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Topic No 753 Form W 4Employee's Withholding Certificate2021 New W 4 FormNo Allowances, Plus Computational BridgeHow To Fill Out with ease

- Locate Topic No 753 Form W 4Employee's Withholding Certificate2021 New W 4 FormNo Allowances, Plus Computational BridgeHow To Fill Out and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Topic No 753 Form W 4Employee's Withholding Certificate2021 New W 4 FormNo Allowances, Plus Computational BridgeHow To Fill Out and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the topic no 753 form w 4employees withholding certificate2021 new w 4 formno allowances plus computational bridgehow to fill out a

How to make an e-signature for your PDF document online

How to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 'me form withholding'?

The 'me form withholding' is a specific tax form used by individuals to report their withholding status for tax purposes. Understanding this form is crucial for accurate tax reporting and compliance. Utilizing airSlate SignNow, you can easily complete and eSign your 'me form withholding' online, ensuring a hassle-free experience.

-

How does airSlate SignNow simplify the 'me form withholding' process?

airSlate SignNow simplifies the 'me form withholding' process by allowing you to easily fill out, sign, and send the form electronically. With an intuitive interface and quick navigation, you can complete the form in just a few minutes. This streamlines your tax filing process and reduces the likelihood of errors.

-

Is airSlate SignNow a cost-effective solution for eSigning the 'me form withholding'?

Yes, airSlate SignNow is designed to be a cost-effective solution for both individuals and businesses looking to eSign documents, including the 'me form withholding'. Our competitive pricing plans offer flexibility based on your needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the 'me form withholding'?

airSlate SignNow offers several features for managing the 'me form withholding', including document templates, a secure signing process, and automated reminders. These features enhance your signing experience by making it easier to track the status of your documents and ensuring timely submissions.

-

Can I integrate airSlate SignNow with other applications for 'me form withholding'?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enabling you to automate your workflow related to the 'me form withholding'. Whether you are using CRM systems or accounting software, our integrations help streamline the process further, saving you time and effort.

-

What benefits does eSigning the 'me form withholding' offer?

eSigning the 'me form withholding' offers multiple benefits, including increased efficiency, enhanced security, and reduced paperwork. By eSigning, you eliminate the need for printing, signing, and scanning, making the process much quicker and more reliable.

-

Is my information secure when using airSlate SignNow for 'me form withholding'?

Yes, your information is secure when using airSlate SignNow for the 'me form withholding'. We implement robust security measures, including encryption and secure access controls, to protect your sensitive data throughout the signing process.

Get more for Topic No 753 Form W 4Employee's Withholding Certificate2021 New W 4 FormNo Allowances, Plus Computational BridgeHow To Fill Out

Find out other Topic No 753 Form W 4Employee's Withholding Certificate2021 New W 4 FormNo Allowances, Plus Computational BridgeHow To Fill Out

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile