Internal Revenue Service Tax Form

What is the Internal Revenue Service Tax?

The Internal Revenue Service (IRS) tax refers to the various taxes collected by the federal government in the United States. This includes income tax, payroll tax, and other types of taxes that fund government programs and services. The IRS is responsible for administering and enforcing federal tax laws, ensuring compliance, and collecting taxes from individuals and businesses. Understanding the IRS tax system is crucial for taxpayers to fulfill their obligations and avoid penalties.

Steps to complete the Internal Revenue Service Tax

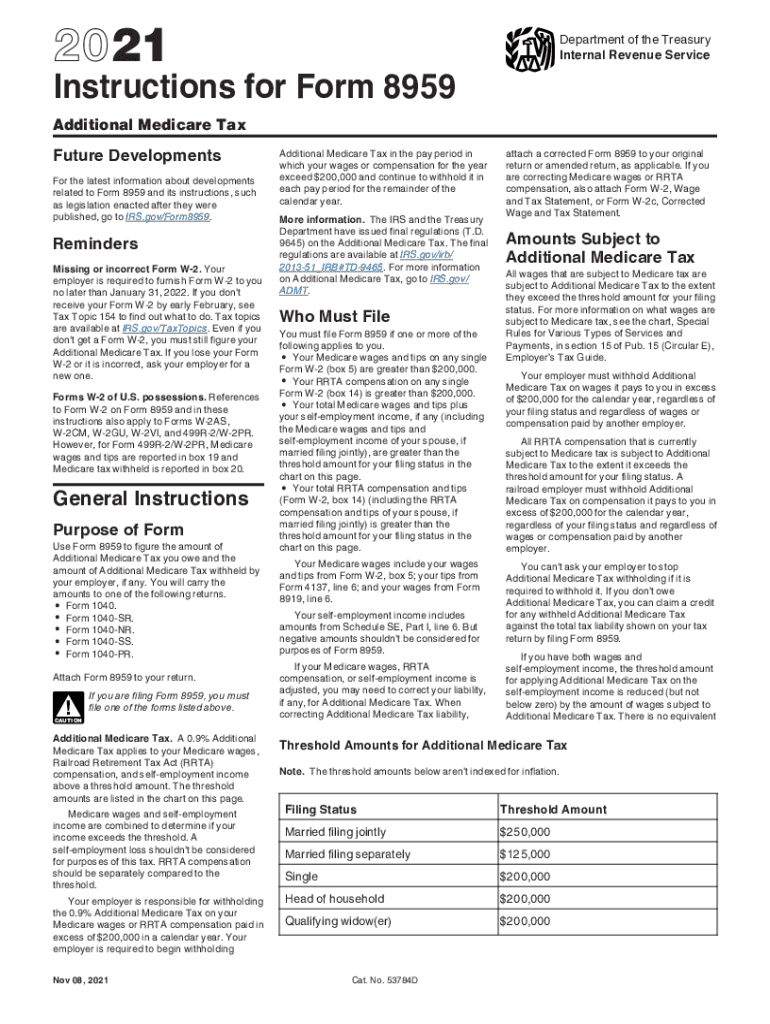

Completing IRS tax forms involves several steps that ensure accuracy and compliance. For the IRS 8959 form, which is used to report Additional Medicare Tax, follow these steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Determine your tax liability: Calculate your total income and determine if you meet the threshold for Additional Medicare Tax.

- Fill out the form: Accurately complete the IRS 8959 form, ensuring all information is correct and complete.

- Review your submission: Double-check all entries for accuracy to prevent errors that could lead to delays or penalties.

- Submit the form: File the form electronically or by mail, following the IRS guidelines for submission.

Legal use of the Internal Revenue Service Tax

The legal use of IRS tax forms, including the IRS 8959, is governed by federal tax laws. To ensure that your submissions are legally binding, it is essential to adhere to the requirements set forth by the IRS. This includes providing accurate information, meeting filing deadlines, and using approved methods for submission. Engaging in fraudulent reporting or failing to comply with tax laws can result in significant penalties, including fines and legal action.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for compliance with IRS regulations. For the IRS 8959 form, the filing deadline typically coincides with the annual tax return due date, which is usually April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes to deadlines that may occur due to legislation or IRS announcements.

Required Documents

When completing the IRS 8959 form, certain documents are required to ensure accurate reporting of income and tax liability. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any additional Medicare tax withheld

- Documentation of any other relevant income or deductions

Having these documents ready will facilitate a smoother filing process and help prevent errors.

Form Submission Methods (Online / Mail / In-Person)

The IRS offers multiple methods for submitting tax forms, including the IRS 8959. Taxpayers can choose to file online using e-filing services, which is often faster and more efficient. Alternatively, forms can be submitted by mail, ensuring they are sent to the correct IRS address based on the taxpayer's location. In-person submission is generally not available, but taxpayers can visit IRS offices for assistance if needed. Each method has its own processing times and requirements, so it is important to choose the one that best fits individual circumstances.

Quick guide on how to complete internal revenue service tax

Complete Internal Revenue Service Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without any delays. Manage Internal Revenue Service Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Internal Revenue Service Tax without stress

- Obtain Internal Revenue Service Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Internal Revenue Service Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are instructions 8959 download?

Instructions 8959 download refers to the specific guidelines provided by airSlate SignNow for downloading essential documents required for your electronic signature processes. These instructions ensure that you can access, fill out, and submit necessary forms efficiently, thus streamlining your workflow.

-

How can I get instructions 8959 download?

To obtain the instructions 8959 download, visit our airSlate SignNow website, where you can find the relevant resources under the support or documentation section. Simply follow the prompts to download the instructions and begin using our eSigning features.

-

Are there any costs associated with using instructions 8959 download?

Downloading instructions 8959 and utilizing airSlate SignNow's features is cost-effective, with no hidden fees associated with accessing the downloadable files. We offer flexible pricing plans to suit various needs, allowing businesses to benefit from streamlined document eSigning without a hefty investment.

-

What features does airSlate SignNow offer related to instructions 8959 download?

airSlate SignNow provides a user-friendly platform where the instructions 8959 download can enhance your eSigning experience. Features include easy document uploads, customizable templates, and real-time collaboration, ensuring that your document signing process is smooth and efficient.

-

How will instructions 8959 download benefit my business?

Using instructions 8959 download can signNowly enhance your business's document management efficiency. By following these guidelines, you can reduce errors, expedite the signing process, and ensure compliance with legal requirements, leading to smoother operations overall.

-

Can I integrate airSlate SignNow with other tools if I use instructions 8959 download?

Yes, airSlate SignNow's functionality allows for seamless integration with various business tools, even when using instructions 8959 download. Connecting our eSigning solution with your existing applications enhances automation and efficiency in managing contracts and agreements.

-

Is there support available if I have questions about instructions 8959 download?

Absolutely! airSlate SignNow offers comprehensive support for users seeking assistance with instructions 8959 download. Our customer service team is available to answer any questions and guide you through the downloading and implementation process.

Get more for Internal Revenue Service Tax

Find out other Internal Revenue Service Tax

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation