Uniform Residential Loan Application URLA2019Borrowerv28 PDF

What is the Uniform Residential Loan Application?

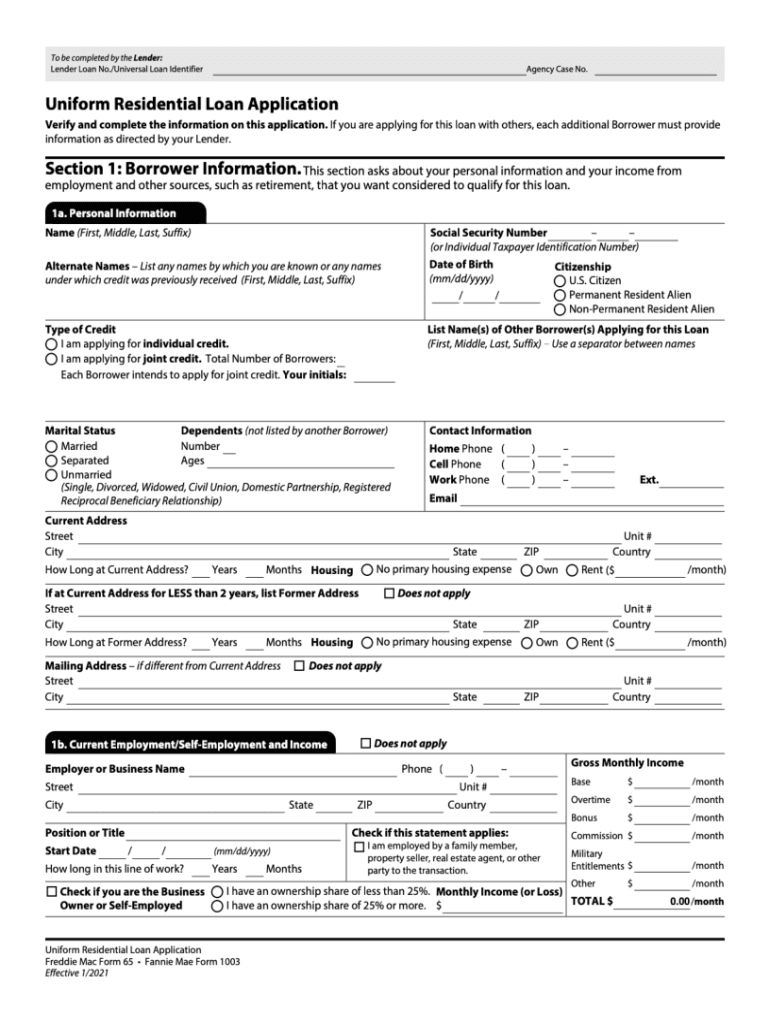

The Uniform Residential Loan Application (URLA) is a standardized form used by lenders to evaluate a borrower's financial situation when applying for a mortgage. This form, often referred to as the 1003 loan application, collects essential information about the borrower, including personal details, employment history, income, and assets. The URLA is designed to streamline the mortgage application process, ensuring that all necessary information is gathered in a consistent manner, which facilitates quicker processing and approval by lenders.

Steps to Complete the Uniform Residential Loan Application

Completing the Uniform Residential Loan Application involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation, such as proof of income, bank statements, and employment verification. Next, fill out the personal information section, including your name, address, and Social Security number. Provide detailed information about your income and assets, ensuring that you include all sources of income. After that, disclose any liabilities, such as existing loans or credit card debt. Finally, review the application for completeness and accuracy before submitting it to your lender.

Legal Use of the Uniform Residential Loan Application

The Uniform Residential Loan Application is legally recognized and must be completed truthfully to avoid potential legal repercussions. Misrepresentation of information can lead to loan denial or even legal action from lenders. The application is governed by regulations that ensure fair lending practices, and it is essential to provide accurate information to comply with these laws. Additionally, lenders are required to maintain confidentiality and protect the personal information provided on the application.

Key Elements of the Uniform Residential Loan Application

Several key elements are crucial to the Uniform Residential Loan Application. These include:

- Borrower Information: Personal details such as name, address, and Social Security number.

- Employment History: Information about current and previous employment, including job titles and duration of employment.

- Income Details: Comprehensive breakdown of income sources, including salary, bonuses, and additional earnings.

- Asset Information: Listing of bank accounts, investments, and real estate owned.

- Liabilities: Disclosure of existing debts, including mortgages, loans, and credit card balances.

How to Obtain the Uniform Residential Loan Application

The Uniform Residential Loan Application can be obtained through various channels. Most lenders provide the form directly on their websites, allowing borrowers to download it in PDF format. Additionally, the URLA is available through government housing agencies and mortgage industry organizations. For those preferring a digital approach, many online platforms offer the ability to fill out the application electronically, ensuring a more streamlined process.

Form Submission Methods

Once the Uniform Residential Loan Application is completed, it can be submitted through various methods. Borrowers can choose to submit the form online via their lender's portal, which is often the fastest option. Alternatively, the application can be mailed directly to the lender or delivered in person at a local branch. Each submission method has its advantages, and borrowers should select the one that best fits their needs and preferences.

Quick guide on how to complete uniform residential loan application urla2019borrowerv28pdf

Manage Uniform Residential Loan Application URLA2019Borrowerv28 pdf effortlessly on any device

Digital document management has gained traction among both organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle Uniform Residential Loan Application URLA2019Borrowerv28 pdf on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Uniform Residential Loan Application URLA2019Borrowerv28 pdf effortlessly

- Find Uniform Residential Loan Application URLA2019Borrowerv28 pdf and click Obtain Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Finish button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Uniform Residential Loan Application URLA2019Borrowerv28 pdf and guarantee exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uniform residential loan application urla2019borrowerv28pdf

The way to generate an e-signature for your PDF online

The way to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an e-signature for a PDF document on Android

People also ask

-

What is a commercial loan application?

A commercial loan application is a formal request made to a lender for financing intended for business purposes. It typically includes details about the business, its revenue, and how the funds will be used. Using airSlate SignNow, you can easily create and manage your commercial loan application electronically, streamlining the process.

-

How does airSlate SignNow simplify the commercial loan application process?

airSlate SignNow simplifies the commercial loan application process by allowing businesses to create, send, and eSign documents digitally. This reduces paperwork and the time spent on the approval process. With customizable templates, companies can efficiently draft their commercial loan applications in minutes.

-

What features does airSlate SignNow offer for commercial loan applications?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time tracking for commercial loan applications. These features enable businesses to ensure they have all necessary information documented and allow for quick revisions, enhancing the application’s overall efficiency.

-

Is there a cost associated with using airSlate SignNow for commercial loan applications?

Yes, there is a cost for using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans are flexible and depend on the number of users and features required. This makes it an affordable option for companies looking to manage commercial loan applications without signNow overhead.

-

Can airSlate SignNow integrate with other software for managing commercial loan applications?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing for a smoother workflow when handling commercial loan applications. Popular integrations include CRM software, accounting tools, and document management systems, making it easier to manage all aspects of the loan application process.

-

What are the benefits of using airSlate SignNow for commercial loan applications?

Using airSlate SignNow for commercial loan applications offers numerous benefits, including increased efficiency, cost savings, and improved compliance. Digital eSignatures facilitate faster approvals and help maintain accurate records. Additionally, streamlined communication during the application process can enhance relationships between businesses and lenders.

-

How secure is airSlate SignNow when managing commercial loan applications?

airSlate SignNow employs strong security measures to protect your commercial loan applications and sensitive business information. This includes SSL encryption and compliance with industry standards for data protection. Rest assured, your documents are handled with utmost care, ensuring confidentiality and integrity.

Get more for Uniform Residential Loan Application URLA2019Borrowerv28 pdf

- Legal last will and testament form for civil union partner with adult and minor children from prior marriage vermont

- Legal last will and testament form for married person with adult and minor children vermont

- Legal last will and testament form for civil union partner with adult and minor children vermont

- Mutual wills package with last wills and testaments for married couple with adult and minor children vermont form

- Legal last will and testament form for a widow or widower with adult children vermont

- Legal last will and testament form for widow or widower with minor children vermont

- Legal last will form for a widow or widower with no children vermont

- Legal last will and testament form for a widow or widower with adult and minor children vermont

Find out other Uniform Residential Loan Application URLA2019Borrowerv28 pdf

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document