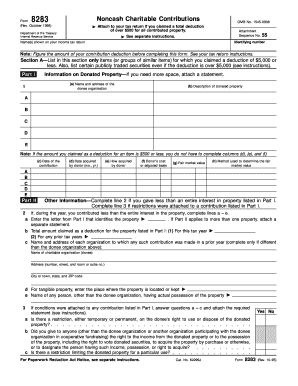

Form 8283 Rev October Noncash Charitable Contributions

What is the Form 8283 for Noncash Charitable Contributions?

The Form 8283, officially titled “Noncash Charitable Contributions,” is a tax document used by individuals and businesses in the United States to report noncash donations made to qualified charitable organizations. This form is essential for taxpayers who wish to claim a deduction for items donated, such as clothing, vehicles, or other tangible goods. The IRS requires this form to ensure that the value of the donated items is accurately reported and that the contributions comply with tax regulations.

How to Use the Form 8283

Using the Form 8283 involves several steps to ensure accurate reporting of noncash charitable contributions. Taxpayers must first gather information about the donated items, including their fair market value. Once this information is collected, the form can be filled out, detailing the items donated, the date of the contribution, and the recipient organization. The completed form must be attached to the taxpayer's income tax return for the year in which the donation was made, allowing the IRS to verify the deduction claimed.

Steps to Complete the Form 8283

Completing the Form 8283 requires careful attention to detail. Here are the steps to follow:

- Gather documentation for each noncash contribution, including receipts and appraisals if necessary.

- Determine the fair market value of each donated item, which is the price at which the item would sell on the open market.

- Fill out the form, providing details such as the description of the items, their value, and the name of the charitable organization.

- If the total value of noncash contributions exceeds $500, complete Section B of the form.

- Sign and date the form, ensuring that all information is accurate before submission.

Legal Use of the Form 8283

The Form 8283 is legally binding when completed correctly and submitted as part of a taxpayer's return. It must comply with IRS regulations regarding noncash charitable contributions to be valid. This includes providing accurate descriptions and valuations of donated items. Failure to adhere to these guidelines may result in penalties or disallowance of the claimed deductions. Taxpayers should retain copies of the form and any supporting documentation for their records.

IRS Guidelines for Form 8283

The IRS has established specific guidelines for the use of Form 8283. Taxpayers must ensure that the charitable organization receiving the donations is qualified under IRS rules. Additionally, the form must be filed in a timely manner, typically alongside the annual tax return. The IRS may require additional documentation, such as written acknowledgments from the charity for contributions over a certain value. Familiarity with these guidelines is crucial for ensuring compliance and maximizing potential tax benefits.

Required Documents for Form 8283

When preparing to file Form 8283, several documents are necessary to substantiate the noncash contributions. These include:

- Receipts from the charitable organization acknowledging the donation.

- Appraisals for items valued over $5,000, as required by IRS regulations.

- Documentation of the fair market value of the donated items.

- Any relevant correspondence with the charity regarding the donation.

Quick guide on how to complete form 8283 rev october 1995 noncash charitable contributions

Finalize Form 8283 Rev October Noncash Charitable Contributions effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow offers you all the resources required to create, edit, and eSign your documents swiftly without interruptions. Manage Form 8283 Rev October Noncash Charitable Contributions on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form 8283 Rev October Noncash Charitable Contributions without hassle

- Find Form 8283 Rev October Noncash Charitable Contributions and click on Get Form to begin.

- Make use of the features we provide to fill out your form.

- Emphasize important parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your needs in document management with just a few clicks from any device you choose. Edit and eSign Form 8283 Rev October Noncash Charitable Contributions to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 8283 and why do I need it?

Form 8283 is a tax form used by taxpayers to report noncash charitable contributions. By using airSlate SignNow, you can efficiently fill out and eSign your Form 8283 to ensure accuracy and compliance, making your charitable giving documentation easier.

-

How can airSlate SignNow help me manage Form 8283?

With airSlate SignNow, you can easily create, edit, and securely eSign Form 8283 from anywhere. Our platform streamlines the process, allowing you to focus on your charitable contributions instead of paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8283?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. For managing Form 8283, our service is designed to be affordable and offers great value for eSigning and document management.

-

What features does airSlate SignNow provide for completing Form 8283?

airSlate SignNow offers features like reusable templates, secure eSigning, and real-time collaboration for Form 8283. This simplifies the process of completing and sharing the form with other parties, ensuring you meet deadlines and requirements.

-

Can I integrate airSlate SignNow with other applications for Form 8283?

Absolutely! airSlate SignNow supports integrations with various applications like Google Drive, Dropbox, and major CRM systems, allowing you to manage Form 8283 seamlessly within your existing workflow.

-

Is my data safe when using airSlate SignNow for Form 8283?

Yes, data security is our top priority. airSlate SignNow utilizes advanced encryption and security practices to protect your information while you complete and eSign Form 8283, ensuring your sensitive data is safe.

-

How quickly can I complete Form 8283 using airSlate SignNow?

Using airSlate SignNow, you can complete Form 8283 in just a few minutes. Our user-friendly interface and pre-filled templates make it easy to fill out the necessary information and sign digitally.

Get more for Form 8283 Rev October Noncash Charitable Contributions

- Warranty deed from two individuals to husband and wife oklahoma form

- Quitclaim deed from a llc to two individuals oklahoma form

- Oklahoma intestate form

- Quitclaim deed from husband wife and two individuals to husband and wife two individuals oklahoma form

- Warranty deed grantee form

- Oklahoma quitclaim deed 497322846 form

- Oklahoma warranty deed 497322847 form

- Oklahoma life estate 497322848 form

Find out other Form 8283 Rev October Noncash Charitable Contributions

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement