Pk Kyc Form

What is the Pk Kyc

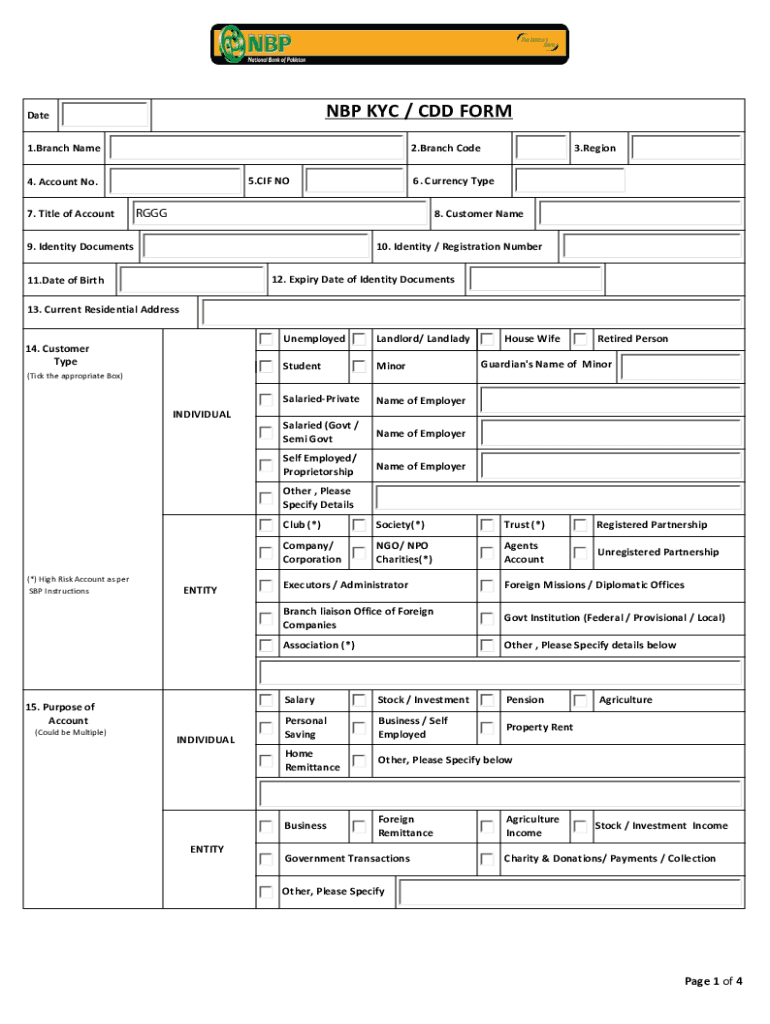

The Pk Kyc, or Pakistan Know Your Customer, is a crucial document used to verify the identity of individuals and entities in financial transactions. It is part of a broader initiative to prevent money laundering and fraud. The Pk Kyc form collects essential information such as personal identification details, financial history, and the purpose of the account. This information helps financial institutions assess the risk associated with their customers and comply with regulatory requirements.

Steps to complete the Pk Kyc

Completing the Pk Kyc form involves several straightforward steps. First, gather all necessary documents, including identification and proof of address. Next, fill out the form accurately, ensuring that all details match the documents provided. After completing the form, submit it to the relevant financial institution. It is advisable to keep copies of all submitted documents for your records. Lastly, follow up with the institution to confirm that your KYC has been processed and approved.

Legal use of the Pk Kyc

The Pk Kyc is legally binding and must be used in compliance with local regulations. Financial institutions are required to implement KYC procedures to ensure that they know their customers and can identify any suspicious activities. The legal framework surrounding the Pk Kyc protects both the institution and the customer by ensuring that all transactions are conducted transparently and within the law. Non-compliance can lead to severe penalties for institutions, making adherence to KYC regulations essential.

Required Documents

To complete the Pk Kyc, specific documents are required to verify identity and address. Commonly required documents include:

- Government-issued photo identification (e.g., passport, driver's license)

- Proof of address (e.g., utility bill, bank statement)

- Tax identification number (if applicable)

- Business registration documents (for entities)

Having these documents ready will streamline the KYC process and help ensure compliance with regulatory standards.

Form Submission Methods

The Pk Kyc form can be submitted through various methods, depending on the financial institution's policies. Common submission methods include:

- Online submission through the institution's secure portal

- Mailing the completed form to the institution's designated address

- In-person submission at a branch office

Choosing the method that best suits your needs can facilitate a smoother KYC process.

Who Issues the Form

The Pk Kyc form is typically issued by financial institutions, including banks, investment firms, and insurance companies. These institutions are required to collect KYC information as part of their compliance with anti-money laundering (AML) regulations. The specific format and requirements of the form may vary by institution, but the core purpose remains the same: to verify the identity of customers and assess potential risks.

Quick guide on how to complete pk kyc

Complete Pk Kyc effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Pk Kyc on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to alter and electronically sign Pk Kyc with ease

- Locate Pk Kyc and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your modifications.

- Choose the method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Edit and electronically sign Pk Kyc and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Pakistan CDD and how does it relate to airSlate SignNow?

Pakistan CDD, or Customer Due Diligence, is a compliance measure requiring businesses to verify the identity of their customers. airSlate SignNow provides a secure platform for businesses operating in Pakistan to manage their document signing processes while adhering to CDD regulations effectively.

-

How does airSlate SignNow support the Pakistan CDD process?

airSlate SignNow streamlines the Pakistan CDD process by enabling businesses to electronically sign and share documents securely. This ensures that all customer identity verifications are documented and easily accessible for compliance purposes.

-

What are the pricing options available for airSlate SignNow in relation to Pakistan CDD?

airSlate SignNow offers competitive pricing plans suitable for businesses focusing on Pakistan CDD. Users can choose from various subscription levels that cater to different needs, making it cost-effective for both small and large enterprises.

-

What features does airSlate SignNow offer to assist with Pakistan CDD?

airSlate SignNow features advanced security measures, including encryption and secure cloud storage, essential for Pakistan CDD compliance. Additionally, the platform provides templates and automation tools to simplify document workflows while ensuring compliance with local regulations.

-

Can airSlate SignNow be integrated with existing CRM systems for Pakistan CDD?

Yes, airSlate SignNow integrates seamlessly with various CRM systems to enhance efficiency in managing Pakistan CDD. These integrations allow users to pull customer data directly into the signing process and maintain consistent compliance effortlessly.

-

What benefits can businesses expect from using airSlate SignNow for Pakistan CDD?

By using airSlate SignNow for Pakistan CDD, businesses can reduce processing time, improve document security, and ensure compliance with regulations. The user-friendly interface makes it easier for teams to focus on customer engagement rather than paperwork.

-

How does airSlate SignNow ensure the security of documents in Pakistan CDD?

airSlate SignNow employs industry-standard security protocols, such as AES-256 encryption and two-factor authentication, to protect documents involved in Pakistan CDD. This emphasis on security gives users peace of mind that their sensitive information is safe.

Get more for Pk Kyc

- Instruction interference with form

- Jury instruction interference with commerce by robbery hobbs act racketeering robbery form

- Jury instruction illegal gambling business bookmaking form

- Jury instruction civil form

- Instruction unlawful form

- Omb approval number 25770083 expires 1231u form

- 60 day notice of proposed information collection family

- Benefits investigation form id symtuza hcp

Find out other Pk Kyc

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple