Internal Revenue Service Application Form

What is the Internal Revenue Service Application

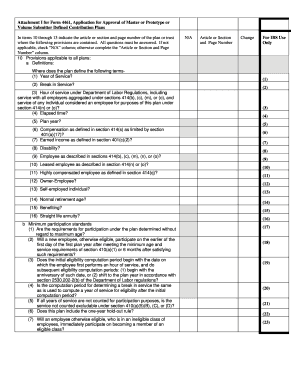

The Internal Revenue Service (IRS) application, specifically form 4461, is a crucial document used by taxpayers in the United States. This form is designed for individuals and businesses seeking to request an extension of time to file their tax returns. It serves as an official request to the IRS, allowing taxpayers to gain additional time without incurring penalties for late filing. Understanding the purpose and importance of form 4461 is essential for compliance with IRS regulations.

Steps to Complete the Internal Revenue Service Application

Completing form 4461 involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary information, including your personal details and tax identification number. Next, accurately fill out the form, providing the required details about your tax situation and the specific extension you are requesting. After completing the form, review it carefully for any errors or missing information. Finally, submit the form to the IRS by the designated deadline, either electronically or via mail, depending on your preference.

Legal Use of the Internal Revenue Service Application

Form 4461 is legally recognized as a valid request for an extension to file tax returns when completed correctly. To ensure legal compliance, it is essential to follow IRS guidelines and submit the form within the stipulated time frame. The electronic submission of the form is considered legally binding, provided it meets the requirements set forth by the IRS. Utilizing a secure eSignature solution can enhance the legal validity of your submission, ensuring that it adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Required Documents

When filling out form 4461, certain documents may be necessary to support your application. Typically, you will need your previous year's tax return, any relevant income statements, and documentation related to your current financial situation. Having these documents on hand will facilitate the completion of the form and help ensure that you provide accurate information to the IRS.

Form Submission Methods

Form 4461 can be submitted to the IRS through various methods, offering flexibility to taxpayers. The primary submission methods include electronic filing via the IRS e-file system, which is quick and efficient, and mailing a paper copy of the form to the appropriate IRS address. It is important to choose the method that best suits your needs and to ensure that the submission is made before the deadline to avoid penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with form 4461 is crucial for avoiding late penalties. Generally, the form must be submitted by the original due date of your tax return. For most individual taxpayers, this date falls on April 15. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. Keeping track of these important dates will help ensure timely compliance with IRS requirements.

Quick guide on how to complete internal revenue service application

Prepare Internal Revenue Service Application easily on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Internal Revenue Service Application on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Internal Revenue Service Application effortlessly

- Obtain Internal Revenue Service Application and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Edit and eSign Internal Revenue Service Application and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service application

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 4461 and how can it be used?

Form 4461 is a document that facilitates the request for an extension of time to file certain tax returns. With airSlate SignNow, you can quickly fill out and eSign Form 4461, ensuring your request is submitted promptly and efficiently.

-

How does airSlate SignNow simplify the signing process for Form 4461?

airSlate SignNow offers an intuitive interface that makes it easy to complete and send Form 4461 for eSignature. Users can drag and drop fields, ensuring a smooth and efficient signing process, which saves time and reduces paperwork.

-

Is airSlate SignNow cost-effective for signing Form 4461?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to eSign Form 4461. Our pricing plans are designed to fit various business sizes, ensuring you get excellent value while managing your document signing needs efficiently.

-

What features does airSlate SignNow offer for Form 4461?

With airSlate SignNow, users can take advantage of features like customizable templates, team collaboration, and real-time tracking for Form 4461. These features enhance the efficiency of document management and ensure compliance with all necessary requirements.

-

Can Form 4461 be integrated with other applications using airSlate SignNow?

Absolutely! airSlate SignNow allows for seamless integration with numerous applications, enabling users to manage Form 4461 alongside other business tools. This integration streamlines your workflow, making it easier to handle various documents and processes.

-

What are the benefits of using airSlate SignNow for Form 4461?

Using airSlate SignNow for Form 4461 streamlines the document signing process, reduces turnaround time, and increases accuracy. With secure eSigning, you can signNowly minimize the risks associated with manual processing, giving you peace of mind.

-

How secure is airSlate SignNow when signing Form 4461?

Security is a top priority for airSlate SignNow. When signing Form 4461, we use advanced encryption and secure authentication protocols, ensuring that your sensitive information remains protected throughout the signing process.

Get more for Internal Revenue Service Application

Find out other Internal Revenue Service Application

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed