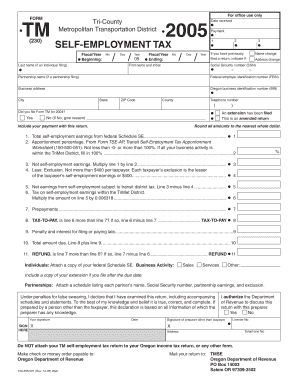

Tmse Oregon Department of Revenue Form

Understanding the Tmse Oregon Department of Revenue

The Tmse Oregon Department of Revenue is a vital entity responsible for administering tax laws and ensuring compliance within the state. It oversees various tax-related activities, including the collection of income taxes, property taxes, and other state revenue sources. Understanding its functions is crucial for individuals and businesses navigating their tax obligations in Oregon.

Steps to Complete the Tmse Oregon Department of Revenue Form

Completing the Tmse Oregon Department of Revenue form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as income statements and previous tax returns. Next, accurately fill out the form, ensuring that all information is correct and complete. Once completed, review the form for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference and the requirements set by the department.

Required Documents for the Tmse Oregon Department of Revenue

To successfully complete the Tmse Oregon Department of Revenue form, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources

- Documentation of deductions and credits

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother filing process.

Filing Deadlines for the Tmse Oregon Department of Revenue

Filing deadlines for the Tmse Oregon Department of Revenue are crucial to avoid penalties. Generally, individual tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to these dates, especially for business entities that may have different deadlines based on their structure.

Penalties for Non-Compliance with the Tmse Oregon Department of Revenue

Failing to comply with the requirements set by the Tmse Oregon Department of Revenue can result in significant penalties. These may include:

- Late filing fees

- Interest on unpaid taxes

- Potential audits and further scrutiny

Understanding these penalties can help individuals and businesses prioritize timely and accurate tax submissions.

Digital vs. Paper Version of the Tmse Oregon Department of Revenue Form

When completing the Tmse Oregon Department of Revenue form, taxpayers have the option to choose between a digital or paper version. The digital version offers convenience and faster processing times, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the choice, ensuring that the form is filled out correctly is essential for compliance.

Quick guide on how to complete tmse oregon department of revenue

Complete Tmse Oregon Department Of Revenue effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the correct form and securely save it online. airSlate SignNow provides all the necessary tools for you to create, alter, and electronically sign your documents quickly and efficiently. Manage Tmse Oregon Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Tmse Oregon Department Of Revenue with ease

- Find Tmse Oregon Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure confidential details with tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to secure your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or out-of-place documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Tmse Oregon Department Of Revenue to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tmse oregon department of revenue

The way to make an e-signature for a PDF file online

The way to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an e-signature straight from your mobile device

The way to make an e-signature for a PDF file on iOS

How to make an e-signature for a PDF document on Android devices

People also ask

-

What features does airSlate SignNow offer for managing tax or documents?

airSlate SignNow provides a range of features specifically designed for managing tax or documents, including electronic signatures, templates, and document tracking. These tools streamline the signing process, ensuring compliance and security for sensitive tax documents. Additionally, users can create custom workflows to manage tax or document approvals efficiently.

-

How does airSlate SignNow ensure the security of tax or documents?

Security is a top priority at airSlate SignNow. The platform uses bank-level encryption to protect your tax or documents during transmission and storage. Additionally, it offers features like two-factor authentication and audit trails to ensure that every action taken on a document is logged and can be tracked.

-

What pricing plans are available for airSlate SignNow for tax or eSigning?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, especially for those dealing with tax or documents. The plans include options for individual users, small teams, and larger enterprises, allowing you to choose the best fit for your organization’s requirements. Each plan includes different features, ensuring you only pay for what you need.

-

Can airSlate SignNow integrate with other software for tax or document management?

Yes, airSlate SignNow seamlessly integrates with various software applications that are commonly used for tax or document management. This includes integration with popular accounting and bookkeeping platforms, making it easier to manage your tax or documents in conjunction with your existing workflows. These integrations enhance productivity and streamline your processes.

-

Is airSlate SignNow user-friendly for handling tax or documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to handle tax or documents without extensive training. The intuitive interface allows users to send, sign, and manage documents swiftly, reducing the learning curve and enhancing efficiency for tax or related operations.

-

What is the benefit of using airSlate SignNow for tax or document signing?

Using airSlate SignNow for tax or document signing offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced compliance. The platform eliminates the need for paper documentation, which not only saves time but also supports environmentally friendly practices. This ensures a quicker process for tax or submissions.

-

How can airSlate SignNow help with taxes or compliance requirements?

airSlate SignNow helps businesses stay compliant with tax or regulations by providing a secure and legally binding way to obtain signatures. The platform keeps track of all activities, ensuring that you have a complete audit trail for compliance purposes. These features are essential for any organization that needs to verify signatures for tax or documentation.

Get more for Tmse Oregon Department Of Revenue

Find out other Tmse Oregon Department Of Revenue

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF