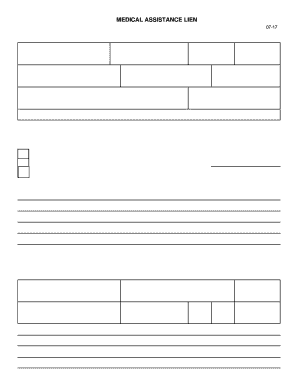

S 3152 Form

What is the S 3152

The S 3152 form is a specialized document used primarily for tax purposes in the United States. This form is designed to assist individuals and businesses in reporting specific financial information to the Internal Revenue Service (IRS). Understanding the S 3152 is crucial for ensuring compliance with federal tax regulations and for accurately reporting income, deductions, or credits. It is essential for taxpayers to be aware of the specific requirements associated with this form to avoid potential penalties.

How to use the S 3152

Using the S 3152 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to the form. This may include income statements, expense reports, and any other pertinent records. Next, carefully fill out the form, ensuring all sections are completed accurately. It is advisable to review the IRS guidelines related to the S 3152 to confirm that all information is provided correctly. Once the form is completed, it can be submitted either electronically or via mail, depending on the specific instructions provided by the IRS.

Steps to complete the S 3152

Completing the S 3152 form requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather all relevant financial documents.

- Download the S 3152 form from the IRS website or obtain a physical copy.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Provide detailed information regarding your income, deductions, or credits as required by the form.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, following the submission guidelines.

Legal use of the S 3152

The S 3152 form must be used in compliance with IRS regulations to ensure its legal standing. This includes adhering to deadlines for submission and providing accurate information. Failure to comply with these regulations can result in penalties, including fines or additional scrutiny from the IRS. It is important for users to understand the legal implications of the information provided on the form and to ensure that all entries are truthful and verifiable.

Filing Deadlines / Important Dates

Filing deadlines for the S 3152 form are critical for compliance with IRS regulations. Typically, the form must be submitted by a specific date each tax year, which can vary based on individual circumstances. Taxpayers should be aware of these deadlines to avoid late fees or penalties. It is advisable to check the IRS website for the most current filing dates and any updates regarding changes in tax law that may affect the S 3152 form.

Who Issues the Form

The S 3152 form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to fulfill their tax obligations accurately. Users can access the form and related materials through the official IRS website.

Quick guide on how to complete s 3152

Effortlessly Prepare S 3152 on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It offers a perfect environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle S 3152 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign S 3152 Effortlessly

- Find S 3152 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), a shareable link, or download it onto your computer.

Eliminate the hassles of lost or misplaced documents, the frustration of searching for forms, and errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign S 3152 to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the S 3152 service offered by airSlate SignNow?

The S 3152 service by airSlate SignNow is designed to facilitate document signing electronically. It allows users to send and eSign documents securely and efficiently, streamlining the signing process for businesses. With S 3152, you can enhance productivity and reduce paperwork.

-

How much does the S 3152 plan cost?

The pricing for the S 3152 plan varies depending on the features selected and the number of users. airSlate SignNow offers competitive pricing structures to suit different business sizes and needs. It's best to visit the airSlate SignNow website for current pricing tiers and to find a plan that fits your budget.

-

What are the key features of the S 3152 offering?

The S 3152 offering includes advanced eSignature capabilities, template creation, and document tracking. Users can also utilize features like mobile compatibility and customizable workflows to meet their specific requirements. These features make S 3152 ideal for businesses looking to simplify their document management processes.

-

How can the S 3152 solution benefit my business?

By adopting the S 3152 solution, businesses can drastically reduce the turnaround time for document approvals, leading to faster transaction speeds. It also enhances security with encrypted signatures, ensuring compliance with regulations. Overall, S 3152 supports improved efficiency and cost-effectiveness.

-

Does S 3152 integrate with other software?

Yes, S 3152 seamlessly integrates with various third-party applications such as CRMs, cloud storage platforms, and productivity tools. This compatibility allows users to incorporate eSigning directly into their existing workflows. By leveraging these integrations, businesses can maximize the effectiveness of the S 3152 service.

-

Is there a free trial available for the S 3152 service?

airSlate SignNow typically offers a free trial for the S 3152 service, allowing prospective customers to explore its features without any commitment. This is an excellent opportunity to see how S 3152 fits your business needs before making a financial commitment. Be sure to check their website for sign-up details.

-

What security measures are in place for the S 3152 eSigning process?

The S 3152 service implements top-notch security measures, including encryption and secure access protocols to protect sensitive data. These measures ensure that all documents signed using S 3152 are safe and meet compliance standards. Trust is paramount, and airSlate SignNow prioritizes the security of your documents.

Get more for S 3152

Find out other S 3152

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer