Www Oregon Gov Form or W 4101 4022022Oregon Withholding Statement and Exemption Certificate

What is the W-4101 form?

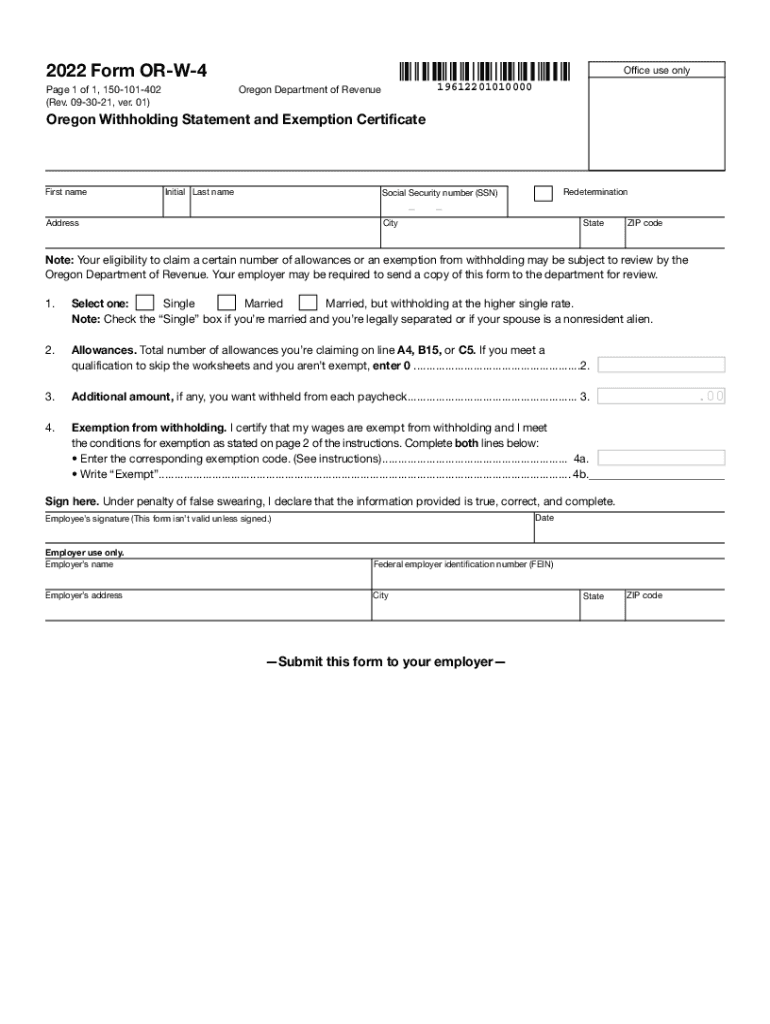

The W-4101 form, also known as the Oregon Withholding Statement and Exemption Certificate, is a crucial document used by employees in Oregon to determine the amount of state income tax that should be withheld from their paychecks. This form allows individuals to claim exemptions from withholding based on their specific tax situations, ensuring that the correct amount of tax is deducted. Understanding the purpose and function of the W-4101 form is essential for both employees and employers to maintain compliance with Oregon tax laws.

How to use the W-4101 form

To effectively use the W-4101 form, employees must first complete it accurately to reflect their personal tax situation. This involves providing personal information, such as name, address, and Social Security number, as well as indicating the number of allowances they wish to claim. Once completed, the form should be submitted to the employer, who will then use the information to calculate the appropriate withholding amount from the employee's wages. It is important to review the form periodically, especially after any significant life changes, to ensure that withholding remains accurate.

Steps to complete the W-4101 form

Completing the W-4101 form involves several straightforward steps:

- Obtain the W-4101 form from the Oregon Department of Revenue website or your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the number of allowances you are claiming based on your tax situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Key elements of the W-4101 form

The W-4101 form contains several key elements that are essential for accurate tax withholding:

- Personal Information: This section requires your name, address, and Social Security number.

- Allowances: Employees can claim allowances based on their tax situation, which directly affects withholding amounts.

- Signature: A signature is required to validate the information provided on the form.

Legal use of the W-4101 form

The W-4101 form is legally binding and must be completed in accordance with Oregon tax laws. Employers are required to keep the form on file for their records and to ensure compliance with state withholding requirements. Failure to accurately complete and submit the W-4101 form can result in incorrect tax withholding, leading to potential tax liabilities for both employees and employers.

Filing Deadlines / Important Dates

It is important to be aware of any deadlines related to the W-4101 form. Typically, employees should submit the form to their employer at the start of their employment or whenever there is a change in their tax situation. Additionally, employers must ensure that they update their payroll systems promptly to reflect any changes in withholding based on the submitted W-4101 forms.

Quick guide on how to complete wwworegongov form or w 4101 4022022oregon withholding statement and exemption certificate

Complete Www oregon gov Form or W 4101 4022022Oregon Withholding Statement And Exemption Certificate with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Www oregon gov Form or W 4101 4022022Oregon Withholding Statement And Exemption Certificate on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to edit and eSign Www oregon gov Form or W 4101 4022022Oregon Withholding Statement And Exemption Certificate effortlessly

- Obtain Www oregon gov Form or W 4101 4022022Oregon Withholding Statement And Exemption Certificate and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Www oregon gov Form or W 4101 4022022Oregon Withholding Statement And Exemption Certificate and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwworegongov form or w 4101 4022022oregon withholding statement and exemption certificate

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the w4101 form and why is it important?

The w4101 form is a document used for tax reporting purposes, specifically for contractors and freelancers. Understanding its significance is crucial for accurate financial reporting and ensuring compliance with tax regulations.

-

How can airSlate SignNow help me with the w4101 form?

With airSlate SignNow, you can easily fill out, send, and eSign the w4101 form electronically. This streamlines the process, reduces paperwork, and allows for quick distribution and signature collection.

-

Is there a cost associated with using airSlate SignNow for the w4101 form?

airSlate SignNow offers various pricing plans that include features to manage documents like the w4101 form. The pricing is designed to be cost-effective, allowing businesses of all sizes to benefit from electronic signatures and document management.

-

What features does airSlate SignNow offer for the w4101 form?

AirSlate SignNow provides features such as customizable templates, audit trails, and secure storage specifically for documents like the w4101 form. These features enhance efficiency and compliance in handling sensitive documents.

-

Can I integrate airSlate SignNow with other software for managing the w4101 form?

Yes, airSlate SignNow offers integrations with various applications like CRM and accounting software, making it easier to manage the w4101 form alongside your other business processes. These integrations improve workflow and data consistency.

-

What are the benefits of using airSlate SignNow for the w4101 form?

Using airSlate SignNow for the w4101 form allows for faster processing, reduced errors, and enhanced security. This digital solution also saves time and money compared to traditional methods of handling paperwork.

-

Is it easy to eSign the w4101 form with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly simple to eSign the w4101 form. Users can sign documents electronically from any device, making the process quick and convenient.

Get more for Www oregon gov Form or W 4101 4022022Oregon Withholding Statement And Exemption Certificate

- Excavator contract for contractor washington form

- Renovation contract for contractor washington form

- Cleaning contract contractor form

- Concrete mason contract for contractor washington form

- Demolition contract for contractor washington form

- Framing contract for contractor washington form

- Security contract for contractor washington form

- Insulation contract for contractor washington form

Find out other Www oregon gov Form or W 4101 4022022Oregon Withholding Statement And Exemption Certificate

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe