Property Tax Name Change Form PDF

What is the Property Tax Name Change Form PDF?

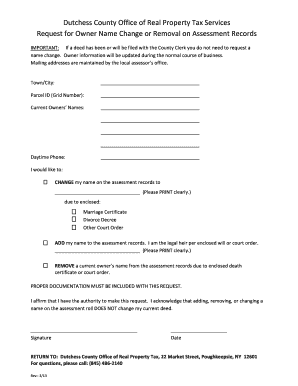

The Property Tax Name Change Form PDF is a standardized document used by property owners to officially request a change of name associated with their property tax records. This form is essential when a property owner undergoes a name change due to marriage, divorce, or other legal reasons. The form typically requires the property owner's current name, the new name, and relevant property details, such as the address and tax identification number. By submitting this form, property owners ensure that their tax records remain accurate and up-to-date, which is crucial for receiving tax bills and other official correspondence.

Steps to Complete the Property Tax Name Change Form PDF

Completing the Property Tax Name Change Form PDF involves several important steps to ensure accuracy and compliance. First, download the form from the appropriate local government website or office. Next, fill in your current name, the new name, and the property details accurately. It is essential to provide all requested information to avoid delays. After completing the form, review it carefully for any errors or omissions. Finally, sign and date the form before submitting it according to your local jurisdiction's guidelines, which may include online submission, mailing, or in-person delivery.

Required Documents for the Property Tax Name Change

When submitting the Property Tax Name Change Form, certain documents may be required to support your request. Commonly required documents include a copy of the legal name change document, such as a marriage certificate or court order, and proof of identity, like a driver's license or passport. Some jurisdictions may also request additional documentation, such as property deeds or tax bills. It is advisable to check with your local tax office for a complete list of required documents to ensure a smooth application process.

Form Submission Methods for the Property Tax Name Change

The Property Tax Name Change Form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online: Many jurisdictions offer an online portal where you can submit the form electronically.

- Mail: You can print the completed form and mail it to the appropriate tax office.

- In-Person: Some offices allow you to submit the form in person, where you can also ask any questions regarding the process.

It is important to confirm the preferred submission method with your local tax authority to ensure compliance with their procedures.

Legal Use of the Property Tax Name Change Form PDF

The Property Tax Name Change Form PDF is legally binding when completed and submitted according to local laws and regulations. The form must be signed by the property owner, and any supporting documentation must be authentic and relevant. Compliance with local statutes regarding name changes is crucial, as inaccuracies or incomplete submissions can lead to delays or rejections. Understanding the legal implications of the name change process helps ensure that property records are maintained correctly, which is essential for tax assessments and ownership verification.

State-Specific Rules for the Property Tax Name Change Form PDF

Each state in the U.S. may have specific rules and regulations governing the Property Tax Name Change Form. These rules can include variations in the required documentation, submission methods, and processing times. It is essential to consult your state’s tax authority or website to obtain the most accurate and relevant information. Familiarizing yourself with state-specific requirements helps ensure that your application is processed efficiently and without unnecessary complications.

Quick guide on how to complete property tax name change form pdf

Complete Property Tax Name Change Form Pdf seamlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the precise form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and effortlessly. Manage Property Tax Name Change Form Pdf on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign Property Tax Name Change Form Pdf effortlessly

- Obtain Property Tax Name Change Form Pdf and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form hunts, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Property Tax Name Change Form Pdf to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the application for property tax name change?

The application for property tax name change is a formal request submitted to local government offices to update the name associated with property tax records. This process is essential for ensuring that tax documents reflect the current ownership or title information, preventing potential legal issues.

-

How does airSlate SignNow assist with the application for property tax name change?

airSlate SignNow provides an easy-to-use platform that allows you to create, sign, and send your application for property tax name change digitally. With our solution, you can streamline the documentation process and ensure that your application is completed accurately and efficiently.

-

What are the pricing options for airSlate SignNow to facilitate my application for property tax name change?

We offer various pricing plans to fit different needs, whether you’re an individual or a business. Our competitive rates make it cost-effective to use our platform for your application for property tax name change while benefiting from an array of features that simplify document management.

-

Can I integrate airSlate SignNow with other apps for my application for property tax name change?

Yes, airSlate SignNow seamlessly integrates with a wide range of applications, enhancing your workflow for the application for property tax name change. By connecting with tools like Google Drive or CRM systems, you can easily manage all relevant documents and communications in one place.

-

What features does airSlate SignNow offer for the application for property tax name change?

Our platform includes features such as customizable document templates, built-in eSigning, and secure cloud storage to ensure your application for property tax name change is managed effectively. These tools help you save time and reduce errors in your paperwork.

-

Is airSlate SignNow secure for handling my application for property tax name change?

Absolutely! At airSlate SignNow, we prioritize security. Our platform employs industry-standard encryption and compliance measures to safeguard your sensitive information throughout the application for property tax name change process.

-

How long does it take to process the application for property tax name change?

The processing time for the application for property tax name change can vary depending on your local government’s policies and backlog. However, using airSlate SignNow speeds up document delivery and helps ensure your application is submitted correctly, thus expediting the overall process.

Get more for Property Tax Name Change Form Pdf

- Nota fiscal magazine luiza pdf form

- 3 month sanchayapatra form word file

- National provider identifier npi applicationupdate form

- Me gusta worksheet form

- Printable comcast channel guide 2022 form

- Ielts liz writing task 2 pdf download form

- Download form phonenomena

- Property disclosure statement pds form

Find out other Property Tax Name Change Form Pdf

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast