Trustee Information Sheet

What is the Trustee Information Sheet

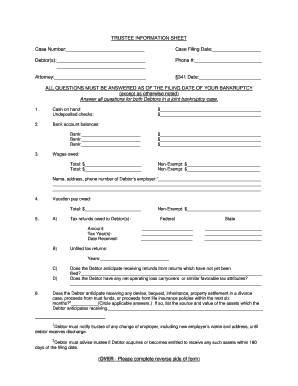

The Trustee Information Sheet is a crucial document used in bankruptcy cases. It provides essential details about the debtor's financial situation and is typically required by the bankruptcy trustee. This sheet helps the trustee assess the debtor's assets, liabilities, and overall financial health. By compiling this information, the trustee can make informed decisions regarding the case, ensuring compliance with legal obligations and facilitating the bankruptcy process.

How to use the Trustee Information Sheet

Using the Trustee Information Sheet involves several steps. First, gather all necessary financial documents, including income statements, tax returns, and a list of assets and debts. Next, fill out the sheet accurately, ensuring that all information is complete and truthful. Once completed, submit the sheet to the bankruptcy trustee as part of your case documentation. This process not only aids the trustee in managing your case but also helps maintain transparency throughout the bankruptcy proceedings.

Key elements of the Trustee Information Sheet

The Trustee Information Sheet includes several key elements essential for a comprehensive overview of the debtor's financial status. These elements typically encompass:

- Personal information, such as name, address, and Social Security number

- Details of income sources, including employment and any additional earnings

- A comprehensive list of assets, including real estate, vehicles, and personal property

- Liabilities, including loans, credit card debts, and any other financial obligations

- Information regarding dependents and household expenses

Each of these components plays a vital role in providing the trustee with a clear picture of the debtor's financial situation, which is necessary for effective case management.

Steps to complete the Trustee Information Sheet

Completing the Trustee Information Sheet involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant financial documents and records.

- Carefully read the instructions provided with the sheet to understand the required information.

- Fill out each section of the sheet, ensuring all details are accurate and up-to-date.

- Review the completed sheet for any errors or omissions.

- Submit the sheet to the bankruptcy trustee by the specified deadline.

By adhering to these steps, you can effectively complete the Trustee Information Sheet, facilitating a smoother bankruptcy process.

Legal use of the Trustee Information Sheet

The Trustee Information Sheet serves a legal purpose in bankruptcy proceedings. It is a formal document that must be completed and submitted to the bankruptcy trustee as part of the filing process. The information provided is used to assess the debtor's financial situation and determine the appropriate course of action in the bankruptcy case. Failure to submit an accurate and complete Trustee Information Sheet can result in delays or complications in the bankruptcy process, underscoring its legal significance.

Filing Deadlines / Important Dates

Filing deadlines for the Trustee Information Sheet are critical in the bankruptcy process. Debtors must adhere to specific timelines to ensure their cases proceed without unnecessary delays. Typically, the Trustee Information Sheet must be submitted shortly after filing for bankruptcy. It is essential to check the local bankruptcy court rules for precise deadlines, as these can vary by jurisdiction. Missing a deadline may jeopardize the case and affect the debtor's ability to discharge debts.

Quick guide on how to complete trustee information sheet

Effortlessly Prepare Trustee Information Sheet on Any Device

The management of online documents has gained popularity among businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed forms, allowing you to find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Handle Trustee Information Sheet on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Trustee Information Sheet with ease

- Find Trustee Information Sheet and click Get Form to begin.

- Utilize the tools we provide to submit your file.

- Emphasize relevant portions of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you wish to send your document, whether via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Trustee Information Sheet and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trustee information sheet

How to create an e-signature for your PDF in the online mode

How to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an e-signature for a PDF on Android OS

People also ask

-

What are case checks in the context of airSlate SignNow?

Case checks refer to the process of verifying the details and status of documents involved in specific cases. With airSlate SignNow, users can efficiently manage and track case checks for all documents, ensuring that every necessary detail is accounted for and improving overall workflow.

-

How does airSlate SignNow simplify the process of case checks?

airSlate SignNow streamlines case checks by allowing users to send and eSign documents quickly. The platform’s user-friendly interface and automated features help eliminate manual errors, making it easier for businesses to ensure accurate and timely completion of essential documentation.

-

What pricing plans are available for case checks with airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to business needs, including options for teams focused on managing case checks. Each plan provides access to essential features that help organizations conduct case checks efficiently, allowing users to select one that best fits their budget and requirements.

-

Can I automate case checks using airSlate SignNow?

Yes, airSlate SignNow allows for automation of case checks through its advanced workflows. By leveraging automated reminders and status updates, users can ensure that case checks are completed promptly, reducing delays and increasing productivity across teams.

-

What features does airSlate SignNow offer to enhance case checks?

To enhance case checks, airSlate SignNow offers features like document templates, real-time tracking, and audit logs. These tools make it easier to manage multiple case checks simultaneously while ensuring compliance and security throughout the entire document signing process.

-

Is airSlate SignNow compatible with other applications for case checks?

airSlate SignNow integrates seamlessly with various applications, allowing users to enhance their case checks process. By connecting with CRM systems, project management tools, and cloud storage services, businesses can create a cohesive environment that maximizes efficiency in managing case checks.

-

How can case checks improve the efficiency of my organization?

Implementing case checks through airSlate SignNow can signNowly improve organizational efficiency. By ensuring that all document-related tasks are meticulously tracked and verified, employees can focus on core activities without the worry of missed details, leading to faster project completions.

Get more for Trustee Information Sheet

Find out other Trustee Information Sheet

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will