Form 8302

What is the Form 8302

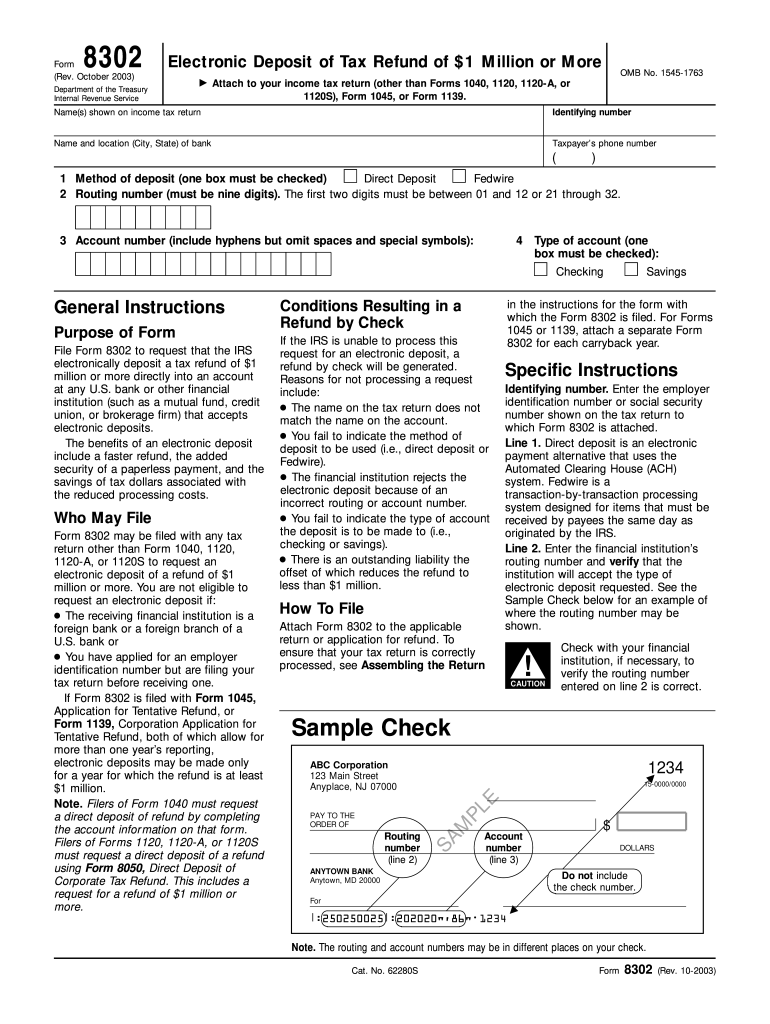

The Form 8302, officially known as the "Electronic Deposit of Tax Refund," is a crucial document used by taxpayers in the United States to request a refund of overpaid taxes. This form is particularly relevant for individuals and businesses seeking to recover excess amounts paid to the Internal Revenue Service (IRS). Understanding the purpose and function of the Form 8302 is essential for ensuring that your tax refund process is efficient and compliant with IRS regulations.

How to use the Form 8302

Using the Form 8302 involves a few straightforward steps. First, you need to gather all necessary information, including your tax identification number and details about the overpayment. Next, fill out the form accurately, ensuring that all sections are completed to avoid delays. Once completed, you can submit the form electronically or through traditional mail, depending on your preference. Utilizing electronic submission can expedite the processing time for your refund.

Steps to complete the Form 8302

Completing the Form 8302 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant tax documents and information.

- Enter your personal information, including your name, address, and tax identification number.

- Detail the amount of overpayment you are requesting to be refunded.

- Review the form for accuracy and completeness.

- Submit the form electronically via a secure platform or mail it to the appropriate IRS address.

Legal use of the Form 8302

The legal use of the Form 8302 is governed by IRS regulations, which stipulate that the form must be filled out correctly to be considered valid. It is essential to ensure that the information provided is accurate and truthful, as any discrepancies can lead to penalties or delays in processing your refund. Compliance with the legal requirements surrounding this form helps protect your rights as a taxpayer and facilitates a smoother refund process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8302 are critical to ensure that you receive your refund in a timely manner. Typically, the form must be submitted within a specific timeframe after the tax year in which the overpayment occurred. It is advisable to check the IRS website or consult a tax professional for the most current deadlines to avoid missing important dates that could affect your refund.

Required Documents

When completing the Form 8302, certain documents are required to support your request for a refund. These may include:

- Copies of previous tax returns showing overpayment.

- Documentation of payments made to the IRS.

- Any correspondence from the IRS regarding your account.

Having these documents ready can streamline the process and help ensure that your refund request is processed without unnecessary delays.

Quick guide on how to complete form 8302 3379

Complete Form 8302 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without interruptions. Handle Form 8302 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-oriented workflow today.

How to edit and eSign Form 8302 seamlessly

- Obtain Form 8302 and select Get Form to start.

- Utilize the tools we provide to finish your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that aim.

- Generate your signature using the Sign tool, which takes mere seconds and retains the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8302 to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an electronic tax refund?

An electronic tax refund is a method of receiving your tax refund directly through electronic channels, such as direct deposit. This process provides a faster and more efficient way to access your funds. Using airSlate SignNow, you can easily manage the necessary documents involved in securing your electronic tax refund.

-

How does airSlate SignNow facilitate electronic tax refunds?

airSlate SignNow enables seamless document management and electronic signatures, making it easy to complete tax-related forms for electronic tax refunds. Our platform ensures that all your documents are securely stored and easily accessible. This efficiency helps speed up your electronic tax refund process considerably.

-

Are there any fees associated with using airSlate SignNow for electronic tax refunds?

While airSlate SignNow offers various pricing plans, many users find the costs to be minimal compared to the benefits of streamlined document handling. Our basic plan makes it affordable to manage electronic tax refunds without breaking the bank. All pricing details are transparently provided on our website.

-

What features does airSlate SignNow offer to assist with electronic tax refunds?

airSlate SignNow provides features like document templates, e-signatures, and real-time collaboration, all tailored for efficient management of electronic tax refunds. Our user-friendly interface simplifies the process, reducing the time and effort needed to prepare your tax documents. Additionally, integration with other tools enhances productivity.

-

Can airSlate SignNow integrate with accounting software for electronic tax refunds?

Yes, airSlate SignNow offers integrations with various accounting software, allowing for a cohesive workflow when filing for electronic tax refunds. This connectivity ensures that all necessary tax documents are easily accessed and managed from within your preferred systems. Improve your efficiency by automating your electronic tax refund process with our integrations.

-

What are the security measures in place when using airSlate SignNow for electronic tax refunds?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and authentication protocols to protect your sensitive information during the electronic tax refund process. You can trust us to keep your personal and financial data safe while you manage your tax documents.

-

How can I get started with airSlate SignNow for electronic tax refunds?

To start using airSlate SignNow for electronic tax refunds, simply sign up for an account on our website. Once registered, you can explore our features, templates, and guides designed to assist you. Our intuitive platform makes it easy to navigate the e-signing process for your tax forms.

Get more for Form 8302

Find out other Form 8302

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA