Cpa Release of Client Information

Understanding the CPA Release of Client Information

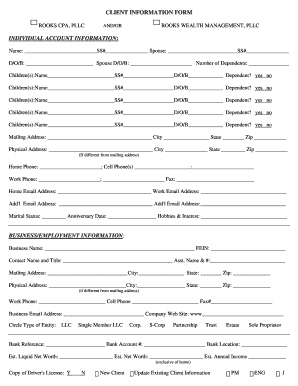

The CPA Release of Client Information is a crucial document that allows accountants to share a client's financial data with third parties. This release is essential for ensuring that clients' sensitive information is handled appropriately and legally. It serves as a safeguard for both the accountant and the client, ensuring compliance with privacy regulations while facilitating necessary communications with other professionals, such as lenders or other tax advisors.

Key Elements of the CPA Release of Client Information

When preparing the CPA Release of Client Information, several key elements must be included to ensure its effectiveness and legal standing. These elements typically consist of:

- Client Identification: The full name and contact details of the client.

- Authorized Parties: Names and contact information of the individuals or organizations authorized to receive the information.

- Scope of Information: A detailed description of the specific information being released, such as tax returns, financial statements, or other relevant documents.

- Duration of Authorization: The time frame during which the release is valid, including any expiration dates.

- Client Signature: The signature of the client, indicating consent to the release of their information.

Steps to Complete the CPA Release of Client Information

Completing the CPA Release of Client Information involves a straightforward process that ensures all necessary details are captured. The steps typically include:

- Gather client information, including full name and contact details.

- Identify the authorized parties who will receive the information.

- Specify the scope of information to be shared.

- Determine the duration for which the release will be valid.

- Obtain the client’s signature to confirm consent.

Legal Use of the CPA Release of Client Information

The legal use of the CPA Release of Client Information is governed by various privacy laws and regulations. It is essential for accountants to ensure that the release complies with the relevant legal frameworks, such as the Gramm-Leach-Bliley Act and state-specific privacy laws. This compliance helps protect client data and minimizes the risk of legal repercussions for unauthorized disclosure of sensitive information.

How to Obtain the CPA Release of Client Information

The CPA Release of Client Information can typically be obtained through various sources. Accountants often have templates available that can be customized to fit specific client needs. Additionally, professional accounting organizations may provide standardized forms that comply with legal requirements. It is advisable for accountants to ensure that any template used is up-to-date and reflects current regulations.

Examples of Using the CPA Release of Client Information

Practical examples of using the CPA Release of Client Information include situations where a client needs to provide their financial data to a lender for a mortgage application or when transferring information to another accountant for tax preparation. In these cases, the release facilitates the smooth exchange of necessary documentation while ensuring that the client's consent is formally recorded.

Quick guide on how to complete cpa release of client information

Complete Cpa Release Of Client Information effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Cpa Release Of Client Information on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to alter and eSign Cpa Release Of Client Information effortlessly

- Obtain Cpa Release Of Client Information and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of your documents or obscure sensitive details with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to share your form, either via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Cpa Release Of Client Information while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cpa release of client information

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an e-signature for a PDF document on Android

People also ask

-

What is an accounting firm new client information sheet?

An accounting firm new client information sheet is a structured document designed to collect essential information from new clients. This sheet typically includes client contact details, financial data, and specific requests which help accountants tailor their services effectively.

-

How can airSlate SignNow help with managing an accounting firm new client information sheet?

airSlate SignNow streamlines the management of your accounting firm new client information sheet by allowing you to create, send, and eSign documents electronically. This ensures a quick and secure way to collect vital information from new clients, enhancing your operational efficiency.

-

What features does airSlate SignNow offer for handling client information sheets?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure eSignature options for your accounting firm new client information sheet. These tools simplify document management and improve client onboarding processes.

-

Is airSlate SignNow cost-effective for small accounting firms?

Yes, airSlate SignNow is designed to be a cost-effective solution for both small and large accounting firms. By utilizing this platform for your accounting firm new client information sheet, you can reduce administrative costs associated with manual paperwork.

-

What integration options are available with airSlate SignNow?

airSlate SignNow offers integrations with popular software tools such as Google Workspace, Microsoft Office, and accounting software. This allows for seamless workflows when managing your accounting firm new client information sheet and ensures all client data is accessible in one place.

-

How does airSlate SignNow enhance client communication regarding information sheets?

With airSlate SignNow, communication related to your accounting firm new client information sheet is simplified through automated notifications and reminders. This keeps clients updated on document statuses and encourages timely submissions.

-

Is it easy to customize the accounting firm new client information sheet in airSlate SignNow?

Absolutely! airSlate SignNow provides user-friendly tools for customizing your accounting firm new client information sheet according to your specific needs. You can easily add fields, adjust layouts, and incorporate your branding into the document.

Get more for Cpa Release Of Client Information

- Texas application form

- Washington revenue form

- Exemption taxes form

- Preschool registration form calgary christian school

- Instructions for form cg 213 cigarette stamping agent certification of compliance with tax law article 20 revised 720

- Form pt 350 petroleum business tax return for fuel

- Sba form 1368

- G1003 483719925 form

Find out other Cpa Release Of Client Information

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer