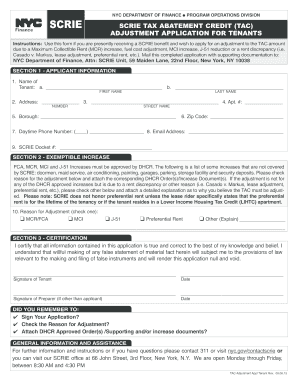

Tac Adjustment Form

What is the Tac Adjustment?

The Tac Adjustment refers to a specific process used to modify or correct tax-related information for individuals or businesses. This adjustment is essential for ensuring that tax records accurately reflect any changes in circumstances, such as income fluctuations or eligibility for tax credits. The Tac Adjustment can be particularly relevant for those seeking tax abatement credits or other financial adjustments that impact their tax liabilities.

Steps to Complete the Tac Adjustment

Completing the Tac Adjustment involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary documentation, including previous tax returns and any relevant financial statements.

- Review the specific requirements for the Tac Adjustment, including eligibility criteria and necessary forms.

- Fill out the Tac Adjustment form, ensuring all information is accurate and complete.

- Submit the completed form either online or via mail, depending on the guidelines provided by the relevant tax authority.

- Keep copies of all submitted documents for your records and follow up if necessary.

Legal Use of the Tac Adjustment

The legal use of the Tac Adjustment is governed by federal and state tax laws. To be considered valid, the adjustment must comply with regulations set forth by the IRS and any applicable state tax agencies. This includes ensuring that all information provided is truthful and substantiated by appropriate documentation. Utilizing a reliable platform for electronic submission can further enhance the legal standing of your Tac Adjustment.

Required Documents

When preparing to submit a Tac Adjustment, certain documents are typically required. These may include:

- Previous tax returns for the relevant years.

- Supporting documents that justify the need for an adjustment, such as income statements or proof of eligibility for tax credits.

- Identification information, including Social Security numbers or Employer Identification Numbers (EIN).

Ensuring that all required documents are included can help facilitate a smoother processing experience.

Eligibility Criteria

Eligibility for the Tac Adjustment varies based on individual circumstances and the specific tax laws in place. Generally, taxpayers must demonstrate a valid reason for seeking an adjustment, such as changes in income, filing status, or eligibility for specific tax credits. It is advisable to review the guidelines provided by the IRS or state tax authorities to confirm eligibility before proceeding with the adjustment.

Who Issues the Form?

The Tac Adjustment form is typically issued by the relevant tax authority, which may be the IRS at the federal level or state tax agencies for local adjustments. Each issuing body may have its own specific form and guidelines, so it is important to ensure that you are using the correct version for your situation. Keeping updated with any changes in form requirements can aid in the timely filing of your adjustment.

Quick guide on how to complete tac adjustment

Complete Tac Adjustment effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow offers all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Tac Adjustment on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

The easiest way to modify and eSign Tac Adjustment seamlessly

- Obtain Tac Adjustment and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and eSign Tac Adjustment and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is scrie leap and how does airSlate SignNow utilize it?

Scrie leap is a concept aimed at streamlining document signing processes in a digital environment. airSlate SignNow utilizes scrie leap by offering an intuitive platform that allows businesses to send and eSign documents easily, enhancing efficiency.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains cost-effective to accommodate different business sizes. The scrie leap model is designed to provide excellent value while offering essential features for document signing.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a range of features including customizable templates, audit trails, and mobile accessibility. These features embody the scrie leap concept by ensuring that companies can manage document workflows seamlessly.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integrations with various applications such as Google Drive, Dropbox, and CRM systems. This enhances the scrie leap experience by allowing users to synchronize their document management processes across multiple platforms.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow provides signNow benefits, including reduced turnaround time for documents and improved team collaboration. These advantages reflect the scrie leap approach by making signing processes faster and more efficient.

-

Is airSlate SignNow secure for eSigning documents?

Absolutely! airSlate SignNow employs industry-standard security measures to ensure that all documents eSigned through their platform are secure. This commitment to security complements the scrie leap methodology by maintaining trust in the digital signing process.

-

Who can benefit from airSlate SignNow?

airSlate SignNow is designed for businesses of all sizes, from startups to large enterprises, looking to simplify their document signing processes. The scrie leap strategy empowers diverse users to achieve operational efficiency and save time.

Get more for Tac Adjustment

- Revocation of general durable power of attorney new jersey form

- Essential legal life documents for newlyweds new jersey form

- Nj legal documents 497319577 form

- Essential legal life documents for new parents new jersey form

- General power of attorney for care and custody of child or children new jersey form

- Small business accounting package new jersey form

- New jersey procedures form

- Nj revocation form

Find out other Tac Adjustment

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast