Azdor Gov File 12144Arizona Form AZ 140V Azdor Gov

Understanding the Arizona Tax Form 140NR

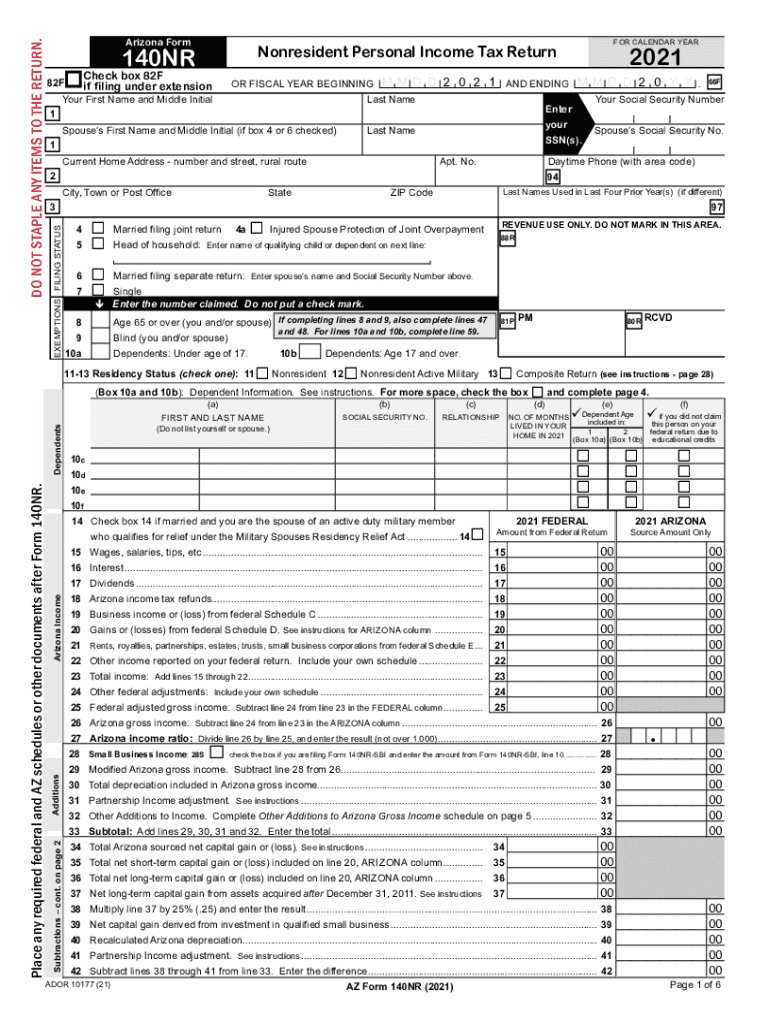

The Arizona Tax Form 140NR is specifically designed for non-resident individuals who need to file an income tax return in Arizona. This form allows individuals who earn income from Arizona sources but do not reside in the state to report their earnings and pay the appropriate taxes. Understanding the purpose and requirements of the 140NR is crucial for compliance with state tax laws.

Steps to Complete the Arizona Tax Form 140NR

Completing the Arizona Tax Form 140NR involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Determine your residency status and the sources of your income in Arizona.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Calculate your tax liability based on the income reported.

- Review the form for accuracy before submission.

Required Documents for Filing the Arizona Tax Form 140NR

When filing the Arizona Tax Form 140NR, it is essential to have the following documents ready:

- W-2 forms for any employment income earned in Arizona.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductions you plan to claim, such as business expenses or education credits.

Filing Methods for the Arizona Tax Form 140NR

The Arizona Tax Form 140NR can be submitted in various ways to ensure convenience for filers:

- Online filing through the Arizona Department of Revenue's website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices, if necessary.

Penalties for Non-Compliance with Arizona Tax Filing

Failing to file the Arizona Tax Form 140NR or submitting it late can result in penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, which increases the total amount owed.

- Potential legal action for continued non-compliance.

Legal Use of the Arizona Tax Form 140NR

The Arizona Tax Form 140NR is legally binding and must be completed in accordance with state tax laws. It is essential to ensure that all information provided is accurate and truthful. Misrepresentation or failure to file can lead to serious legal consequences.

Quick guide on how to complete azdorgov file 12144arizona form az 140v azdorgov

Complete Azdor gov File 12144Arizona Form AZ 140V Azdor gov effortlessly on any gadget

Digital document management has become popular with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can attain the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Azdor gov File 12144Arizona Form AZ 140V Azdor gov on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

The easiest method to modify and electronically sign Azdor gov File 12144Arizona Form AZ 140V Azdor gov without hassle

- Obtain Azdor gov File 12144Arizona Form AZ 140V Azdor gov and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and holds the same legal value as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from your preferred device. Modify and electronically sign Azdor gov File 12144Arizona Form AZ 140V Azdor gov and guarantee outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the azdorgov file 12144arizona form az 140v azdorgov

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Arizona tax form 140NR?

The Arizona tax form 140NR is a state tax return used by non-residents to report their income earned in Arizona. It helps individuals accurately declare their income, calculate their taxes owed, and avoid penalties. It is important to be familiar with the form to ensure compliance with Arizona tax laws.

-

How can I fill out the Arizona tax form 140NR using airSlate SignNow?

Filling out the Arizona tax form 140NR with airSlate SignNow is simple and efficient. You can easily upload your form, add necessary information, and electronically sign it all within our user-friendly platform. This streamlines the process, making tax filing less stressful and more organized.

-

What are the benefits of using airSlate SignNow for the Arizona tax form 140NR?

Using airSlate SignNow for the Arizona tax form 140NR offers several benefits, including increased efficiency and time savings. Our platform allows for easy document sharing and secure electronic signatures, ensuring your tax return is filed promptly and securely. Additionally, our cost-effective solutions cater to both individual and business needs.

-

Is there a cost associated with using airSlate SignNow for the Arizona tax form 140NR?

Yes, there is a subscription cost associated with using airSlate SignNow; however, it is designed to be cost-effective for users needing to handle the Arizona tax form 140NR. We offer various pricing plans that cater to different needs, ensuring that you can choose one that fits your budget while enjoying all our features.

-

Can airSlate SignNow help with IRS tax forms in addition to the Arizona tax form 140NR?

Absolutely! airSlate SignNow supports a variety of IRS tax forms alongside the Arizona tax form 140NR. This flexibility allows you to manage all your tax documentation in one place, simplifying your tax filing process and ensuring compliance across different jurisdictions.

-

What integrations does airSlate SignNow offer for handling the Arizona tax form 140NR?

airSlate SignNow integrates with several popular applications to enhance your workflow when dealing with the Arizona tax form 140NR. These integrations facilitate seamless document management, sharing, and electronic signing processes, making it easier for you to file your taxes efficiently.

-

How secure is my information when I submit the Arizona tax form 140NR through airSlate SignNow?

Your information is highly secure with airSlate SignNow. We implement robust security measures, including encryption and secure servers, to protect your data while you fill out and submit the Arizona tax form 140NR. This guarantees that your sensitive tax information remains confidential and safe.

Get more for Azdor gov File 12144Arizona Form AZ 140V Azdor gov

Find out other Azdor gov File 12144Arizona Form AZ 140V Azdor gov

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors