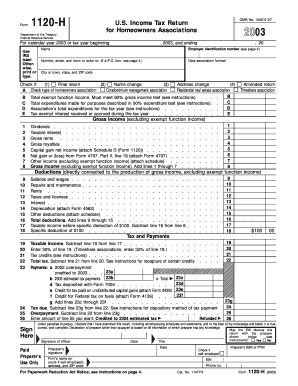

Income Tax 1120 H Form

What is the Income Tax 1120 H Form

The Income Tax 1120 H form is specifically designed for homeowners associations in the United States. This form allows these associations to report their income, deductions, and credits to the Internal Revenue Service (IRS). It is essential for associations that qualify under the tax-exempt status to ensure compliance with federal tax regulations. The 1120 H form simplifies the tax filing process for homeowners associations by providing a streamlined method to report income derived from common area maintenance fees, assessments, and other sources.

How to use the Income Tax 1120 H Form

Using the Income Tax 1120 H form involves several key steps. First, associations must determine their eligibility to file this form, which typically includes having 90 percent or more of their income from members. Next, associations should gather necessary financial information, including income and expenses related to the operation of the association. Once the form is completed, it must be submitted to the IRS by the appropriate deadline, ensuring that all required documentation is included to avoid penalties.

Steps to complete the Income Tax 1120 H Form

Completing the Income Tax 1120 H form requires careful attention to detail. Follow these steps:

- Gather financial records, including income statements and expense reports.

- Determine if your association qualifies to file the 1120 H form based on income sources.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review the form for any errors or omissions before submission.

- File the completed form with the IRS by the designated deadline.

Legal use of the Income Tax 1120 H Form

The legal use of the Income Tax 1120 H form is crucial for homeowners associations to maintain their tax-exempt status. Filing this form correctly ensures compliance with IRS regulations, which helps avoid potential penalties or loss of tax-exempt status. Associations must adhere to the guidelines set forth by the IRS regarding income reporting and allowable deductions to ensure that their filing is legally valid.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax 1120 H form are critical for homeowners associations. Typically, the form is due on the fifteenth day of the third month following the end of the association's tax year. For associations operating on a calendar year, this means the form is generally due by March 15. It is important for associations to mark these dates on their calendars to ensure timely filing and avoid penalties.

Required Documents

To complete the Income Tax 1120 H form, associations must gather several key documents. These include:

- Financial statements detailing income and expenses.

- Records of assessments and fees collected from members.

- Documentation of any deductions claimed, such as maintenance costs.

- Previous tax returns, if applicable, for reference.

Penalties for Non-Compliance

Failure to file the Income Tax 1120 H form on time or inaccuracies in the form can result in significant penalties for homeowners associations. The IRS may impose fines based on the length of delay and the amount of tax owed. Additionally, non-compliance can jeopardize the association's tax-exempt status, leading to further financial implications. It is vital for associations to prioritize accurate and timely filing to avoid these consequences.

Quick guide on how to complete income tax 1120 h form

Complete Income Tax 1120 H Form effortlessly on any device

Digital document management has surged in popularity among corporations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to produce, modify, and eSign your documents swiftly without delays. Manage Income Tax 1120 H Form on any system with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Income Tax 1120 H Form with ease

- Locate Income Tax 1120 H Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Adjust and eSign Income Tax 1120 H Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax 1120 h form

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an e-signature for a PDF file on Android devices

People also ask

-

What is a tax return 1120 h?

A tax return 1120 h is a tax form specifically designed for homeowners associations that operate on a not-for-profit basis. This form allows you to report income, deductions, and calculate any taxes owed. Understanding the nuances of the tax return 1120 h can help ensure compliance and maximize potential deductions.

-

How can airSlate SignNow assist with filing a tax return 1120 h?

airSlate SignNow streamlines the process of gathering signatures and approvals required for your tax return 1120 h. With our easy-to-use platform, you can quickly send, eSign, and manage the necessary documents from anywhere. This increases your efficiency and helps you stay organized throughout tax season.

-

What features does airSlate SignNow offer for managing tax return 1120 h documents?

airSlate SignNow provides features such as templates, customizable fields, and secure storage for managing tax return 1120 h documents. You can easily create templates for your 1120 h forms and ensure that all necessary signatures are obtained electronically. This reduces the time spent on administrative tasks and helps maintain accuracy.

-

Is there a cost associated with using airSlate SignNow for tax return 1120 h?

Yes, airSlate SignNow operates on a subscription-based model, offering various pricing tiers to suit different business needs. Even with a small investment, you'll find that the cost savings from improved efficiency in filing your tax return 1120 h outweigh the subscription fees. Check our website for detailed pricing plans.

-

Can I integrate airSlate SignNow with other software for my tax return 1120 h submissions?

Absolutely! airSlate SignNow integrates with numerous accounting and tax preparation software to streamline your tax return 1120 h submission process. These integrations help ensure that all your financial data is aligned and makes it easier to compile the necessary documents. Review our list of compatible software on our website.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance, especially for your tax return 1120 h, ensures accuracy and saves signNow time. The platform's eSigning capabilities mean that you can get documents signed faster, improving your workflow and reducing the chances of delays. This leads to a more seamless filing experience overall.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods to protect your sensitive tax documents, including any files related to your tax return 1120 h. This ensures that your data remains confidential and secure during the entire signing process.

Get more for Income Tax 1120 H Form

Find out other Income Tax 1120 H Form

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple