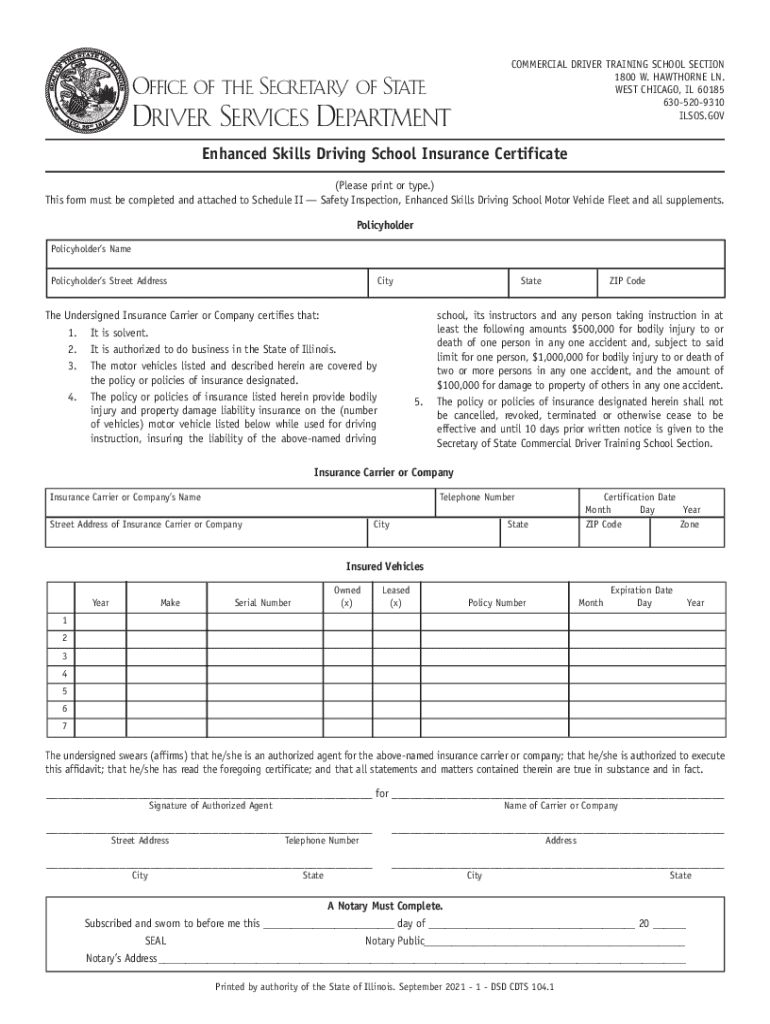

HAWTHORNE LN Form

What is the IL CDTS Insurance?

The IL CDTS insurance, or Illinois Commercial Driver's License Temporary Suspension insurance, is a specific insurance requirement for commercial drivers in Illinois. This insurance is designed to provide coverage during the period when a driver's commercial license is temporarily suspended. It ensures that drivers remain compliant with state regulations while they navigate the complexities of reinstating their driving privileges.

How to Obtain the IL CDTS Insurance

Obtaining IL CDTS insurance involves a few straightforward steps. First, drivers need to contact insurance providers that offer coverage tailored for temporary suspensions. It is essential to gather necessary documentation, including the details of the suspension and any previous insurance information. Once you have selected a provider, you can complete the application process, which may include providing personal information and payment details to secure the policy.

Steps to Complete the IL CDTS Insurance Application

Completing the IL CDTS insurance application requires careful attention to detail. Follow these steps:

- Gather required documents, such as your driver's license number and details of the suspension.

- Research and choose an insurance provider that offers IL CDTS insurance.

- Fill out the application form, ensuring all information is accurate and complete.

- Submit the application along with any required payment.

- Receive confirmation of your coverage and keep a copy for your records.

Legal Use of the IL CDTS Insurance

The legal use of IL CDTS insurance is crucial for maintaining compliance with Illinois state laws. This insurance serves as proof that a driver has coverage during the suspension period, which is necessary for reinstating their commercial driving privileges. Failure to maintain this insurance can lead to further penalties or complications in the reinstatement process.

Eligibility Criteria for IL CDTS Insurance

To be eligible for IL CDTS insurance, applicants must meet specific criteria. Generally, drivers must possess a valid commercial driver's license prior to suspension. Additionally, they should not have any outstanding fines or unresolved issues related to their driving record. Each insurance provider may have its own requirements, so it is advisable to check with them for any additional eligibility factors.

Required Documents for IL CDTS Insurance

When applying for IL CDTS insurance, certain documents are typically required. These may include:

- A copy of your suspended commercial driver's license.

- Documentation detailing the reason for the suspension.

- Proof of previous insurance coverage, if applicable.

- Personal identification, such as a state-issued ID or Social Security number.

Form Submission Methods for IL CDTS Insurance

Submitting the IL CDTS insurance application can usually be done through various methods. Most insurance providers offer online submission through their websites, allowing for a quick and efficient process. Alternatively, some may accept applications via mail or in-person visits to their offices. It is essential to confirm the submission method with the chosen insurance provider to ensure compliance with their requirements.

Quick guide on how to complete hawthorne ln

Effortlessly Prepare HAWTHORNE LN on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to find the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without issues. Manage HAWTHORNE LN on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign HAWTHORNE LN with Ease

- Find HAWTHORNE LN and click on Get Form to begin.

- Make use of the features we provide to fill out your document.

- Emphasize important portions of the documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign HAWTHORNE LN while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is il cdts insurance and how does it work?

Il cdts insurance is a specialized coverage designed to protect against various risks associated with business operations. It functions by providing financial compensation for losses incurred, ensuring that your organization remains secure from unforeseen events. By integrating il cdts insurance, businesses can safeguard their assets and maintain operational continuity.

-

How much does il cdts insurance cost?

The cost of il cdts insurance can vary based on several factors, including the size of your business, the specific coverage options selected, and your claims history. Typically, premiums are structured to provide maximum value while ensuring comprehensive coverage. To get a precise quote, it's advisable to consult an insurance broker who can tailor solutions to your needs.

-

What are the key benefits of using il cdts insurance?

Il cdts insurance offers numerous benefits, including financial protection against liabilities and peace of mind for business owners. This type of insurance can also improve business credibility, as clients and partners often prefer working with companies that are properly insured. Additionally, il cdts insurance provides resources for risk management, helping businesses minimize potential losses.

-

What features should I look for in il cdts insurance?

When selecting il cdts insurance, it's crucial to look for coverage options that address your specific business needs. Features might include property damage coverage, liability protection, and business interruption insurance. Additionally, consider any additional services, such as risk assessment consultations, which can enhance the value of your policy.

-

Can I integrate il cdts insurance with other business tools?

Yes, il cdts insurance can often be integrated with various business management tools. Many providers offer digital platforms that allow for seamless management of your insurance policies alongside other operational systems. This integration enhances efficiency and ensures that your business stays compliant with insurance requirements without additional hassle.

-

How do I file a claim for il cdts insurance?

Filing a claim for il cdts insurance typically involves notifying your insurance provider promptly after the incident occurs. Most insurers offer online platforms or mobile applications for submitting claims, which streamline the process. Be sure to gather all necessary documentation to support your claim, including photos, reports, and receipts.

-

What should I consider when choosing an il cdts insurance provider?

When selecting an il cdts insurance provider, consider their reputation, customer service quality, and claim settlement ratios. It's also essential to look at the variety of coverage options they offer, as well as the flexibility of their policies. Taking the time to explore reviews and testimonials can help ensure that you choose a reliable partner.

Get more for HAWTHORNE LN

- Quitclaim deed from trust to trust virginia form

- Special warranty deed from an individual to an individual virginia form

- Virginia deed correction form

- Virginia special warranty form

- Virginia deed trust form

- Special warranty deed template form

- Virginia deed form 497428043

- Quitclaim deed three individuals to an individual virginia form

Find out other HAWTHORNE LN

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT