Ir264 Form

What is the IR264?

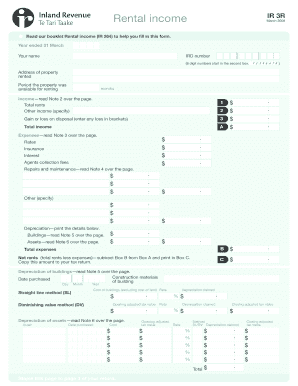

The IR264 is a specific form used in New Zealand for reporting rental income to the tax authorities. This form is essential for property owners who earn income from renting out residential or commercial properties. It helps ensure that all rental income is accurately reported, which is crucial for tax compliance. The IR264 assists taxpayers in calculating their taxable rental income and any allowable deductions related to property expenses.

Steps to Complete the IR264

Completing the IR264 involves several key steps:

- Gather all relevant financial records, including rental income statements and expense receipts.

- Fill out the personal information section, including your name and tax identification number.

- Report total rental income received during the tax year.

- List any allowable deductions, such as property maintenance, management fees, and mortgage interest.

- Calculate your net rental income by subtracting total deductions from total income.

- Review the completed form for accuracy before submission.

Legal Use of the IR264

The IR264 is legally binding when filled out correctly and submitted to the tax authorities. It is important to ensure that all information provided is truthful and accurate to avoid potential legal issues. Misreporting rental income or failing to submit the form can result in penalties or audits. Understanding the legal implications of the IR264 helps property owners maintain compliance with tax laws.

Required Documents

To complete the IR264, you will need several documents:

- Rental income statements from tenants.

- Receipts for any property-related expenses.

- Bank statements showing rental income deposits.

- Any previous tax filings that may relate to rental income.

Form Submission Methods

The IR264 can be submitted through various methods, ensuring convenience for property owners:

- Online submission through the tax authority's website.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IR264. Generally, the form must be submitted by the end of the tax year, which varies based on individual circumstances. Missing the deadline can lead to penalties, so staying informed about important dates is essential for compliance.

Quick guide on how to complete ir264

Effortlessly Prepare Ir264 on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with everything required to create, modify, and eSign your documents swiftly and without delays. Manage Ir264 on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Alter and eSign Ir264 with Ease

- Locate Ir264 and click on Get Form to initiate.

- Use the tools available to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive details with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which is done in seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that require printing additional copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Revise and eSign Ir264 to ensure effective communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a rental income form nz and why is it important?

A rental income form nz is a document used to report rental income for tax purposes in New Zealand. It's important because it helps landlords disclose their earnings accurately to the IRD, ensuring compliance with tax laws and avoiding potential penalties.

-

How can airSlate SignNow help me with my rental income form nz?

airSlate SignNow enables users to easily prepare, send, and electronically sign their rental income form nz. The platform streamlines the process, making it user-friendly and efficient, so you can focus on managing your properties instead of paperwork.

-

Are there any costs associated with using airSlate SignNow for rental income form nz?

Yes, airSlate SignNow offers various pricing plans to suit different needs. You can choose a plan that fits your budget, ensuring you have the tools necessary for managing your rental income form nz effectively without overspending.

-

What features does airSlate SignNow offer for managing rental income documents?

airSlate SignNow provides features like cloud storage, customizable templates, and real-time notifications that make managing your rental income form nz seamless. These tools allow you to collaborate with tenants and streamline your documentation process.

-

Is it easy to integrate airSlate SignNow into my existing systems for rental income form nz management?

Absolutely! airSlate SignNow integrates smoothly with various platforms, including CRM and accounting software, allowing you to manage your rental income form nz alongside other business functions. This integration helps save time and enhances your overall workflow.

-

Can I access my rental income form nz anytime and anywhere using airSlate SignNow?

Yes, one of the great benefits of using airSlate SignNow is that your rental income form nz is stored securely in the cloud, allowing you to access it anytime and from anywhere. This flexibility is essential for busy landlords.

-

How does eSigning a rental income form nz work with airSlate SignNow?

eSigning a rental income form nz with airSlate SignNow is straightforward. Simply upload your document, add the necessary fields for signatures, and send it to the relevant parties. They can sign electronically from any device, making the process quick and efficient.

Get more for Ir264

- Moon phases worksheet pdf answer key form

- Short term seasonal lease agreement form

- Formulir klaim rawat jalan prudential

- Intermediate accounting ifrs edition 3rd edition solution manual pdf form

- On boarding checklist for st christophers hospital for form

- Skin wellness center of alabama hipaa patient consent form

- Observation of communicative competencecs1doc form

- Mind map from text list veterinary invoice templat form

Find out other Ir264

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF