Nrl1 Form Print

What is the NRL1 Form?

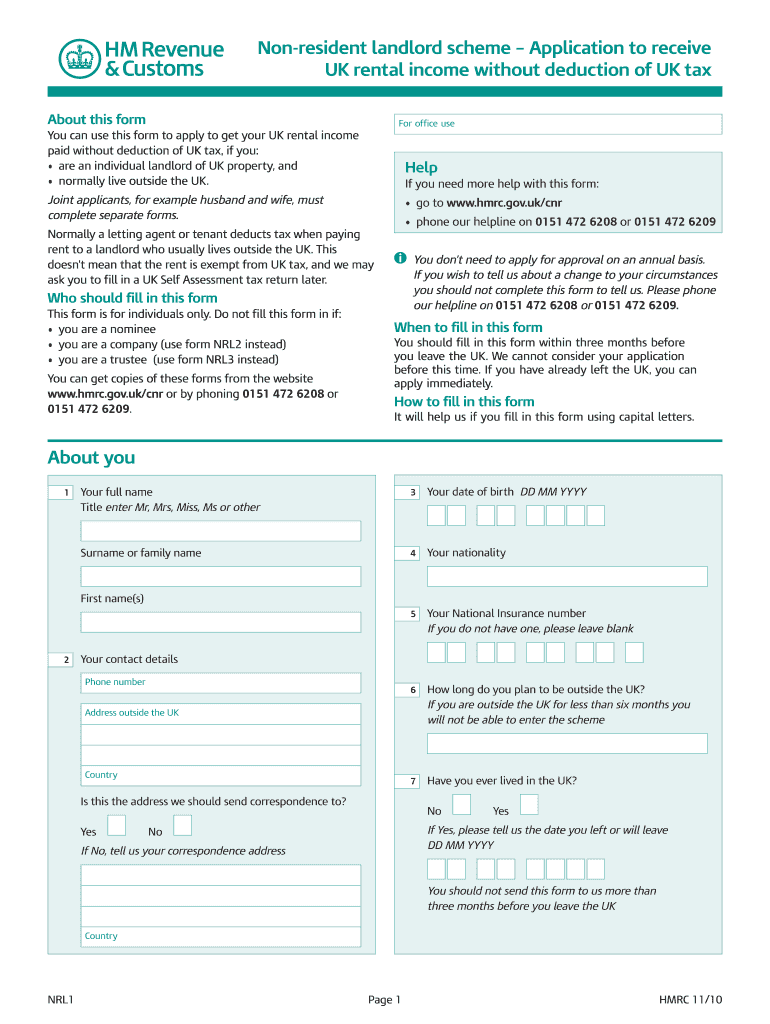

The NRL1 form, also known as the non-resident landlord application form, is a crucial document for individuals who own rental properties in the United Kingdom but reside outside the country. This form is primarily used to apply for approval under the HMRC non-resident landlord scheme, allowing landlords to receive rental income without tax being deducted at source. Understanding this form is essential for compliance with UK tax regulations, ensuring that non-resident landlords can manage their rental income effectively.

Steps to Complete the NRL1 Form

Completing the NRL1 form involves several key steps to ensure accuracy and compliance with HMRC requirements. Here’s a straightforward guide:

- Gather Necessary Information: Collect all relevant details, including personal identification, property information, and bank account details.

- Fill Out the Form: Carefully complete each section of the NRL1 form, ensuring that all information is accurate and up to date.

- Sign and Date: Provide your signature and the date to validate the application.

- Submit the Form: Choose your preferred method of submission, whether online or via mail, and ensure it is sent to the correct HMRC address.

Legal Use of the NRL1 Form

The NRL1 form is legally recognized as a formal application to the HMRC. For it to be considered valid, it must be completed accurately and submitted in accordance with HMRC guidelines. This form allows non-resident landlords to avoid tax deductions at source on their rental income, provided they meet the eligibility criteria. It is essential to maintain compliance with all legal requirements to avoid penalties or issues with tax authorities.

Eligibility Criteria for the NRL1 Form

To qualify for the non-resident landlord scheme and successfully submit the NRL1 form, applicants must meet specific eligibility criteria. These include:

- The applicant must be a non-resident landlord, meaning they live outside the UK.

- The property in question must be rented out and not used for personal purposes.

- The landlord must provide accurate and complete information on the NRL1 form.

Meeting these criteria is crucial for the approval of the application and for ensuring compliance with UK tax laws.

Form Submission Methods

The NRL1 form can be submitted through various methods, allowing flexibility for applicants. The available submission methods include:

- Online Submission: Landlords can complete and submit the NRL1 form electronically through the HMRC portal.

- Mail Submission: Alternatively, the completed form can be printed and mailed to the appropriate HMRC address.

- In-Person Submission: Some may choose to submit the form in person at designated HMRC offices, although this option may be less common.

Required Documents for the NRL1 Form

When completing the NRL1 form, certain documents are required to support the application. These typically include:

- Proof of identity, such as a passport or driver’s license.

- Details of the rental property, including its address and ownership information.

- Bank account details for where rental income will be deposited.

Having these documents ready can streamline the application process and help ensure that the form is processed efficiently.

Quick guide on how to complete nrl1 form print

Easily Create Nrl1 Form Print on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to generate, modify, and electronically sign your documents quickly and efficiently. Manage Nrl1 Form Print on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and eSign Nrl1 Form Print Effortlessly

- Obtain Nrl1 Form Print and then click Get Form to begin.

- Employ the tools available to complete your form.

- Emphasize important sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and then click the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Nrl1 Form Print while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the nrl1 form hmrc?

The nrl1 form hmrc is a document used in the UK tax system for reporting income earned by non-residents. This form helps non-residents declare their UK income to HMRC, ensuring compliance with tax regulations. By using digital solutions like airSlate SignNow, completing the nrl1 form hmrc becomes more efficient and secure.

-

How can airSlate SignNow help with the nrl1 form hmrc?

airSlate SignNow allows users to complete and eSign the nrl1 form hmrc online, simplifying the submission process. With our platform, you can securely store and manage your documents, making it easier to track and submit forms on time. This saves you both time and hassle during tax season.

-

Are there any costs associated with submitting the nrl1 form hmrc through airSlate SignNow?

Using airSlate SignNow to submit the nrl1 form hmrc involves a subscription fee, which varies depending on the plan you choose. Our pricing is designed to be cost-effective, providing value for businesses of all sizes. We also offer a free trial so you can explore the benefits before committing.

-

What features does airSlate SignNow offer for the nrl1 form hmrc?

airSlate SignNow provides a range of features tailored for the nrl1 form hmrc, including eSigning, document tracking, and templates for easy form completion. These tools streamline the process, ensuring that your submissions are accurate and timely. Additionally, you can collaborate with team members within the platform.

-

Can I store my nrl1 form hmrc documents in airSlate SignNow?

Yes, airSlate SignNow offers secure cloud storage for all your documents, including the nrl1 form hmrc. This ensures that your sensitive information is protected and easily accessible whenever you need it. With our platform, you can manage your documents in one place without worrying about losing important files.

-

Is airSlate SignNow compatible with other software for filing the nrl1 form hmrc?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and financial software, facilitating an efficient workflow when handling the nrl1 form hmrc. This compatibility helps users streamline their tax filing processes and ensures that all necessary information is readily available.

-

How secure is airSlate SignNow when handling the nrl1 form hmrc?

airSlate SignNow takes security seriously, employing advanced encryption methods to protect your documents, including the nrl1 form hmrc. Our platform is compliant with industry standards to ensure that your personal and financial data remain private and secure. You can trust us to keep your information safe.

Get more for Nrl1 Form Print

Find out other Nrl1 Form Print

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will