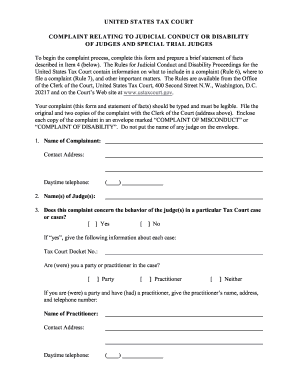

UNITED STATES TAX COURT COMPLAINT RELATING to JUDICIAL Form

What is the United States Tax Court Complaint Relating to Judicial

The United States Tax Court Complaint Relating to Judicial is a formal legal document used by taxpayers to contest decisions made by the Internal Revenue Service (IRS) regarding tax disputes. This complaint initiates a case in the U.S. Tax Court, allowing taxpayers to seek judicial review of IRS determinations. The document outlines the taxpayer's grievances and the specific actions or decisions being challenged, providing a structured format to present the case before the court.

Steps to Complete the United States Tax Court Complaint Relating to Judicial

Completing the United States Tax Court Complaint requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including personal details and specifics of the IRS decision being contested.

- Fill out the complaint form accurately, ensuring all required fields are completed.

- Provide a clear statement of the facts supporting your case, including relevant dates and actions taken.

- Include any supporting documents that substantiate your claims, such as correspondence with the IRS.

- Review the completed complaint for accuracy and completeness before submission.

How to Obtain the United States Tax Court Complaint Relating to Judicial

The United States Tax Court Complaint can be obtained directly from the official U.S. Tax Court website or through legal resources that provide tax-related forms. It is essential to ensure that you are using the most current version of the form, as updates may occur. Additionally, legal assistance may be beneficial in navigating the complexities of tax law and filling out the complaint correctly.

Key Elements of the United States Tax Court Complaint Relating to Judicial

Several key elements must be included in the United States Tax Court Complaint to ensure it is valid:

- Caption: The title of the case, including the names of the parties involved.

- Jurisdiction: A statement confirming that the Tax Court has jurisdiction over the matter.

- Statement of Facts: A detailed account of the events leading to the dispute with the IRS.

- Legal Basis: The legal grounds on which the complaint is based, including relevant tax laws.

- Relief Sought: A clear statement of what the taxpayer is asking the court to do.

Filing Deadlines / Important Dates

Timely filing of the United States Tax Court Complaint is crucial. Generally, taxpayers must file their complaint within ninety days of receiving a notice of deficiency from the IRS. Missing this deadline can result in the loss of the right to contest the IRS's decision. It is advisable to keep track of important dates related to the case and to consult with a tax professional if there are any uncertainties regarding deadlines.

Form Submission Methods (Online / Mail / In-Person)

The United States Tax Court Complaint can be submitted in various ways:

- Online: Some forms may be submitted electronically through the Tax Court's online filing system.

- Mail: Complaints can be sent via postal mail to the appropriate Tax Court address.

- In-Person: Taxpayers may also file their complaints in person at the Tax Court, ensuring all documents are complete and properly formatted.

Quick guide on how to complete united states tax court complaint relating to judicial

Complete UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents promptly without any holdups. Handle UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL with ease

- Locate UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL and select Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether it be via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL?

A UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL is a legal document filed to challenge tax deficiencies. It initiates a case in Tax Court to review and resolve disputes over tax assessments made by the IRS. Understanding this process can be complex, but using airSlate SignNow simplifies the eSigning of such documents.

-

How does airSlate SignNow help with a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL?

With airSlate SignNow, you can easily create, send, and eSign your UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL documents online. Our platform ensures that all parties can sign quickly, securely, and legally. This efficiency helps reduce turnaround times, making it easier to manage your tax disputes.

-

Is airSlate SignNow cost-effective for filing a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL?

Yes, airSlate SignNow offers a variety of pricing plans to suit different budgets, making it a cost-effective solution for filing a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL. Our plans provide essential features, including document templates and eSigning capabilities, at competitive rates. This means you can manage your tax documents without breaking the bank.

-

What features does airSlate SignNow offer for legal documents like the UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and status tracking for documents like the UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL. These tools ensure that you can efficiently manage your files and know the status of signatures in real-time. Additionally, our platform integrates seamlessly with other tools you may already be using.

-

Can I collaborate with others on a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL using airSlate SignNow?

Absolutely! airSlate SignNow allows you to collaborate with attorneys and tax professionals when working on a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL. You can share documents and receive feedback in one secure location. This collaboration streamlines the process and ensures everyone is on the same page.

-

What are the benefits of using airSlate SignNow for a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL?

Using airSlate SignNow for a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL offers numerous benefits, including increased efficiency and improved compliance with legal standards. The platform's user-friendly interface minimizes the learning curve, allowing you to complete necessary documentation quickly. Plus, the electronic signature feature enhances security and facilitates faster processing.

-

Is airSlate SignNow secure for filing sensitive documents like a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive filings like a UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL. Our platform uses advanced encryption technologies to protect your data and ensure confidentiality. You can rest assured that your legal documents are safe during the signing process.

Get more for UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL

- Promissory note template pennsylvania form

- Pennsylvania installments fixed rate promissory note secured by residential real estate pennsylvania form

- Pennsylvania note form

- Pennsylvania secured form

- Pa memorandum form

- Life documents planning 497324782 form

- General durable power of attorney for property and finances or financial effective upon disability pennsylvania form

- Essential legal life documents for baby boomers pennsylvania form

Find out other UNITED STATES TAX COURT COMPLAINT RELATING TO JUDICIAL

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form