Exemption Certificate Care Form

What is the Exemption Certificate Care

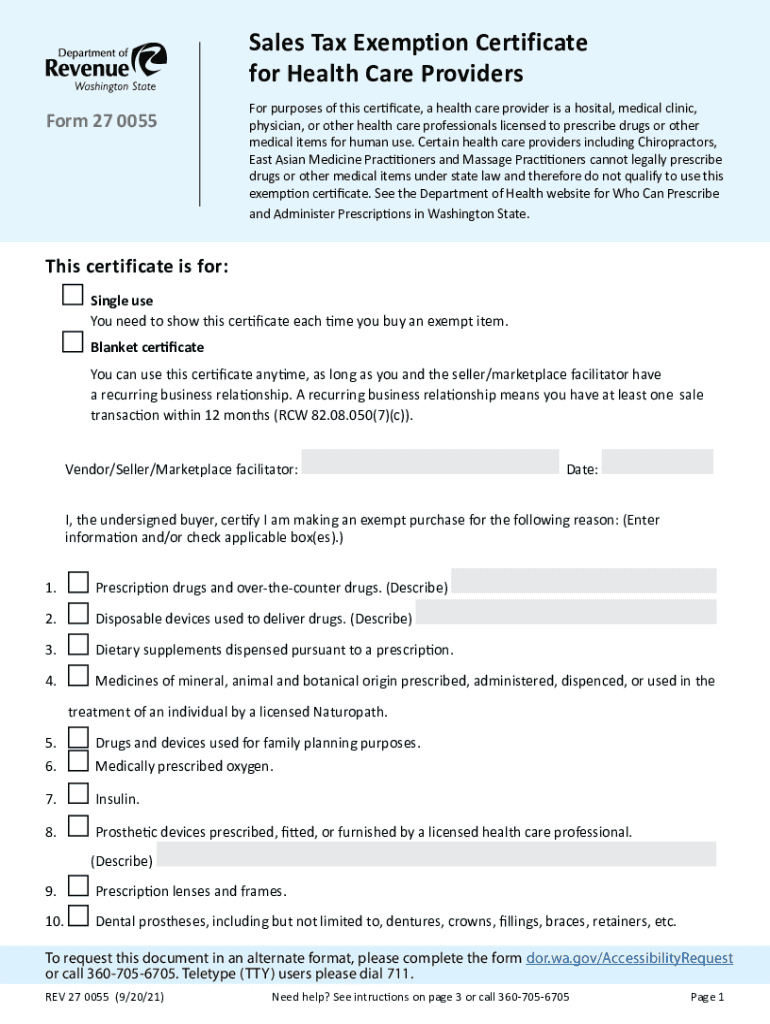

The exemption certificate care is a vital document that allows eligible individuals and businesses to claim exemptions from certain taxes. This certificate is particularly important in Washington, where it serves various purposes, including sales tax exemptions for qualifying purchases. By providing this certificate, taxpayers can ensure they are not overpaying on taxes that they are legally exempt from, thereby optimizing their financial responsibilities.

How to Use the Exemption Certificate Care

Using the exemption certificate care involves several steps to ensure compliance with state regulations. First, the individual or business must determine their eligibility for the exemption. Once confirmed, the certificate should be filled out accurately, including all required information such as the name of the purchaser, the seller, and a description of the items being purchased. After completing the form, it should be presented to the seller at the time of purchase to validate the exemption claim.

Steps to Complete the Exemption Certificate Care

Completing the exemption certificate care requires attention to detail. Follow these steps for accuracy:

- Identify the correct exemption category applicable to your situation.

- Gather necessary information, including your business name, address, and tax identification number.

- Fill out the certificate, ensuring all fields are completed, including item descriptions.

- Sign and date the certificate to validate it.

- Provide the completed certificate to the seller before the transaction.

Legal Use of the Exemption Certificate Care

The legal use of the exemption certificate care is governed by specific state laws. In Washington, the certificate must be used in accordance with the Washington Department of Revenue guidelines. It is essential for users to understand that misuse of the exemption certificate can lead to penalties, including back taxes owed and fines. Therefore, ensuring that the certificate is used correctly and only for eligible transactions is crucial for compliance.

Eligibility Criteria

Eligibility for the exemption certificate care varies based on the type of exemption being claimed. Generally, businesses and individuals must meet specific criteria, such as being a non-profit organization or purchasing items for resale. It is important to review the state’s guidelines to confirm eligibility before applying for the exemption. Understanding these criteria helps prevent potential compliance issues in the future.

Required Documents

To successfully complete the exemption certificate care, certain documents may be required. Typically, these include:

- A valid tax identification number.

- Proof of eligibility, such as a non-profit status letter or resale certificate.

- Identification documents, if applicable.

Having these documents ready can streamline the process and ensure that the exemption certificate is filled out correctly.

Filing Deadlines / Important Dates

Filing deadlines for the exemption certificate care can vary based on the type of exemption and the specific tax year. It is crucial to stay informed about these dates to avoid any penalties or late fees. Generally, taxpayers should check the Washington Department of Revenue's official calendar for the most accurate and up-to-date information regarding filing deadlines.

Quick guide on how to complete exemption certificate care

Complete Exemption Certificate Care effortlessly on any gadget

Digital document management has gained increased popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without interruptions. Handle Exemption Certificate Care on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to adjust and electronically sign Exemption Certificate Care with ease

- Locate Exemption Certificate Care and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select key sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for these purposes.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you prefer. Edit and electronically sign Exemption Certificate Care and guarantee effective communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the washington tax exemption care?

Washington tax exemption care refers to the benefits and protections available for individuals or businesses seeking to qualify for tax exemptions in Washington State. Understanding these exemptions can lead to signNow savings on taxes and improved financial management. airSlate SignNow can help streamline the documentation process for applying to these exemptions.

-

How can airSlate SignNow assist with washington tax exemption care?

airSlate SignNow provides an easy-to-use platform for businesses to prepare, send, and eSign documents necessary for obtaining washington tax exemption care. Our solution simplifies the paperwork involved, ensuring compliance with state regulations and accelerating approval times. This allows users to focus on their business while we handle the document management.

-

What are the pricing options for using airSlate SignNow for washington tax exemption care?

airSlate SignNow offers a variety of pricing plans tailored to fit the needs of different businesses looking for washington tax exemption care solutions. Our plans are cost-effective, providing essential features at competitive rates, ensuring you get the best value for your investment. Contact us for a tailored quote based on your specific requirements.

-

Are there any benefits to using airSlate SignNow for washington tax exemption care?

Yes, using airSlate SignNow for washington tax exemption care provides numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. Our platform enables you to manage your documents seamlessly, leading to better compliance and fewer mistakes. This allows you to focus on applying for exemptions rather than getting bogged down in administration.

-

Can airSlate SignNow integrate with other tools for managing washington tax exemption care?

Absolutely! airSlate SignNow offers integration capabilities with various tools and platforms to enhance your management of washington tax exemption care. This includes integration with accounting software, CRMs, and cloud storage solutions, ensuring a smooth workflow and easier access to your documentation. Simplifying your processes makes it easier to track your tax exemption status.

-

What features does airSlate SignNow provide for washington tax exemption care documentation?

airSlate SignNow includes features such as templates for common tax exemption forms, customizable workflows, and secure eSigning capabilities, all aimed at ensuring a smooth experience for washington tax exemption care. Additionally, our user-friendly interface makes it easy to navigate and manage your documents efficiently. Time-saving features help accelerate the exemption application process.

-

Is airSlate SignNow secure for managing washington tax exemption care documents?

Yes, security is a top priority at airSlate SignNow. We implement industry-leading encryption and security protocols to protect your documents related to washington tax exemption care. Users can confidently send and receive sensitive information, knowing their data is protected from unauthorized access.

Get more for Exemption Certificate Care

- Framing contract for contractor oregon form

- Security contract for contractor oregon form

- Insulation contract for contractor oregon form

- Paving contract for contractor oregon form

- Site work contract for contractor oregon form

- Siding contract for contractor oregon form

- Refrigeration contract for contractor oregon form

- Drainage contract for contractor oregon form

Find out other Exemption Certificate Care

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors