Form Boe 571 L

What is the Form Boe 571 L

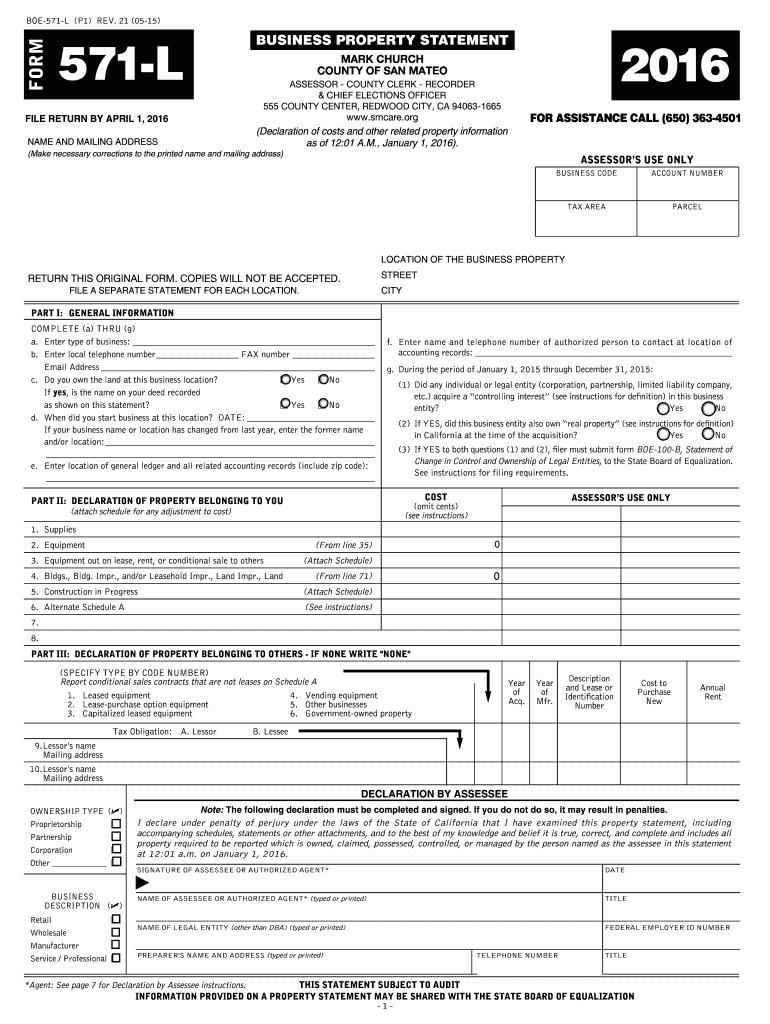

The Form Boe 571 L is a property statement used primarily in the United States for reporting business personal property. This form is essential for businesses to disclose their tangible assets to local tax authorities, enabling accurate assessment for property tax purposes. It typically includes details about the type of property owned, its location, and its estimated value. Understanding this form is crucial for compliance with local tax regulations and ensuring that businesses are not over or under-taxed based on their asset holdings.

How to use the Form Boe 571 L

Using the Form Boe 571 L involves several straightforward steps. First, gather all necessary information about your business assets, including equipment, furniture, and any other personal property. Next, accurately fill out the form by providing details such as the description of each asset, its location, and the estimated value. Once completed, the form should be submitted to the appropriate local tax authority by the specified deadline. It is important to retain a copy of the submitted form for your records.

Steps to complete the Form Boe 571 L

Completing the Form Boe 571 L requires careful attention to detail. Follow these steps:

- Collect information on all business personal property, including acquisition dates and values.

- Fill out the form, ensuring each section is completed accurately. Include descriptions and values for each asset.

- Review the form for any errors or omissions.

- Submit the completed form to your local tax authority by the deadline.

By following these steps, businesses can ensure compliance and avoid potential penalties.

Legal use of the Form Boe 571 L

The legal use of the Form Boe 571 L is governed by state and local laws regarding property taxation. Filing this form accurately is a legal requirement for businesses that own personal property. Failure to submit the form or providing false information can result in penalties, including fines or increased tax assessments. Therefore, it is essential to understand the legal implications and ensure that the form is completed in accordance with applicable regulations.

Key elements of the Form Boe 571 L

Several key elements must be included in the Form Boe 571 L for it to be valid:

- Business Information: Name, address, and contact details of the business.

- Property Description: Detailed descriptions of all personal property owned.

- Value Assessment: Estimated value of each asset, typically based on purchase price or fair market value.

- Signature: The form must be signed by an authorized representative of the business.

Including these elements ensures that the form meets the requirements set by local tax authorities.

Form Submission Methods

The Form Boe 571 L can typically be submitted in several ways, depending on the local regulations. Common submission methods include:

- Online Submission: Many jurisdictions allow electronic filing through their official websites.

- Mail: The form can be printed and mailed to the appropriate tax authority.

- In-Person: Some businesses may choose to deliver the form directly to the local tax office.

Choosing the right submission method can help ensure timely processing and compliance with deadlines.

Quick guide on how to complete form boe 571 l 2016

Effortlessly Prepare Form Boe 571 L on Any Device

Online document management has gained traction among corporations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Form Boe 571 L on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign Form Boe 571 L with Ease

- Locate Form Boe 571 L and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form Boe 571 L and ensure outstanding communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Form Boe 571 L?

The Form Boe 571 L is a vital tax form used for reporting specific transactions in California. This form helps businesses comply with state regulations and provides essential information about use tax liabilities.

-

How can airSlate SignNow help with Form Boe 571 L?

airSlate SignNow enables you to easily eSign and send the Form Boe 571 L quickly and securely. Our platform's intuitive interface makes it simple for businesses to manage their documents without hassle.

-

Is there a cost associated with using airSlate SignNow for Form Boe 571 L?

Yes, there is a pricing structure for using airSlate SignNow, which is designed to be cost-effective. We offer various plans tailored to fit businesses of all sizes, ensuring you have access to tools for eSigning the Form Boe 571 L without breaking your budget.

-

What features does airSlate SignNow offer for the Form Boe 571 L?

With airSlate SignNow, you gain access to features including document templates, secure storage, and real-time tracking. These features streamline the process of preparing and managing the Form Boe 571 L for your business.

-

Can I integrate airSlate SignNow with other applications while handling Form Boe 571 L?

Absolutely! airSlate SignNow supports integrations with various applications, providing you with flexibility while managing the Form Boe 571 L. This ensures that your workflow remains efficient and cohesive across platforms.

-

What are the benefits of using airSlate SignNow for the Form Boe 571 L?

Using airSlate SignNow for the Form Boe 571 L allows businesses to expedite the signing process, reduce paperwork, and enhance compliance. Additionally, it contributes to a more sustainable practice by minimizing the use of physical documents.

-

How secure is airSlate SignNow when dealing with the Form Boe 571 L?

Security is a top priority at airSlate SignNow. We implement robust encryption and comply with industry standards to ensure that your Form Boe 571 L and associated data are protected throughout the signing process.

Get more for Form Boe 571 L

Find out other Form Boe 571 L

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract