Purely Public Charity Registration Form

What is the Purely Public Charity Registration Form

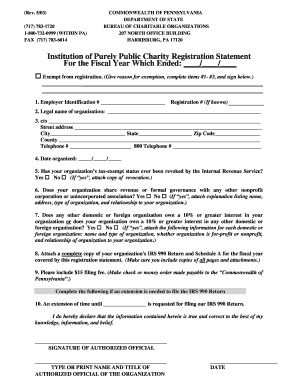

The purely public charity registration form is a legal document that allows organizations to register as purely public charities in the United States. This form is essential for entities seeking to obtain tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. By completing this form, organizations can demonstrate their commitment to public benefit and compliance with state regulations. This registration is particularly important for charities that wish to solicit donations and apply for grants, as it provides legitimacy and transparency to their operations.

Steps to Complete the Purely Public Charity Registration Form

Completing the purely public charity registration form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about your organization, including its mission, structure, and financial details. Next, fill out the form with precise data, ensuring that all sections are completed. It is crucial to provide a clear description of the charitable activities your organization will undertake. After completing the form, review it for any errors or omissions before submitting it to the appropriate state agency. This careful preparation helps prevent delays in processing your application.

Legal Use of the Purely Public Charity Registration Form

The purely public charity registration form serves a legal purpose by establishing an organization as a recognized charity under state law. This designation allows the organization to operate legally, solicit donations, and apply for grants. It is vital to adhere to the legal requirements outlined in the form, as failure to do so can result in penalties or the denial of tax-exempt status. Organizations must also ensure compliance with federal regulations, including those set forth by the IRS, to maintain their charitable status.

Eligibility Criteria

To qualify for registration as a purely public charity, an organization must meet specific eligibility criteria. Typically, this includes being organized and operated exclusively for charitable purposes, which may encompass relief of the poor, advancement of education, or other community benefits. Additionally, the organization must not engage in activities that primarily benefit private interests. It is essential to review the eligibility requirements carefully to ensure that your organization qualifies before submitting the registration form.

Required Documents

When completing the purely public charity registration form, certain documents are required to support your application. These may include the organization's articles of incorporation, bylaws, and a detailed description of its planned charitable activities. Financial statements, such as budgets or funding sources, may also be necessary to demonstrate the organization's viability and commitment to its mission. Providing thorough documentation helps establish credibility and supports the approval process.

Form Submission Methods

The purely public charity registration form can be submitted through various methods, depending on state regulations. Common submission options include online filing, mailing a physical copy, or delivering it in person to the appropriate state agency. Each method may have different processing times and requirements, so it is important to choose the one that best fits your organization's needs. Ensuring that the form is submitted correctly and on time is crucial for maintaining compliance and securing tax-exempt status.

Quick guide on how to complete purely public charity registration form

Effortlessly Prepare Purely Public Charity Registration Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Handle Purely Public Charity Registration Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-based procedure today.

How to Edit and eSign Purely Public Charity Registration Form with Ease

- Obtain Purely Public Charity Registration Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize necessary sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any chosen device. Modify and eSign Purely Public Charity Registration Form and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is purely public charity registration?

Purely public charity registration refers to the process through which organizations can obtain nonprofit status that allows them to seek tax-exempt donations. This status is vital for charities wanting to operate effectively and maintain compliance with state and federal regulations.

-

How can airSlate SignNow assist with purely public charity registration?

AirSlate SignNow provides a streamlined solution for managing the paperwork associated with purely public charity registration. Our platform allows users to create, send, and eSign the necessary documents securely, facilitating a faster registration process.

-

What are the benefits of purely public charity registration?

Purely public charity registration grants organizations access to tax benefits, enhances credibility, and opens doors for additional funding opportunities. It is critical for nonprofits looking to engage with donors and sustain their operations effectively.

-

What features does airSlate SignNow offer for nonprofit organizations?

AirSlate SignNow offers multiple features that cater specifically to nonprofit organizations, including customizable templates, bulk sending capabilities, and secure eSigning. These tools simplify the documentation process associated with purely public charity registration.

-

What is the pricing structure for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored for nonprofits, ensuring they can access essential functionalities at a cost-effective rate. Organizations can select the plan that best meets their needs without overspending, especially when focusing on purely public charity registration.

-

Are there integrations available with airSlate SignNow for nonprofits?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms that nonprofits commonly use. This functionality can enhance your workflow and ease the management of documents related to purely public charity registration.

-

How secure is the eSigning process with airSlate SignNow?

The eSigning process with airSlate SignNow is extremely secure, ensuring that all documents associated with purely public charity registration are protected. We use advanced encryption and comply with industry regulations to ensure your data remains confidential and secure.

Get more for Purely Public Charity Registration Form

- Instruction agent form

- Jury instruction age of plaintiff age discrimination mississippi form

- Jury instruction damages lost wages benefits etc mississippi form

- St marys area high school excuse form smasd

- Functional assessment checklist for students fact form

- Band saw safety test form

- Home improvement ldeed of trust form

- The credit application handbook the kaplan groupcredit application form templates office comthe credit application handbook the

Find out other Purely Public Charity Registration Form

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe