Form 5227 Instructions

Understanding the Form 5227 Instructions

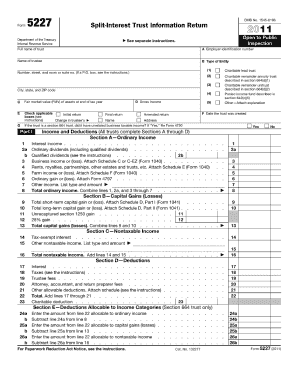

The Form 5227 is a tax form used to report information about certain trusts, including their income, deductions, and distributions. It is essential for individuals or entities managing specific types of trusts to understand the requirements outlined in the form's instructions. These instructions provide detailed guidance on how to accurately complete the form, ensuring compliance with IRS regulations.

Steps to Complete the Form 5227 Instructions

Completing the Form 5227 requires careful attention to detail. Here are the key steps to follow:

- Gather necessary information about the trust, including its name, taxpayer identification number, and details about the trustee.

- Review the instructions for specific sections, such as income sources, deductions, and distributions.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the calculations to confirm accuracy before submission.

- Sign and date the form as required.

Legal Use of the Form 5227 Instructions

The Form 5227 instructions are legally binding, meaning that completing the form in accordance with the guidelines ensures compliance with federal tax laws. It is crucial to adhere to the specified requirements to avoid potential penalties or legal issues. Utilizing a reliable electronic signature solution, such as signNow, can enhance the security and legitimacy of the completed form.

Filing Deadlines and Important Dates

Timely submission of the Form 5227 is vital to avoid penalties. Generally, the form must be filed annually, and the deadline aligns with the tax return due date for the trust. It is important to keep track of any changes in deadlines that may occur due to tax law updates or extensions granted by the IRS.

Required Documents for Form 5227

To complete the Form 5227, certain documents are necessary. These may include:

- Trust agreement or declaration.

- Financial statements for the trust.

- Records of income received and expenses incurred.

- Documentation of distributions made to beneficiaries.

Form Submission Methods

The Form 5227 can be submitted through various methods, including:

- Online submission through authorized e-filing platforms.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices.

Quick guide on how to complete form 5227 instructions

Complete Form 5227 Instructions effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It serves as an optimal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, edit, and eSign your documents swiftly without any hold-ups. Manage Form 5227 Instructions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 5227 Instructions with ease

- Find Form 5227 Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 5227 Instructions to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the dss 5227 form, and why is it important?

The dss 5227 form is a crucial document used for specific legal and administrative processes. Understanding its significance can streamline your business operations. Whether for compliance or internal procedures, using tools like airSlate SignNow enhances the efficiency of managing the dss 5227.

-

How can airSlate SignNow assist with filling out the dss 5227?

airSlate SignNow simplifies the process of filling out the dss 5227 by providing intuitive templates and easy-to-use form fields. This ensures that all necessary information is captured accurately and efficiently. Plus, with its user-friendly interface, you can complete the dss 5227 in minutes.

-

Is airSlate SignNow a cost-effective solution for handling dss 5227 documentation?

Absolutely! airSlate SignNow offers competitive pricing, making it a cost-effective choice for businesses handling dss 5227 documentation. With flexible plans and no hidden fees, you can save time and money while ensuring compliance and accuracy.

-

What features does airSlate SignNow offer for managing dss 5227 forms?

airSlate SignNow provides a range of features tailored for managing dss 5227 forms, including eSignature capabilities, document tracking, and customizable templates. These features enhance accuracy and reduce turnaround time for document processing. You can manage your dss 5227 seamlessly with these tools.

-

Can I integrate airSlate SignNow with other software to handle dss 5227 forms?

Yes, airSlate SignNow seamlessly integrates with various software tools, allowing you to manage your dss 5227 forms alongside your existing workflows. This simplifies collaboration and enhances data management. By integrating, you can enhance productivity and keep your documents organized.

-

How secure is airSlate SignNow when handling sensitive dss 5227 information?

Security is a top priority for airSlate SignNow, especially when it comes to handling sensitive documents like the dss 5227. The platform utilizes advanced encryption and compliance standards to ensure your data is protected. You can trust airSlate SignNow for secure document management.

-

What are the benefits of using airSlate SignNow for dss 5227 document management?

Using airSlate SignNow for managing the dss 5227 offers numerous benefits, including faster processing times, increased accessibility, and enhanced collaboration. The platform allows multiple stakeholders to interact with the document simultaneously, which speeds up approval processes. This efficiency can signNowly improve your workflow.

Get more for Form 5227 Instructions

- Or quitclaim deed form

- Warranty deed from a trust to a husband and wife oregon form

- Quitclaim deed three individuals to one individual oregon form

- Warranty deed oregon form

- Heirship affidavit descent oregon form

- Quitclaim deed trust to an individual oregon form

- Oregon husband wife 497323591 form

- Oregon warranty deed form

Find out other Form 5227 Instructions

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure